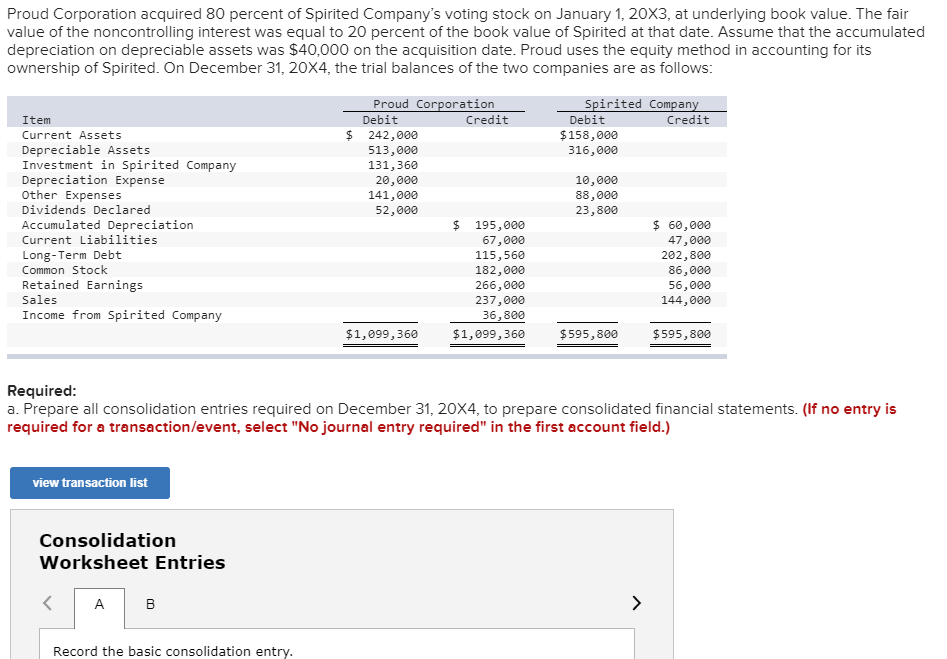

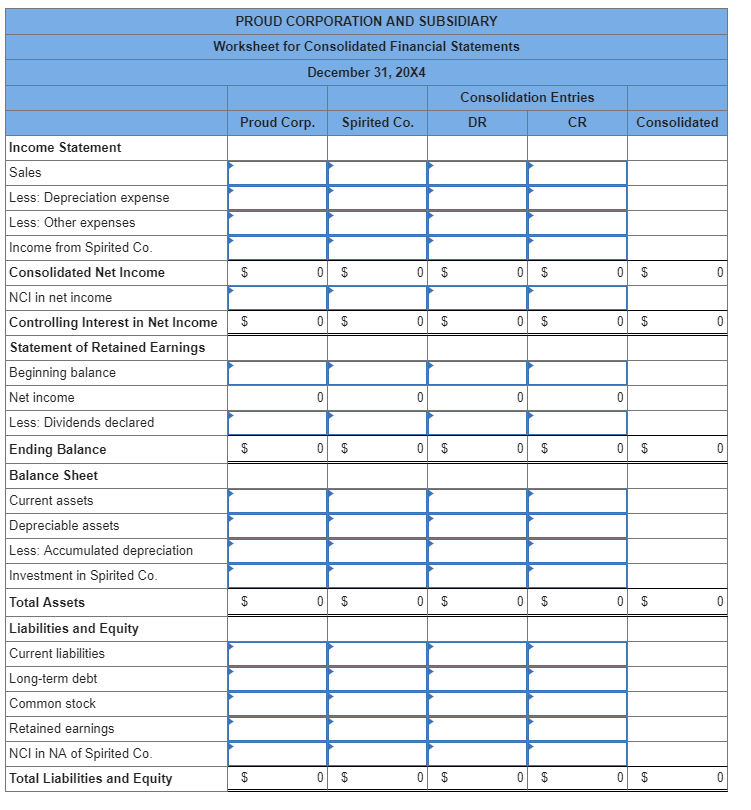

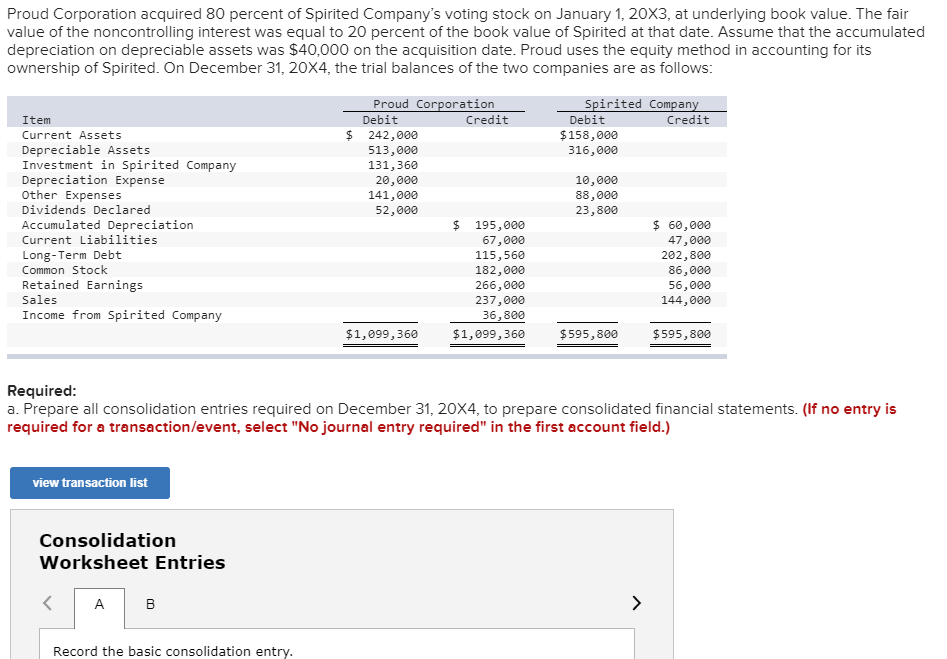

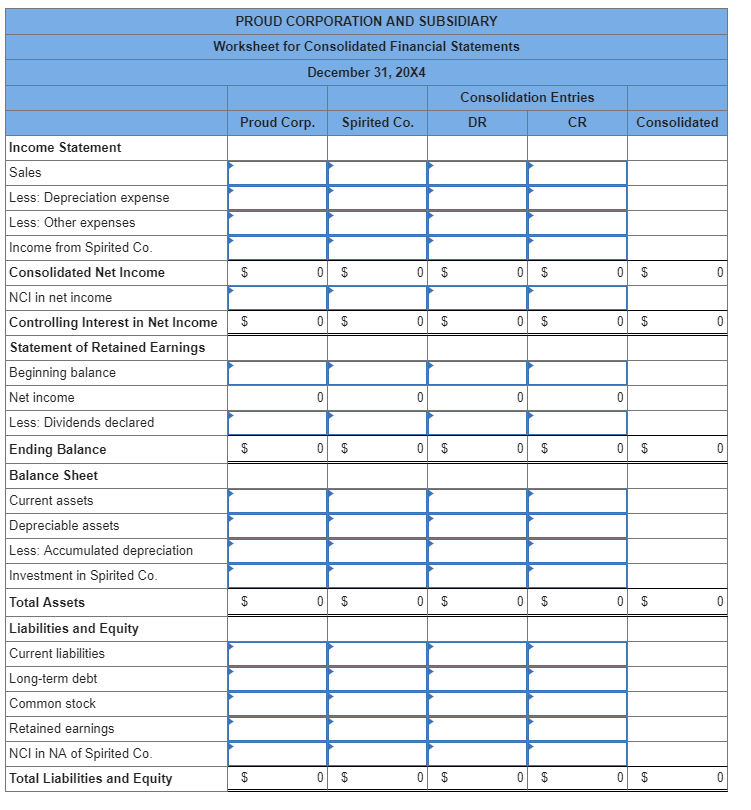

Proud Corporation acquired 80 percent of Spirited Company's voting stock on January 1, 20X3, at underlying book value. The fair value of the noncontrolling interest was equal to 20 percent of the book value of Spirited at that date. Assume that the accumulated depreciation on depreciable assets was $40,000 on the acquisition date. Proud uses the equity method in accounting for its ownership of Spirited. On December 31, 20X4, the trial balances of the two companies are as follows Proud Corporation Debit Spirited Compan Debit Item Current Assets Depreciable Assets Investment in Spirited Depreciation Expense Other Expenses Dividends Declared Accumulated Depreciation Current Liabilities Long-Term Debt Common Stock Retained Earnings Sales Income from Spirited Company Credit Credit $ 242,000 513,000 131,360 20,000 141,000 52,000 $158,000 316,000 Company 10,000 88,000 23,800 $ 195,000 67,000 115,560 182,000 266,000 237,000 36,800 $1,099,360 $ 60,000 47,000 202,800 86,000 56,000 144,000 $1,099,360 $595,800 $595,800 Required a. Prepare all consolidation entries required on December 31, 20X4, to prepare consolidated financial statements. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) view transaction list Consolidation Worksheet Entries Record the basic consolidation entry PROUD CORPORATION AND SUBSIDIARY Worksheet for Consolidated Financial Statements December 31, 20X4 Consolidation Entries DR CR Proud Corp. Spirited Co Consolidated Income Statement Sales Less: Depreciation expense Less: Other expenses Income from Spirited Co Consolidated Net Income NCI in net income Controlling Interest in Net Income$ Statement of Retained Earnings Beginning balance Net income Less: Dividends declared Ending Balance Balance Sheet Current assets Depreciable assets Less: Accumulated depreciation Investment in Spirited Co Total Assets Liabilities and Equity Current liabilities Long-term debt Common stock Retained earnings NCI in NA of Spirited Co Total Liabilities and Equity Proud Corporation acquired 80 percent of Spirited Company's voting stock on January 1, 20X3, at underlying book value. The fair value of the noncontrolling interest was equal to 20 percent of the book value of Spirited at that date. Assume that the accumulated depreciation on depreciable assets was $40,000 on the acquisition date. Proud uses the equity method in accounting for its ownership of Spirited. On December 31, 20X4, the trial balances of the two companies are as follows Proud Corporation Debit Spirited Compan Debit Item Current Assets Depreciable Assets Investment in Spirited Depreciation Expense Other Expenses Dividends Declared Accumulated Depreciation Current Liabilities Long-Term Debt Common Stock Retained Earnings Sales Income from Spirited Company Credit Credit $ 242,000 513,000 131,360 20,000 141,000 52,000 $158,000 316,000 Company 10,000 88,000 23,800 $ 195,000 67,000 115,560 182,000 266,000 237,000 36,800 $1,099,360 $ 60,000 47,000 202,800 86,000 56,000 144,000 $1,099,360 $595,800 $595,800 Required a. Prepare all consolidation entries required on December 31, 20X4, to prepare consolidated financial statements. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) view transaction list Consolidation Worksheet Entries Record the basic consolidation entry PROUD CORPORATION AND SUBSIDIARY Worksheet for Consolidated Financial Statements December 31, 20X4 Consolidation Entries DR CR Proud Corp. Spirited Co Consolidated Income Statement Sales Less: Depreciation expense Less: Other expenses Income from Spirited Co Consolidated Net Income NCI in net income Controlling Interest in Net Income$ Statement of Retained Earnings Beginning balance Net income Less: Dividends declared Ending Balance Balance Sheet Current assets Depreciable assets Less: Accumulated depreciation Investment in Spirited Co Total Assets Liabilities and Equity Current liabilities Long-term debt Common stock Retained earnings NCI in NA of Spirited Co Total Liabilities and Equity