Prompt : First, review the Final Project Scenario document and the accompanying workbook. Using your review of the scenario, develop a management analysis brief that

Prompt: First, review the Final Project Scenario document and the accompanying workbook. Using your review of the scenario, develop a management analysis brief that addresses the critical elements indicated below. Use information from your accounting workbook to support your claims in the management analysis brief. Note: Milestone One is a draft of some critical elements of the final project. Note that the management analysis brief corresponds to the management analysis memo in the final project. Specifically, the following critical elements must be addressed:

Overview: You just began a position as a financial accountant at Peyton Approved. In this role, your first task is to prepare the companys financials for the year-end audit. Additionally, the company is interested in expanding its business within the next year. They would like your support in assessing their ability to meet their goals.

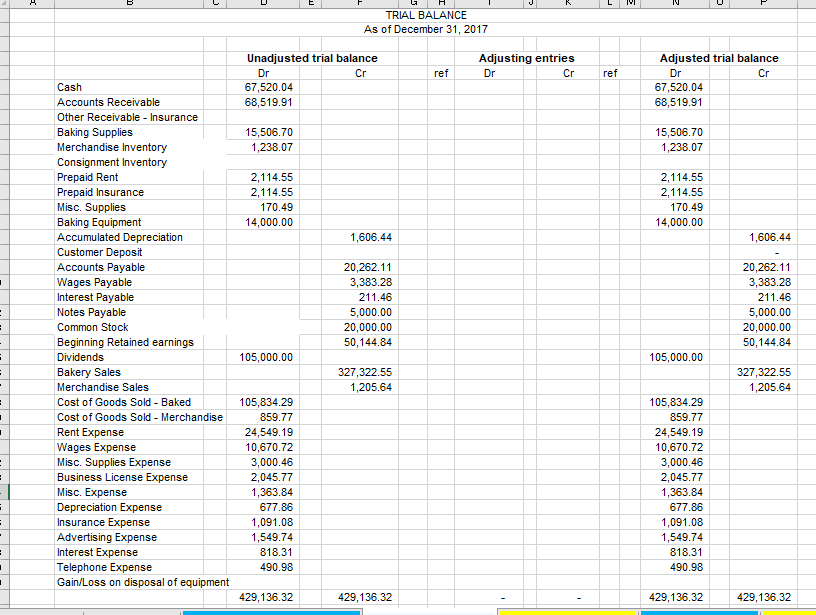

Refer to the data below and use the Final Project Workbook that includes the income statement, balance sheet, retained earnings statement and cash flow statement to complete the final project and associated milestones.

Peyton Approved Financial Data: Preliminary Financial Statements have already been prepared (2017 statements in the Final Project Workbook). Final adjusting entries have not yet been made. See table for possible adjustments that indicate what will be recorded at 12/31/17 (fiscal year end). Use the following to complete year-to-year documentation and notes for managing depreciation, inventory, and long-term debt.

|

|

|

|

The company is planning to open another location in 2018. Using the Preliminary Statements as a base, prepare pro forma (budgeted) financials for 2018 for the new location using the following information:

| Cost of leasing commercial space: $1,500 per month. |

| Cost of new equipment: $15,000, purchased with a long-term note. Use straight line depreciation assuming a seven-year life, no residual value. Use full years depreciation for the first year. Equipment purchase was financed with a long-term note. |

| Cost of hiring and training new employees: three at $25,000 each for the first year. |

| Except as noted in 1, 2, 3, and 5, assets, current liabilities, sales, costs, and expenses are expected to be 80% of the existing store (from preliminary statements) except no stock. Retained earnings = net income. |

| Cash: $7,000. Accounts receivable amount to 4.0 turns (accounts receivable turnover will be 4.0); inventory amount to show 3.0 turns (inventory turnover will be 3.0). No stock will be issued. Retained earnings are to equal net income. Additional financing of $5,000 will be long-term. Add remaining amount needed to balance into accounts payable. |

For notes to the financial statements and Management Analysis Memo, consider the following:

Peyton Approved uses the following accounting practices:

- Inventory: Periodic, LIFO for both baking and merchandise

- Equipment: Straight line method used for equipment

Business Financing Information: Use this information to calculate interest rates and insurance information, and to assess their impact on the companys financial obligations:

- 6% interest note payable was made on Jan 31, 2017, and is due Feb 1, 2019.

- 5-year loan was made on June 1, 2016. Terms are 7.5% annual rate, interest only until due date.

- Insurance: Annual policy covers 12 months, purchased in February, covering March 2017 to February 2018. No monthly adjustments have been made.

I. Accounting Workbook: Your accounting workbook must include appropriate calculations, ratios, and notes:

A. Create adjusting entries for financial statement preparation. B. Create an adjusted trial balance for financial statement preparation. C. Prepare financial statements for determining the companys financial position. D. Calculate ratios for determining the companys financial health.

Management Analysis Brief: Your management analysis brief should explain financial information to management. Provide evidence from your accounting workbook to support your ideas when applicable. A. Assess the companys financial health based on ratio analyses presented in the accounting workbook. B. Compare ratio analysis to trends in financial ratios over time for illustrating their impact, providing examples to support your claims. C. Summarize the effects of different compounding periods and interest rates on future value of money.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started