Answered step by step

Verified Expert Solution

Question

1 Approved Answer

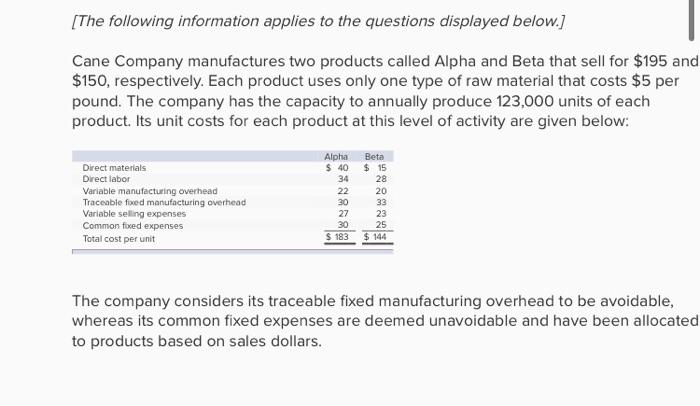

What contribution margin per pound of raw material is earned by Alpha and Beta? Assume that Canes customers would buy a maximum of 95,000 units

What contribution margin per pound of raw material is earned by Alpha and Beta?

Assume that Canes customers would buy a maximum of 95,000 units of Alpha and 75,000 units of Beta. Also assume that the companys raw material available for production is limited to 245,000 pounds. How many units of each product should Cane produce to maximize its profits?

Assume that Canes customers would buy a maximum of 95,000 units of Alpha and 75,000 units of Beta. Also assume that the companys raw material available for production is limited to 245,000 pounds. What is the maximum contribution margin Cane Company can earn given the limited quantity of raw materials?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started