Answered step by step

Verified Expert Solution

Question

1 Approved Answer

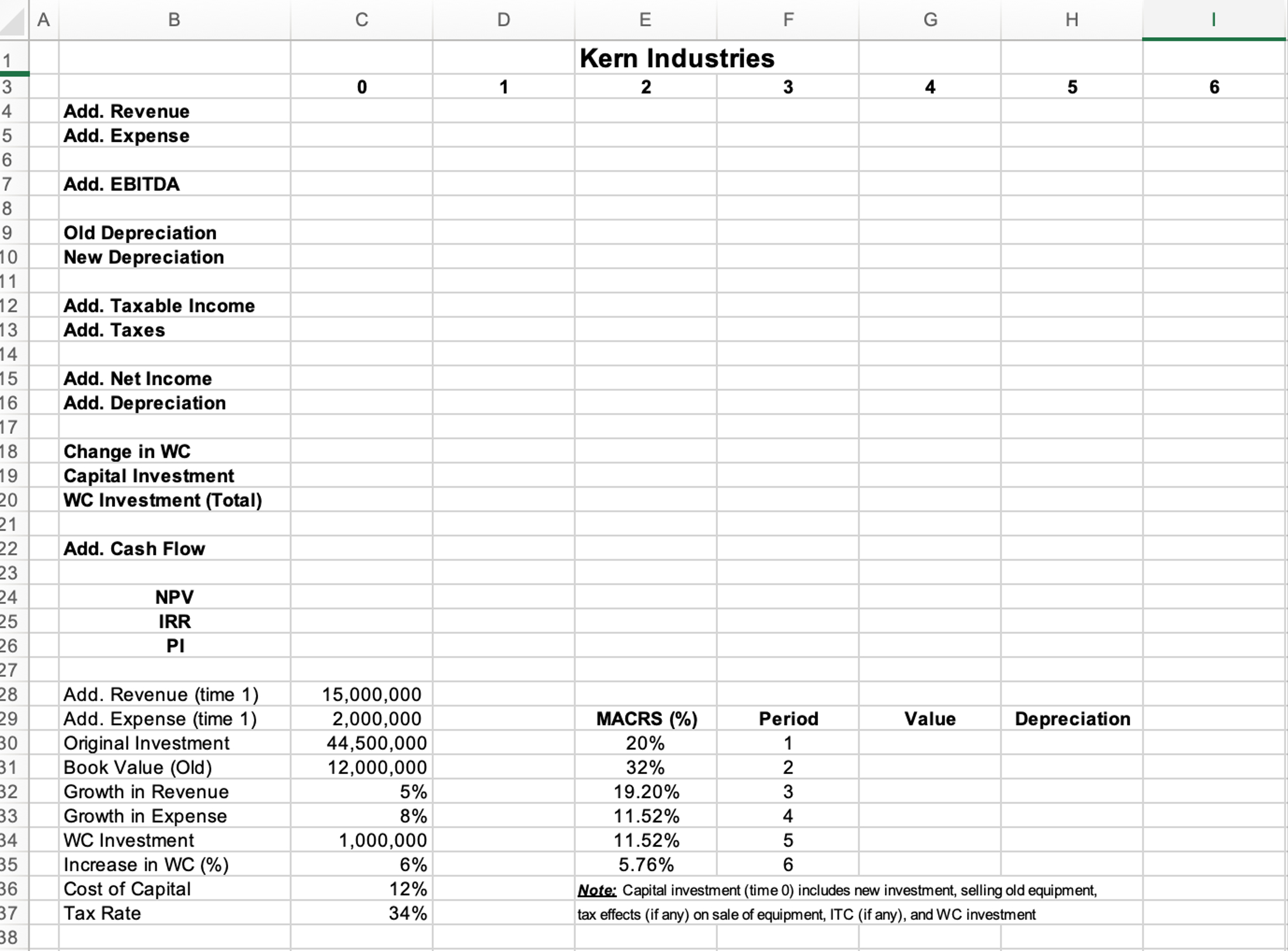

Project Valuation ( Example ) Kern Industries is considering the replacement of an older technology with new technology that will have a capitalized base of

Project Valuation Example Kern Industries is considering the replacement of an older technology with new technology that will have a capitalized base of $ The older technology, having a remaining sixyear useful life operating life and accounting life with no anticipated salvage value under a straightline depreciation method, currently has a book value of $ and is believed to be marketable at book. Under the current tax system, the new equipment purchase qualifies for the fiveyear MACRS depreciation rates, has no allowable investment tax credit, and has an operating life of six years. Further, the company projects that over the sixyear life of the new machine, the company will increase revenues by $ in the first year and expenses by only $ in the first year in each subsequent year, revenues will increase by and expenses are expected to increase by In addition, the company plans to invest an additional $ in working capital immediately and estimates that it will have to increase each year its working capital investment inventory accounts receivable, etc. by of the increase in revenues. Throughout, the marginal corporate tax rate is expected to remain at If the firms cost of capital is what is the value of the technology to this company and should it make this investment? The obvious questions are whether this is a profitable or valuable investment; and, how does one measure the value in order to make such a decision?

Fill in all the estimates for periods through on the Excel template, including the total aftertax cash flow for each period and complete the depreciation amounts in the table which you will need After that, you should calculate the NPV IRR, and the profitability index PI for the project.Please use the Excel template as your answer.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started