Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. A company purchased a truck on October 1 of the current year at a cost of $40,000. The truck is expected to last

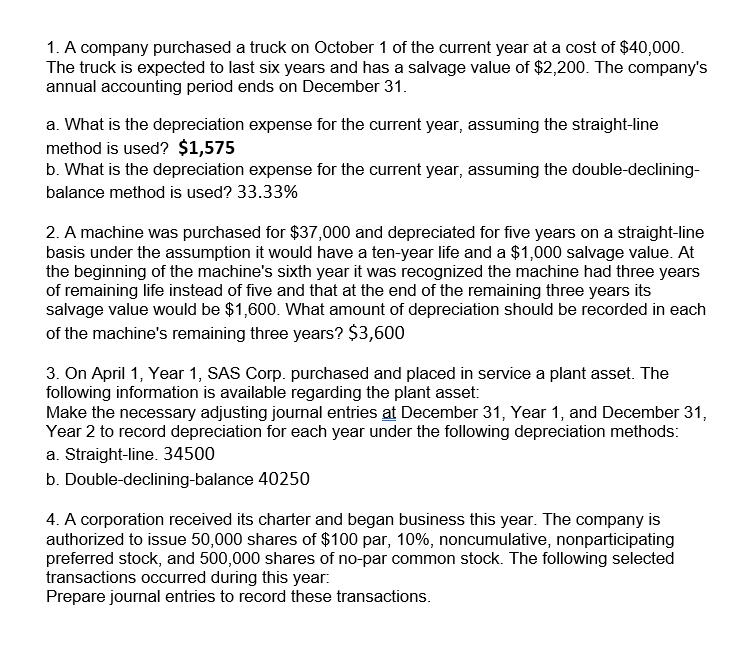

1. A company purchased a truck on October 1 of the current year at a cost of $40,000. The truck is expected to last six years and has a salvage value of $2,200. The company's annual accounting period ends on December 31. a. What is the depreciation expense for the current year, assuming the straight-line method is used? $1,575 b. What is the depreciation expense for the current year, assuming the double-declining- balance method is used? 33.33% 2. A machine was purchased for $37,000 and depreciated for five years on a straight-line basis under the assumption it would have a ten-year life and a $1,000 salvage value. At the beginning of the machine's sixth year it was recognized the machine had three years of remaining life instead of five and that at the end of the remaining three years its salvage value would be $1,600. What amount of depreciation should be recorded in each of the machine's remaining three years? $3,600 3. On April 1, Year 1, SAS Corp. purchased and placed in service a plant asset. The following information is available regarding the plant asset: Make the necessary adjusting journal entries at December 31, Year 1, and December 31, Year 2 to record depreciation for each year under the following depreciation methods: a. Straight-line. 34500 b. Double-declining-balance 40250 4. A corporation received its charter and began business this year. The company is authorized to issue 50,000 shares of $100 par, 10%, noncumulative, nonparticipating preferred stock, and 500,000 shares of no-par common stock. The following selected transactions occurred during this year: Prepare journal entries to record these transactions.

Step by Step Solution

★★★★★

3.39 Rating (165 Votes )

There are 3 Steps involved in it

Step: 1

1 a Depreciation expense for the current year using straightline method Cost of truck 40000 Salvage ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started