Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Project Planning put answers on excel sheet and use different numbers that are on excel sheet in the pictures Your friend, Pip, wants to start

Project Planning put answers on excel sheet and use different numbers that are on excel sheet in the pictures

Your friend, Pip, wants to start a new four-year business project and would like your help with the financial side of things. Use the Project planning tool sheet in Finance Final Student Worksheet to help Pip (A) come up with some plausible assumptions and (B) understand the financial projections. I dont know Pip (because theyre your imaginary friend, not mine), so youre going to have to fill in the details. But once you fill in assumptions to column C, then the OCF and NPV/IRR calculations should all take care of themselves.

Note: You can, of course, pick a different (imaginary or real?) friend or relative if you want to or you can even use your own business idea

1. Describe the basic outlines of the business: What will it sell? Where and how? Will Pip do the work, hire employees, or something else? Who are the potential customers? etc

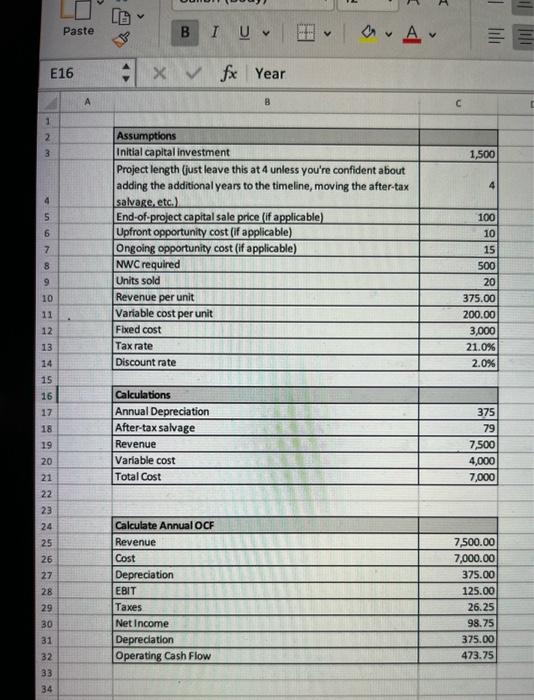

2. Paste your assumptions table here.

3. Explain all of the key assumptions that you put in and what they mean in real life (dont just tell me the numbers you picked). It would be good to do some research to make sure your assumptions are reasonable. Please cite your sources.

a. How much will the business sell each year and for what price?

b. What initial capital/equipment (if any) investment will be required? How will it be depreciated?

(note, the way the worksheet is set up is just for straight-line depreciation to 0 over four years, so youll need to edit that if you want something different)

c. What are the fixed and/or variable costs? Note that if the business has employees, their wages should be showing up here in addition to the more obvious things like raw materials or electricity.

d. Are there any resources (including time) that Pip already has but will use for this project so they need to be included as opportunity cost? (just in year 0 or throughout the operation of the business)?

e. Will Pip need any current assets such as inventory or accounts receivable (from letting customers buy on credit)? How much? How about current liabilities? If so, remember to include this as the NWC required

f. What discount rate are you using? Why is this an appropriate required return for this project? This is another good place to use a resource or informed reasoning.

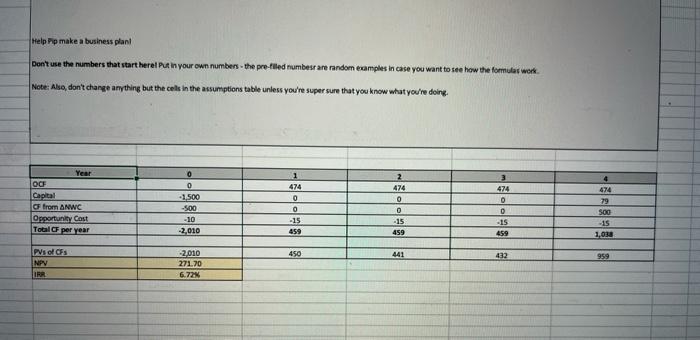

4. What are the annual OCF, and the NPV/IRR under these assumptions? Explain what that means like you would to a friend who doesnt know about finance yet.. E.g., The expected OCF is $5000 a year, which means that

5. How sensitive are these projections to the number of units sold?

a. If the number of units is 10% less than your initial assumption, will the NPV still be positive?

b. How about the IRR and/or the annual OCF?

c. What if the number of units is 25% or 50% less?

6. Which assumptions are you the least (and/or most) confident about? Why?

7. What are some of the strategy/contingency features of this project?

a. If the project performs better than expected, is there anything Pip can do to build/expand on the success? If so, what? If not, why?

b. If the project does not meet expectations then how well can Pip cut costs and/or minimize losses? If so, what? If not, why?

8. Based on your calculations and analysis, give Pip a recommendation for whether or not you think they should proceed with the business/project.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started