Question

Suppose that you are 34 years old now, and that you would like to retire at the age of 75. Furthermore, you would like

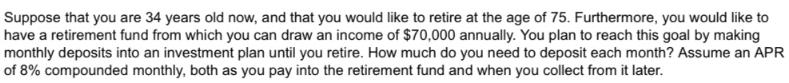

Suppose that you are 34 years old now, and that you would like to retire at the age of 75. Furthermore, you would like to have a retirement fund from which you can draw an income of $70,000 annually. You plan to reach this goal by making monthly deposits into an investment plan until you retire. How much do you need to deposit each month? Assume an APR of 8% compounded monthly, both as you pay into the retirement fund and when you collect from it later.

Step by Step Solution

3.48 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

To determine the monthly deposit required to reach your retirement goal we can use the future value ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Personal Finance Turning Money into Wealth

Authors: Arthur J. Keown

8th edition

134730364, 978-0134730363

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App