Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Proten Bhd purchased a machinery costing RM500,000 on 1 Janaury 2014 and the machinery is depreciated over 10 years. Proten Bhd spends RM10,000 per

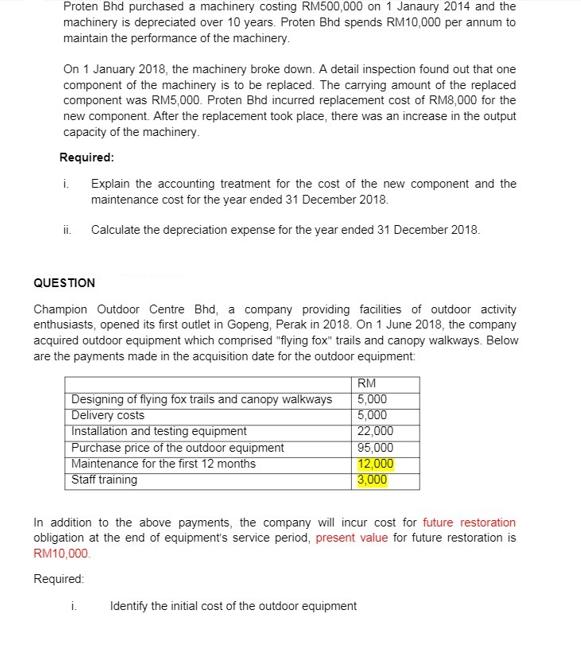

Proten Bhd purchased a machinery costing RM500,000 on 1 Janaury 2014 and the machinery is depreciated over 10 years. Proten Bhd spends RM10,000 per annum to maintain the performance of the machinery. On 1 January 2018, the machinery broke down. A detail inspection found out that one component of the machinery is to be replaced. The carrying amount of the replaced component was RM5,000. Proten Bhd incurred replacement cost of RM8,000 for the new component. After the replacement took place, there was an increase in the output capacity of the machinery. Required: i. ii. Explain the accounting treatment for the cost of the new component and the maintenance cost for the year ended 31 December 2018. Calculate the depreciation expense for the year ended 31 December 2018. QUESTION Champion Outdoor Centre Bhd, a company providing facilities of outdoor activity enthusiasts, opened its first outlet in Gopeng, Perak in 2018. On 1 June 2018, the company acquired outdoor equipment which comprised "flying fox" trails and canopy walkways. Below are the payments made in the acquisition date for the outdoor equipment: Designing of flying fox trails and canopy walkways Delivery costs Installation and testing equipment Purchase price of the outdoor equipment Maintenance for the first 12 months Staff training i. RM 5,000 5,000 22,000 95,000 12,000 3,000 In addition to the above payments, the company will incur cost for future restoration obligation at the end of equipment's service period, present value for future restoration is RM10,000. Required: Identify the initial cost of the outdoor equipment

Step by Step Solution

★★★★★

3.50 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

For the Proten Bhd case i Accounting treatment for the cost of the new component and the maintenance cost for the year ended 31 December 2018 The cost ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started