Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Provide 3 years worth ofprojected income statements up through the net income common stockholder category based on the following information while discussing how you

Provide 3 years worth of projected income statements up through the net income common stockholder category based on the following information while discussing how you arrived at your estimates.

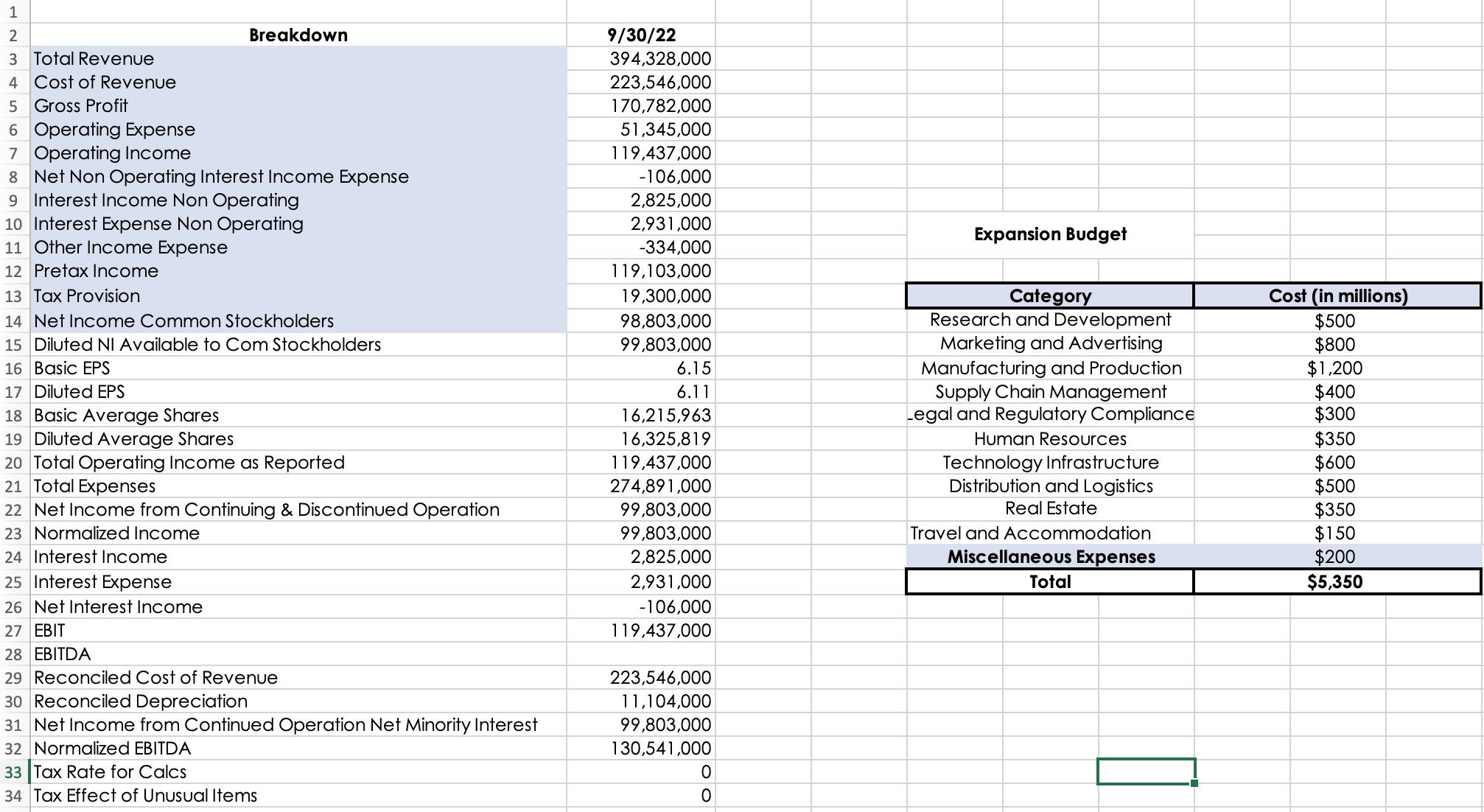

1 2 3 Total Revenue 4 Cost of Revenue 5 Gross Profit 6 Operating Expense 7 Operating Income Breakdown 8 Net Non Operating Interest Income Expense 9 Interest Income Non Operating 10 Interest Expense Non Operating 11 Other Income Expense 12 Pretax Income 13 Tax Provision 14 Net Income Common Stockholders 15 Diluted NI Available to Com Stockholders 16 Basic EPS 17 Diluted EPS 18 Basic Average Shares 19 Diluted Average Shares 20 Total Operating Income as Reported 21 Total Expenses 22 Net Income from Continuing & Discontinued Operation 23 Normalized Income 24 Interest Income 25 Interest Expense 26 Net Interest Income 27 EBIT 28 EBITDA 29 Reconciled Cost of Revenue 30 Reconciled Depreciation 31 Net Income from Continued Operation Net Minority Interest 32 Normalized EBITDA 33 Tax Rate for Calcs 34 Tax Effect of Unusual Items 9/30/22 394,328,000 223,546,000 170,782,000 51,345,000 119,437,000 -106,000 2,825,000 2,931,000 -334,000 119,103,000 19,300,000 98,803,000 99,803,000 6.15 6.11 16,215,963 16,325,819 119,437,000 274,891,000 99,803,000 99,803,000 2,825,000 2,931,000 -106,000 119,437,000 223,546,000 11,104,000 99,803,000 130,541,000 0 0 Expansion Budget Category Research and Development Marketing and Advertising Manufacturing and Production Supply Chain Management Legal and Regulatory Compliance Human Resources Technology Infrastructure Distribution and Logistics Real Estate Travel and Accommodation Miscellaneous Expenses Total Cost (in millions) $500 $800 $1,200 $400 $300 $350 $600 $500 $350 $150 $200 $5,350

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To create a projected income statement for the next three years I will need to apply assumptions regarding the growth of revenue costs and other income statement items However I do not have historical ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started