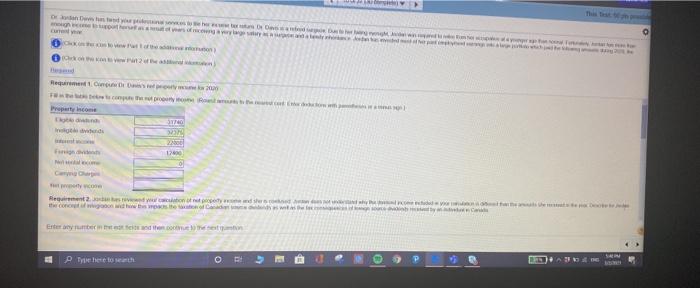

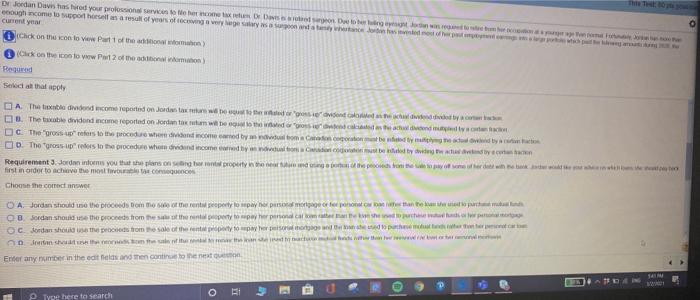

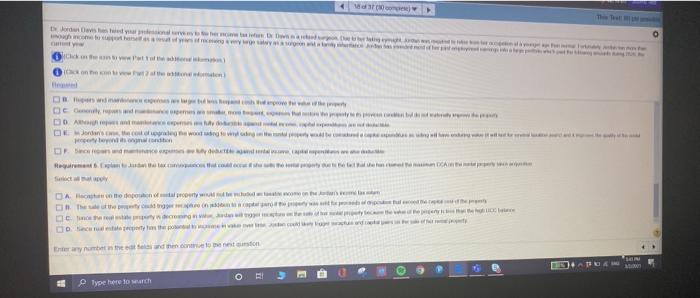

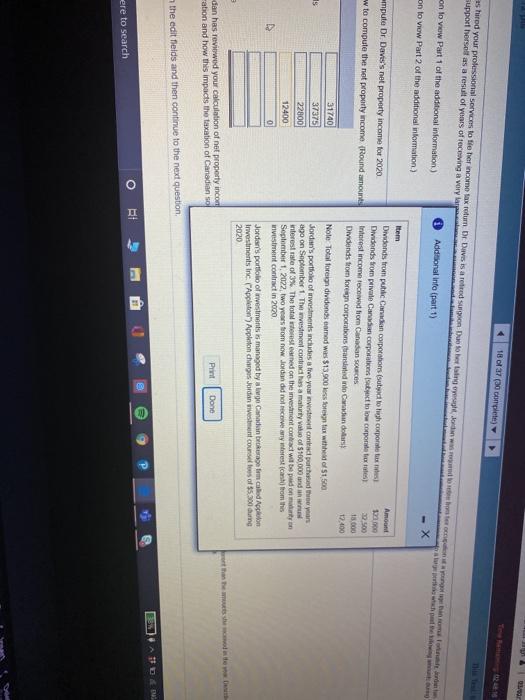

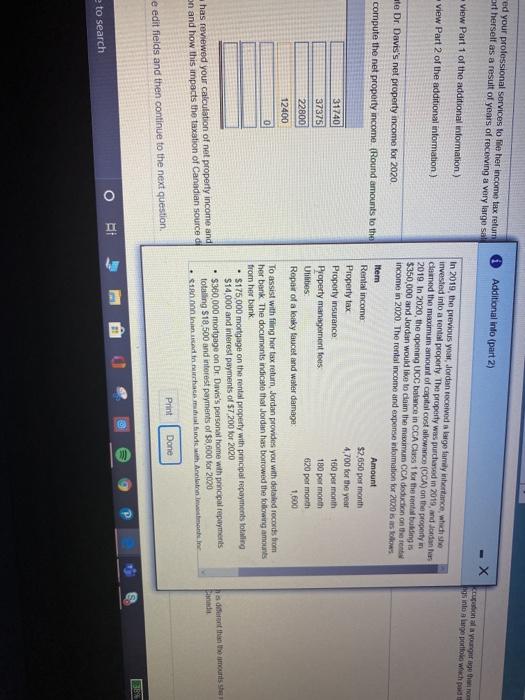

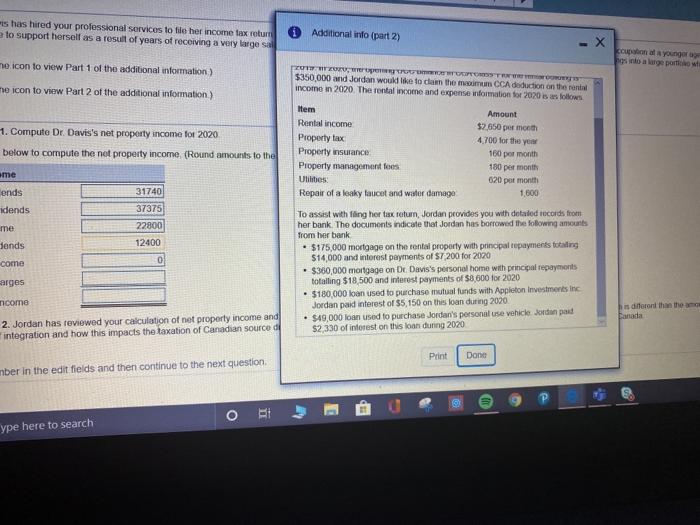

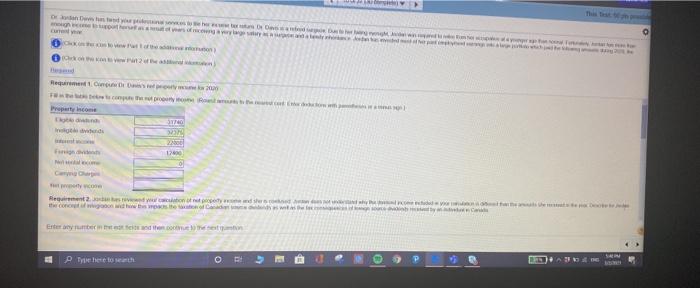

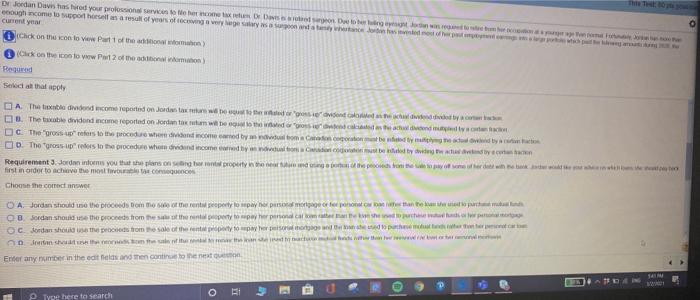

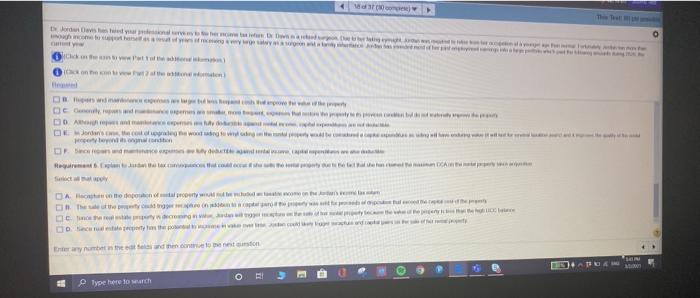

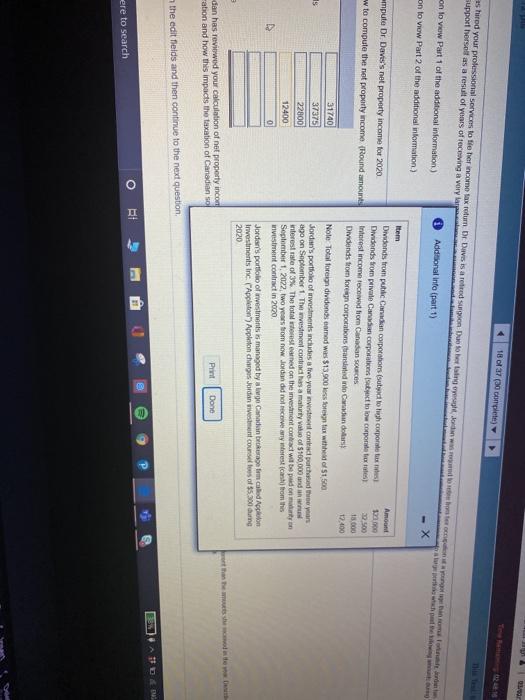

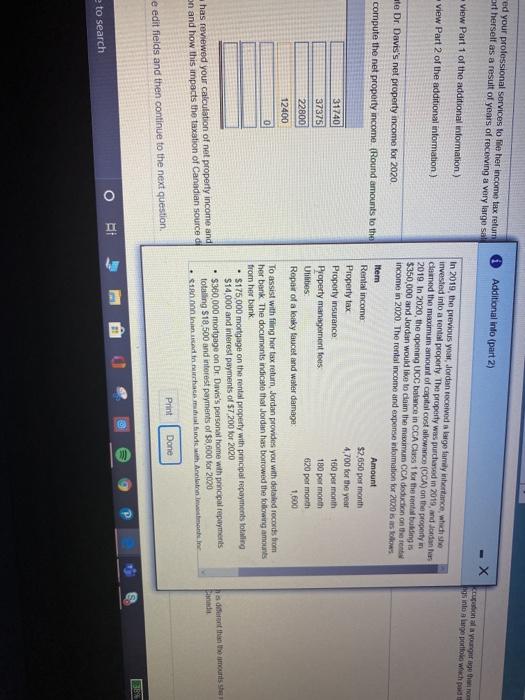

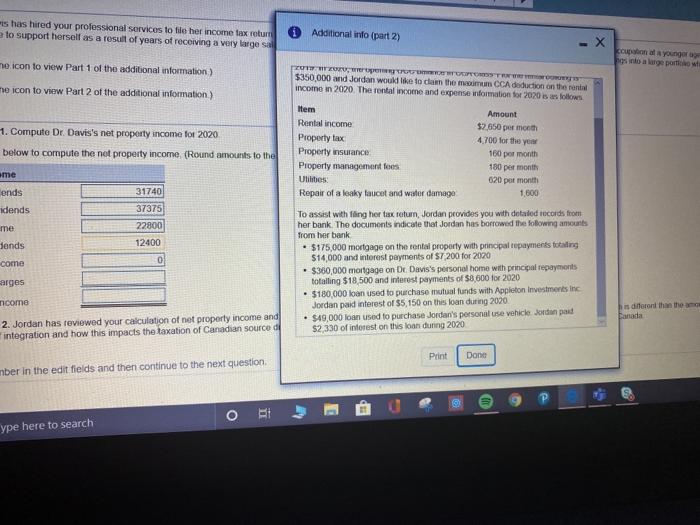

Property Income age | NAL 12.000 Frigate N one par Prebelo P DAS o Dr Jordan Davishared your professional service to Weber Debler enough incomes the small of your fingered Current year Chck on the icon to view Part of the women on the tow Port of the action Select all that apply JA The taxa dided income reported on Jordan man with her gosteiden tied by 6. The table dividend income reported on Jordan tulum w booth decided DC The gross us to the procedure when and come came tyd om att betydby D. The grass-refers to the procedure who died income and your bed te dy Requirement. Jorden inform you that the plan on ng property and the persone first in order to achieve the most we Choose the correct answer O A Jordan should be the proceeds to the rent geoperty to pay the personer OBJordan should use the proceeds from the other topic ec Jordan should use the promo sale of the top dopter normalt www Enter any number in the edited and men cantone 14 DAI O BI Type here to search o How DAN OF B. CA Hotely Type here to war 18 of 27 cm) shared your professional services to the income tax return Dr. Davis is a retired surgoon Due to healing worden was born support herself as a result of years of receiving a very Additional into (part 1) -X on to view Part 1 of the additional information) on to view Part 2 of the additional information) ampule Dr Dave's not property income for 2020 w to compute the net property income (Round amounts 31740 37375 is Item Dividends from public Canadian corpersons (ty to high corporate Amount Dividends from private Canadian Corporations betworporate 120 9.500 Interest income received from Canadian scores 18.000 Dividends from foreign corporations anslated into Canada 17.400 Note Total foreign dividends came was $13.900 less foreign is what 1.500 Jordan's portfolio of investments includes a five your vesten contact purchased three years ago on Soptomber 1. The wivestment contract has a maturity value of 100,000 and in interest rate of 3%. The total worst earned on the investment contract will be paid on man September 1, 2022, two years from now. Jordan did not receive any interest and from this investment contract in 2020 Jordan's portfolio of investments is managed by two Canadian brokerage om caled Appleton Investments inc. Appleton) Appleton charges Jordan weet couses of $5,300 during 2020 22800 12400 dan has reviewed your calculation of net property incon ation and how this impacts the taxation of Canadian Print Dono the edit fields and then continue to the next question 33 O BI 2 E ere to search ed your professional Services to file her income tax return art herself as a result of years of receiving a very large sa Additional info (part 2) view Part 1 of the additional information) into lange portfolio wachpad view Part 2 of the additional information) ate Dr Davis's net property income for 2020 compute the net property income. (Round amounts to the 31740 37375 22800 12400 In 2019, the previous year, Jordan received a ge family inheritance, which she invested into a rental property. The property was purchased in 2015, and Joonas clowned the maximum amount of capital costwowano (CCA) on the property in 2019. In 2020, the opening UCC balance in CCA Class for the regis $350,000 and Jordan would like to claim the maximum CCA deduction on the rest income in 2020. The rental income and expense information for 2020 is as fotos Item Amount Rental income $2650 per month Property tax 4,700 for the year Property insurance 160 per month Property management foes 180 per month Ulilibes 620 per month Ropa of a leaky faucet and water damage 1600 To assist with fling her tax return, Jordan provides you with detailed records from her bank. The documents indicate that Jordan has borrowed the following amounts from her bank $175,000 mortgage on the rental property with principal repayments totalling $14,000 and interest payments of $7.200 for 2020 $360,000 mortgage on Dr Davis's personal home with principal repayments totalling $18.500 and interest payments of $8,000 for 2020 1 din hac malfunds with Annen min 0 ha durant the mousse Ponada has reviewed your calculation of not property income and on and how this impacts the taxation of Canadian source de Print Done e edit fields and then continue to the next question 3 o e to search is has hired your professional services to file her income tax return to support herself as a result of years of receiving a very larges Additional info (part 2) ccupational a younger Feintoa luge portio he icon to view Part 1 of the additional information) pro TRS $350,000 and Jordan would like to claim the mom CCA deduction on the rent income an 2020. The rental income and expense information for 2020 is a The icon to view Part 2 of the additional information) 1. Compute Dr. Davis's net property income for 2020 below to compute the not property income (Round amounts to the Item Rental income Property tax Property insurance Property management foes Utilities: Repair of a leaky faucet and water damage Amount $2,650 per month 4.700 for the year 160 por month 180 per month 020 per month 1.600 ame ends idends me Jends come 31740 37375 22800 12400 0 To assist with fing her tax return, Jordan provides you with detailed records from her bank. The documents indicate that Jordan has borrowed the following amounts from her bank $175,000 mortgage on the total property with principal repayments totaling $14,000 and interest payments of $7.200 for 2020 $360,000 mortgage on Dr Davis's personal home with principal repayments totalling $18.500 and interest payments of $8,600 for 2020 $180,000 loan used to purchase mutual funds with Appleton Investments inc Jordan paid interest of $5,150 on this loan during 2020 $49,000 loan used to purchase Jordan's personal use vehicle and paid $2,330 of inforest on this loan duning 2020 arges ncome he different than the amo Canada 2. Jordan has reviewed your calculation of net property income and integration and how this impacts the taxation of Canadian source of Print Done mber in the edit fields and then continue to the next question ype here to search Property Income age | NAL 12.000 Frigate N one par Prebelo P DAS o Dr Jordan Davishared your professional service to Weber Debler enough incomes the small of your fingered Current year Chck on the icon to view Part of the women on the tow Port of the action Select all that apply JA The taxa dided income reported on Jordan man with her gosteiden tied by 6. The table dividend income reported on Jordan tulum w booth decided DC The gross us to the procedure when and come came tyd om att betydby D. The grass-refers to the procedure who died income and your bed te dy Requirement. Jorden inform you that the plan on ng property and the persone first in order to achieve the most we Choose the correct answer O A Jordan should be the proceeds to the rent geoperty to pay the personer OBJordan should use the proceeds from the other topic ec Jordan should use the promo sale of the top dopter normalt www Enter any number in the edited and men cantone 14 DAI O BI Type here to search o How DAN OF B. CA Hotely Type here to war 18 of 27 cm) shared your professional services to the income tax return Dr. Davis is a retired surgoon Due to healing worden was born support herself as a result of years of receiving a very Additional into (part 1) -X on to view Part 1 of the additional information) on to view Part 2 of the additional information) ampule Dr Dave's not property income for 2020 w to compute the net property income (Round amounts 31740 37375 is Item Dividends from public Canadian corpersons (ty to high corporate Amount Dividends from private Canadian Corporations betworporate 120 9.500 Interest income received from Canadian scores 18.000 Dividends from foreign corporations anslated into Canada 17.400 Note Total foreign dividends came was $13.900 less foreign is what 1.500 Jordan's portfolio of investments includes a five your vesten contact purchased three years ago on Soptomber 1. The wivestment contract has a maturity value of 100,000 and in interest rate of 3%. The total worst earned on the investment contract will be paid on man September 1, 2022, two years from now. Jordan did not receive any interest and from this investment contract in 2020 Jordan's portfolio of investments is managed by two Canadian brokerage om caled Appleton Investments inc. Appleton) Appleton charges Jordan weet couses of $5,300 during 2020 22800 12400 dan has reviewed your calculation of net property incon ation and how this impacts the taxation of Canadian Print Dono the edit fields and then continue to the next question 33 O BI 2 E ere to search ed your professional Services to file her income tax return art herself as a result of years of receiving a very large sa Additional info (part 2) view Part 1 of the additional information) into lange portfolio wachpad view Part 2 of the additional information) ate Dr Davis's net property income for 2020 compute the net property income. (Round amounts to the 31740 37375 22800 12400 In 2019, the previous year, Jordan received a ge family inheritance, which she invested into a rental property. The property was purchased in 2015, and Joonas clowned the maximum amount of capital costwowano (CCA) on the property in 2019. In 2020, the opening UCC balance in CCA Class for the regis $350,000 and Jordan would like to claim the maximum CCA deduction on the rest income in 2020. The rental income and expense information for 2020 is as fotos Item Amount Rental income $2650 per month Property tax 4,700 for the year Property insurance 160 per month Property management foes 180 per month Ulilibes 620 per month Ropa of a leaky faucet and water damage 1600 To assist with fling her tax return, Jordan provides you with detailed records from her bank. The documents indicate that Jordan has borrowed the following amounts from her bank $175,000 mortgage on the rental property with principal repayments totalling $14,000 and interest payments of $7.200 for 2020 $360,000 mortgage on Dr Davis's personal home with principal repayments totalling $18.500 and interest payments of $8,000 for 2020 1 din hac malfunds with Annen min 0 ha durant the mousse Ponada has reviewed your calculation of not property income and on and how this impacts the taxation of Canadian source de Print Done e edit fields and then continue to the next question 3 o e to search is has hired your professional services to file her income tax return to support herself as a result of years of receiving a very larges Additional info (part 2) ccupational a younger Feintoa luge portio he icon to view Part 1 of the additional information) pro TRS $350,000 and Jordan would like to claim the mom CCA deduction on the rent income an 2020. The rental income and expense information for 2020 is a The icon to view Part 2 of the additional information) 1. Compute Dr. Davis's net property income for 2020 below to compute the not property income (Round amounts to the Item Rental income Property tax Property insurance Property management foes Utilities: Repair of a leaky faucet and water damage Amount $2,650 per month 4.700 for the year 160 por month 180 per month 020 per month 1.600 ame ends idends me Jends come 31740 37375 22800 12400 0 To assist with fing her tax return, Jordan provides you with detailed records from her bank. The documents indicate that Jordan has borrowed the following amounts from her bank $175,000 mortgage on the total property with principal repayments totaling $14,000 and interest payments of $7.200 for 2020 $360,000 mortgage on Dr Davis's personal home with principal repayments totalling $18.500 and interest payments of $8,600 for 2020 $180,000 loan used to purchase mutual funds with Appleton Investments inc Jordan paid interest of $5,150 on this loan during 2020 $49,000 loan used to purchase Jordan's personal use vehicle and paid $2,330 of inforest on this loan duning 2020 arges ncome he different than the amo Canada 2. Jordan has reviewed your calculation of net property income and integration and how this impacts the taxation of Canadian source of Print Done mber in the edit fields and then continue to the next question ype here to search