Answered step by step

Verified Expert Solution

Question

1 Approved Answer

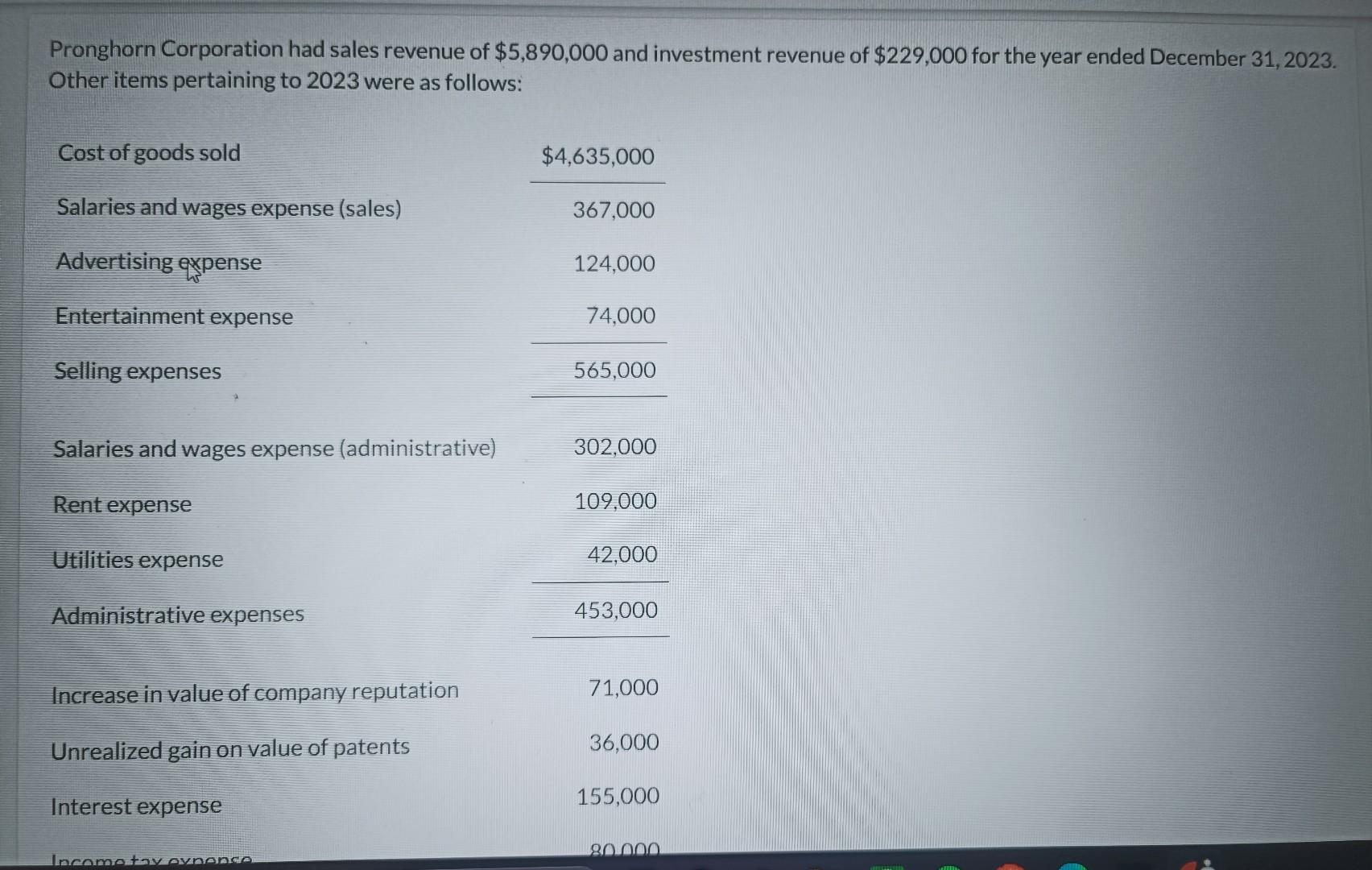

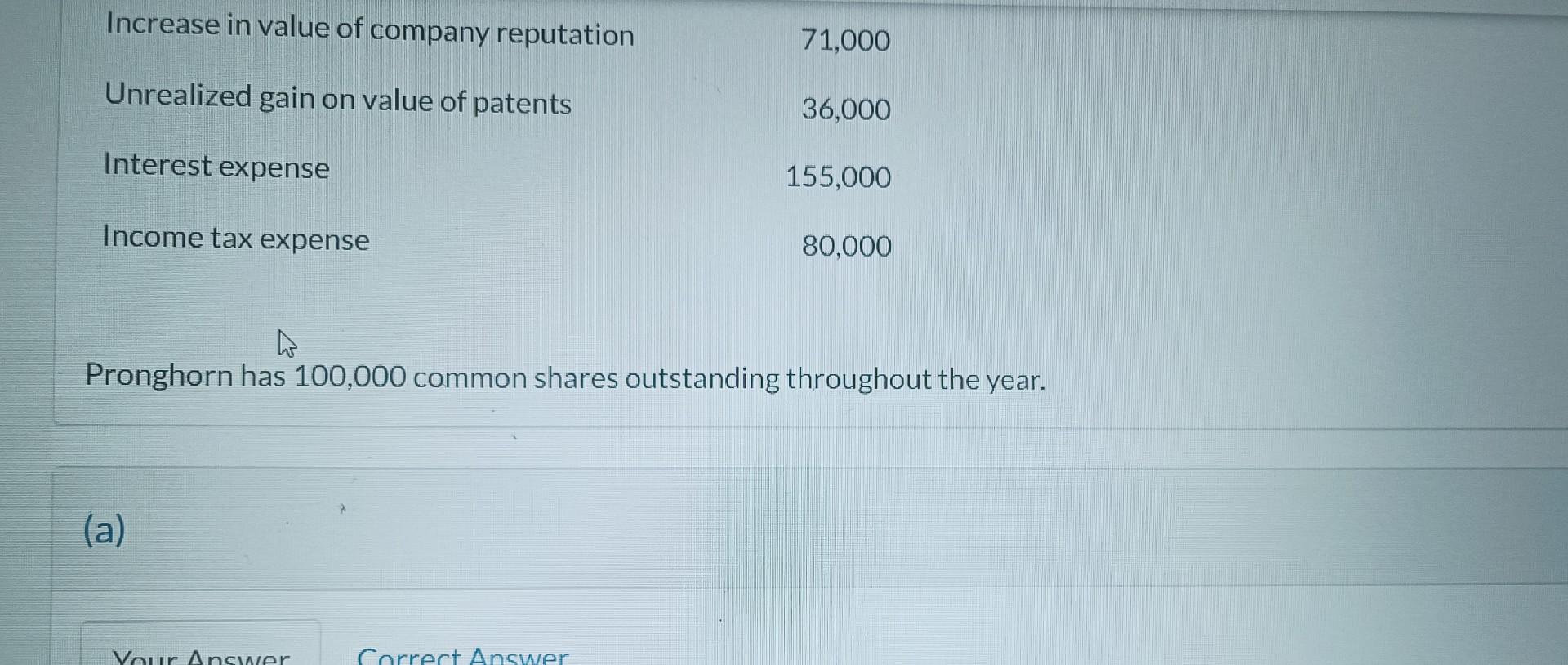

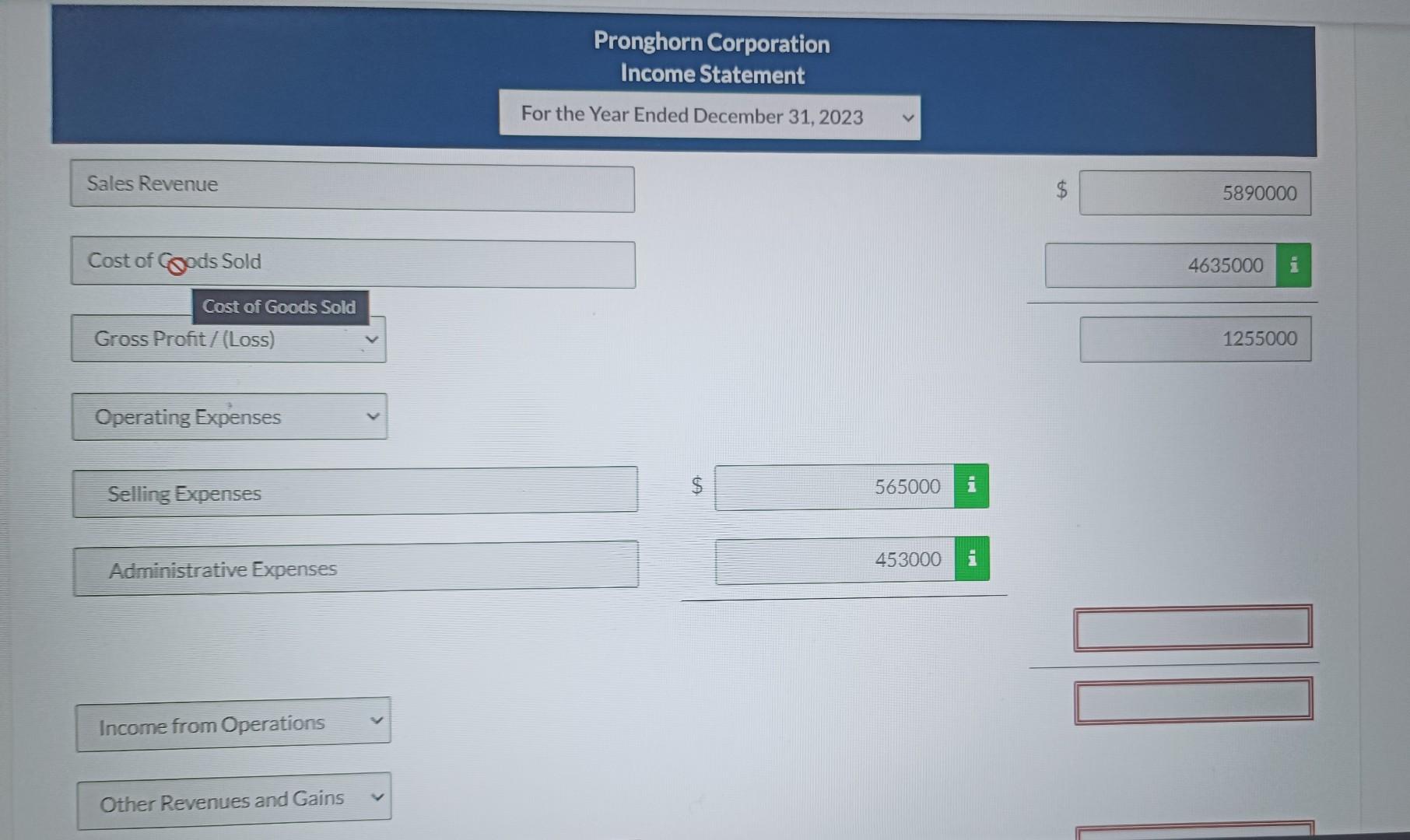

Pronghorn has 100,000 common shares outstanding throughout the year. Pronghorn Corporation Income Statement For the Year Ended December 31, 2023 Sales Revenue Cost of Gods

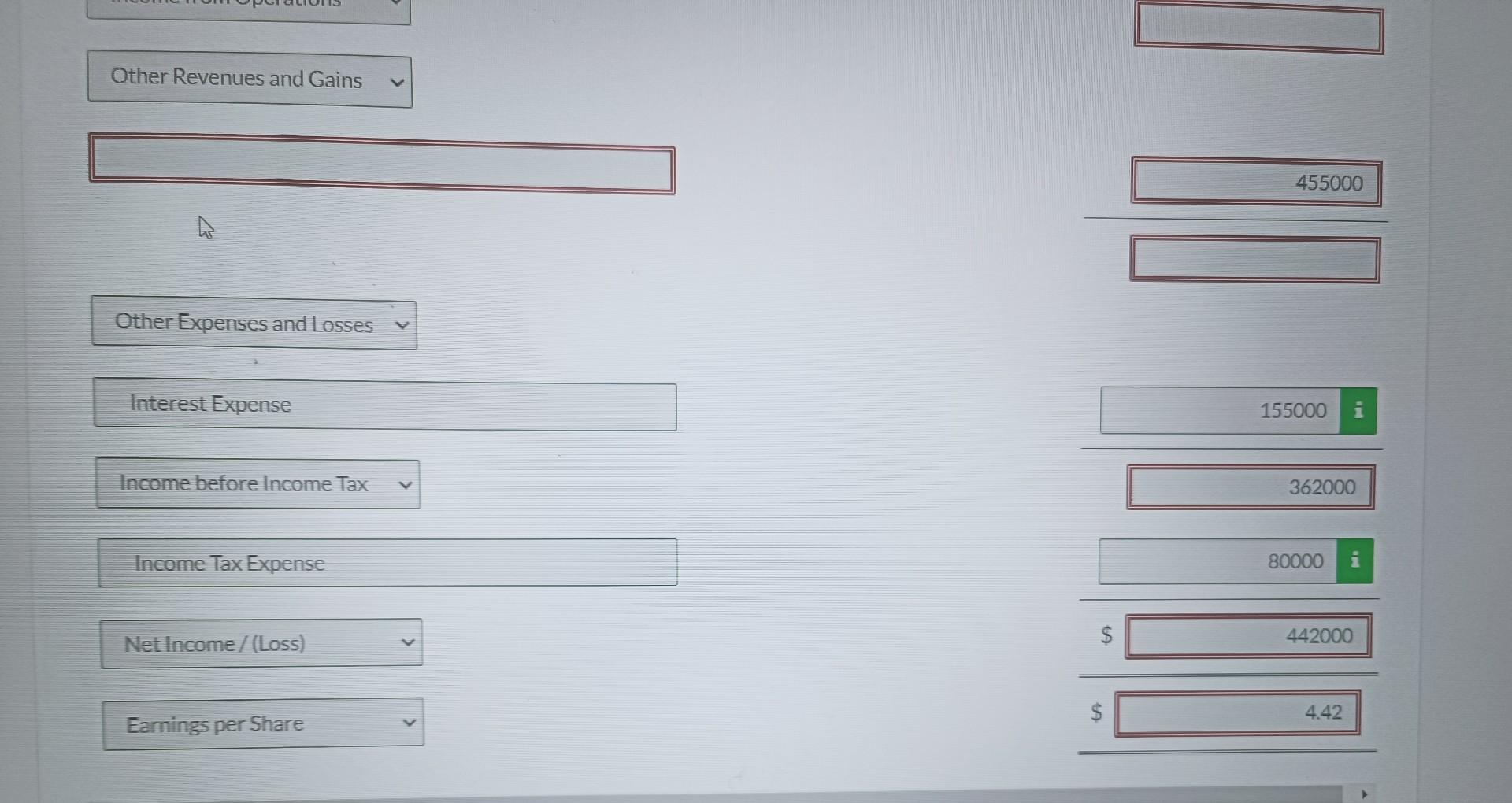

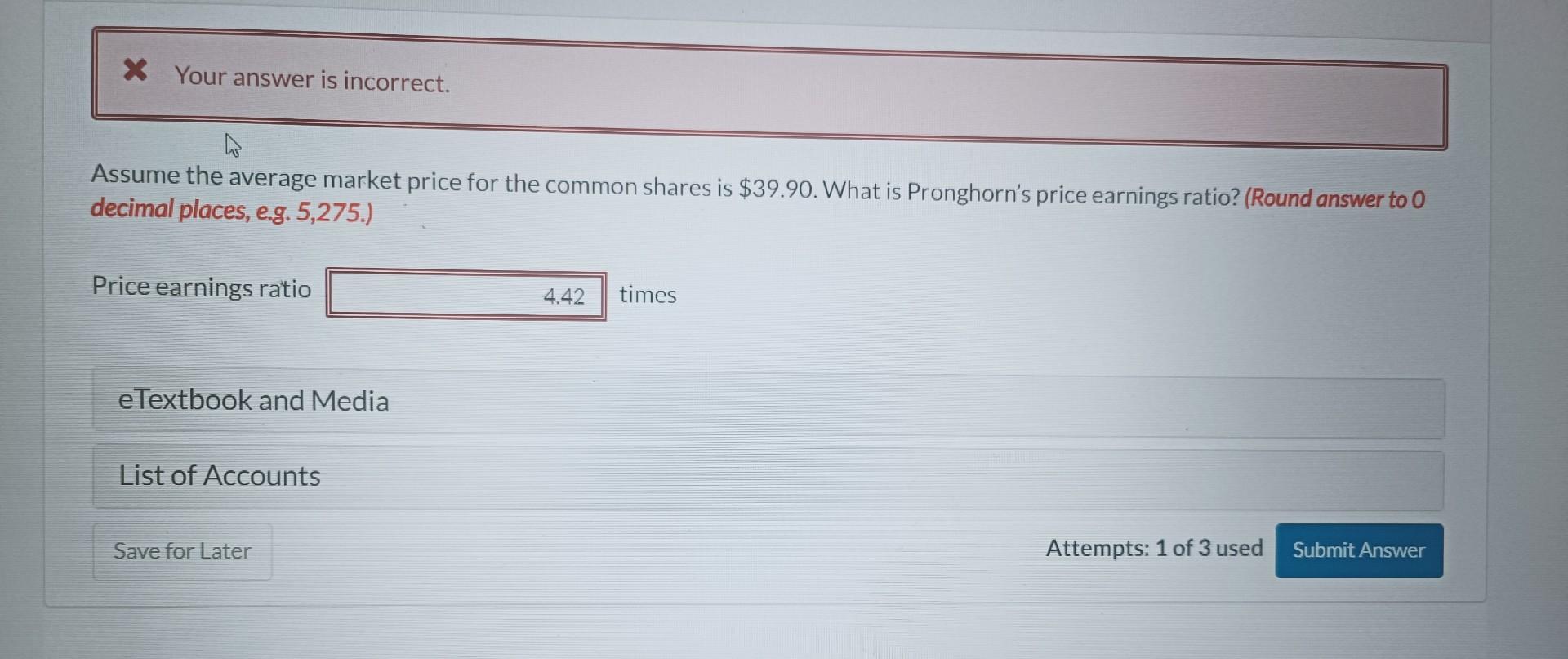

Pronghorn has 100,000 common shares outstanding throughout the year. Pronghorn Corporation Income Statement For the Year Ended December 31, 2023 Sales Revenue Cost of Gods Sold Cost of Goods Sold Gross Profit/(Loss) Operating Expenses Selling Expenses Administrative Expenses Income from Operations Other Revenues and Gains $ 5890000 4635000 1255000 $ 565000 i 453000 i \begin{tabular}{r} \hline 4635000 \\ \hline 1255000 \\ \hline \end{tabular} \begin{tabular}{|r|r|} \hline 565000 & i \\ \hline 453000 & i \\ \hline \end{tabular} Other Revenues and Gains Other Expenses and Losses Interest Expense Income before Income Tax Income Tax Expense \begin{tabular}{r} \hline 155000 i \\ \hline362000 \\ \hline \end{tabular} Net Income / (Loss) \begin{tabular}{|c|c|c|} \hline & 80000 & i \\ \hline$ & \multicolumn{2}{|c|}{442000} \\ \hline$ & \multicolumn{2}{|c|}{4.42} \\ \hline \end{tabular} Assume the average market price for the common shares is $39.90. What is Pronghorn's price earnings ratio? (Round answer to 0 decimal places, e.g. 5,275.) Price earnings ratio times eTextbook and Media Attempts: 1 of 3 used Pronghorn Corporation had sales revenue of $5,890,000 and investment revenue of $229,000 for the year ended December 31,2023 . Other items pertaining to 2023 were as follows

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started