Question

These transactions occurred during the second half of January. Continue the General Journal where you left off in the previous chapter. Be sure to account

These transactions occurred during the second half of January. Continue the General Journal where you left off in the previous chapter. Be sure to account for HST as indicated.

20—Jan. 16 Bought advertising space in the local community newspaper, $125 plus 13% HST. Issued Cheque #7.

16 Paid shipping costs on the merchandise bought on the 5th, $85 plus HST. Issued Cheque #8.

17 Paid transportation cost for new paint mixer and colour dispenser bought on the 9th and delivered from Toronto. Issued Cheque #9 for $84.75 (includes $9.75 HST).

20 Cash sales: paint and supplies, $2,500; wallpaper, $2,000; plus HST.

21 Paid delivery costs for paint and supplies delivered to our customer, $60 plus HST. Cheque #10.

26 Bought paint and supplies, $8,500 plus HST. Cheque #11.

26 Paid the shipping on paint and supplies bought today, $45 plus HST. Cheque #12.

30 Cash sales: paint and supplies, $3,000; wallpaper, $1,000; plus HST

Please prepare a General Journal, Ledger account and Trial balance for the above transaction

Previous date Transaction for reference

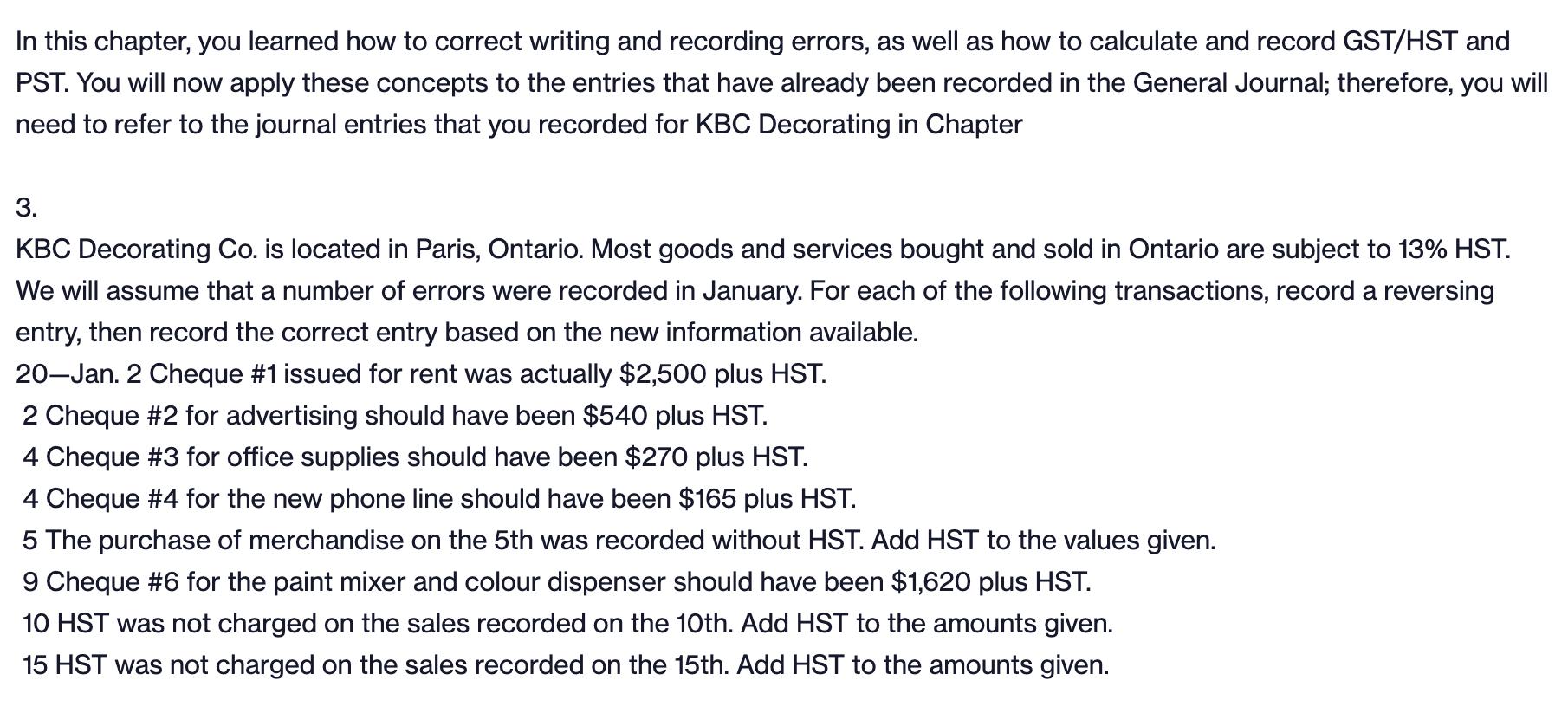

In this chapter, you learned how to correct writing and recording errors, as well as how to calculate and record GST/HST and PST. You will now apply these concepts to the entries that have already been recorded in the General Journal; therefore, you will need to refer to the journal entries that you recorded for KBC Decorating in Chapter 3. KBC Decorating Co. is located in Paris, Ontario. Most goods and services bought and sold in Ontario are subject to 13% HST. We will assume that a number of errors were recorded in January. For each of the following transactions, record a reversing entry, then record the correct entry based on the new information available. 20-Jan. 2 Cheque #1 issued for rent was actually $2,500 plus HST. 2 Cheque #2 for advertising should have been $540 plus HST. 4 Cheque #3 for office supplies should have been $270 plus HST. 4 Cheque #4 for the new phone line should have been $165 plus HST. 5 The purchase of merchandise on the 5th was recorded without HST. Add HST to the values given. 9 Cheque #6 for the paint mixer and colour dispenser should have been $1,620 plus HST. 10 HST was not charged on the sales recorded on the 10th. Add HST to the amounts given. 15 HST was not charged on the sales recorded on the 15th. Add HST to the amounts given.

Step by Step Solution

3.44 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

HST ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started