Question: Project A Project B Initial investment ( CF 0 ) $ 8 0 , 0 0 0 $ 5 0 , 0 0 0 Year

Project A Project B

Initial investment CF$$

Year t Cash inflows CFt

$ $

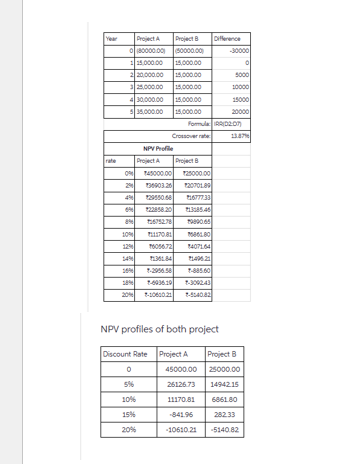

THE QUESTION BEING ANSWERED IS: "Draw the NPV profiles for both projects on the same set of axes, and discuss any conflict in ranking that may exist between NPV and IRR."

CAN SOMEONE PLEASE SHOW THE FORMULACALCULATION FOR THE VALUES SHOWN TO THE RIGHT OF THE PERCENTAGES IN THE PHOTO ETC.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock