Answered step by step

Verified Expert Solution

Question

1 Approved Answer

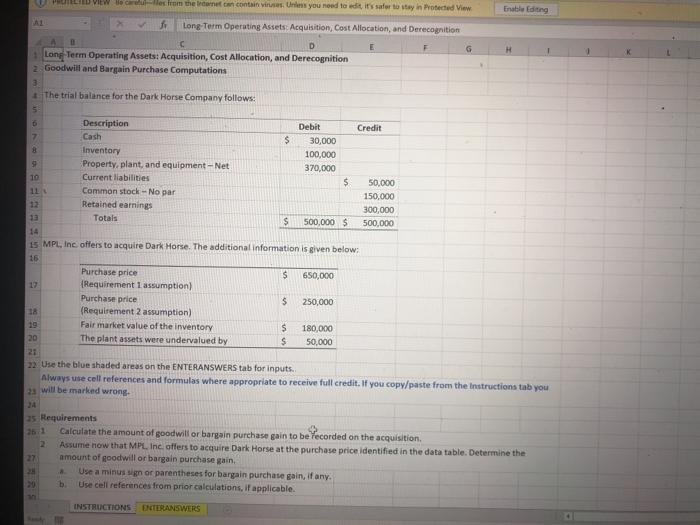

PROTECTED VIEW Be careful-es from the learnet can contain viruses. Unless you need to edit, it's safer to stay in Protected View fr Long-Term

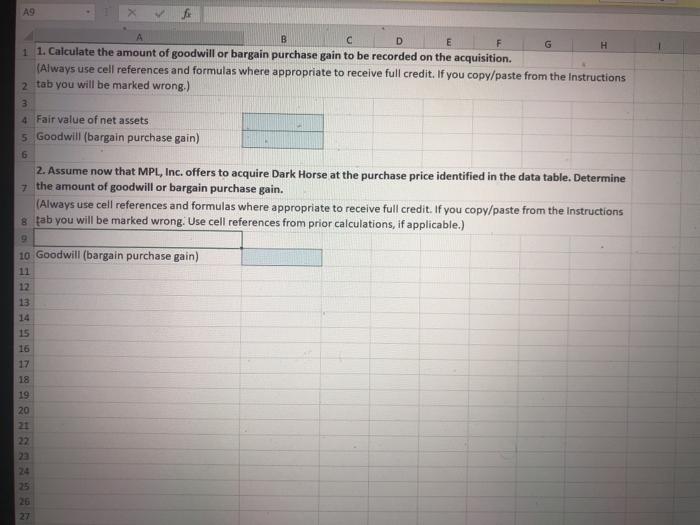

PROTECTED VIEW Be careful-es from the learnet can contain viruses. Unless you need to edit, it's safer to stay in Protected View fr Long-Term Operating Assets: Acquisition, Cost Allocation, and Derecognition C D Long-Term Operating Assets: Acquisition, Cost Allocation, and Derecognition 2 Goodwill and Bargain Purchase Computations AL 3 4 The trial balance for the Dark Horse Company follows: 5 6 7 8 SP 10 11 s 12 13 17 29888 18 19 20 21 Description Cash Inventory Property, plant, and equipment - Net Current liabilities 14 15 MPL, Inc. offers to acquire Dark Horse. The additional information is given below: 16 27 28 Common stock - No par Retained earnings Totals 29 M 25 Requirements 26-1 2 Purchase price (Requirement 1 assumption) Purchase price (Requirement 2 assumption) Fair market value of the inventory The plant assets were undervalued by $ $ INSTRUCTIONS ENTERANSWERS $ $ $ Debit $ 30,000 100,000 370,000 500,000 $ 650,000 $ 250,000 180,000 50,000 22 Use the blue shaded areas on the ENTERANSWERS tab for inputs.. Always use cell references and formulas where appropriate to receive full credit. If you copy/paste from the Instructions tab you 23 will be marked wrong. Credit 50,000 150,000 300,000 500,000 Enable Editing Calculate the amount of goodwill or bargain purchase gain to be recorded on the acquisition. Assume now that MPL, Inc. offers to acquire Dark Horse at the purchase price identified in the data table. Determine the amount of goodwill or bargain purchase gain, A Use a minus sign or parentheses for bargain purchase gain, if any. b. Use cell references from prior calculations, if applicable. a A9 A B C D F 1 1. Calculate the amount of goodwill or bargain purchase gain to be recorded on the acquisition. (Always use cell references and formulas where appropriate to receive full credit. If you copy/paste from the Instructions 2 tab you will be marked wrong.) 3 4 Fair value of net assets 5 Goodwill (bargain purchase gain) 6 9 10 Goodwill (bargain purchase gain) 2. Assume now that MPL, Inc. offers to acquire Dark Horse at the purchase price identified in the data table. Determine 7 the amount of goodwill or bargain purchase gain. (Always use cell references and formulas where appropriate to receive full credit. If you copy/paste from the Instructions 8 tab you will be marked wrong. Use cell references from prior calculations, if applicable.) onn Bus 6 7 8 9 20 unpz557 11 12 13. 14 15 16 17 18 19 21 22 23 24 25 26 G 27 H

Step by Step Solution

There are 3 Steps involved in it

Step: 1

LongTerm Operating Assets Acquisition Cost Allocation and Derecognition Goodwill and Bargain Purchas...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started