Question

Provide a British Pound Valuation for the Yellow Page businesses of British Telecom assuming you are a banker for Hicks, Muse. Utilize the information from

Provide a British Pound Valuation for the Yellow Page businesses of British Telecom assuming you are a banker for Hicks, Muse. Utilize the information from the case study as well as guidance provided below. If you find that you need a make assumption for anything not discussed below document it and briefly discuss why you are making such an assumption.

Assumptions for Yellow Pages UK:

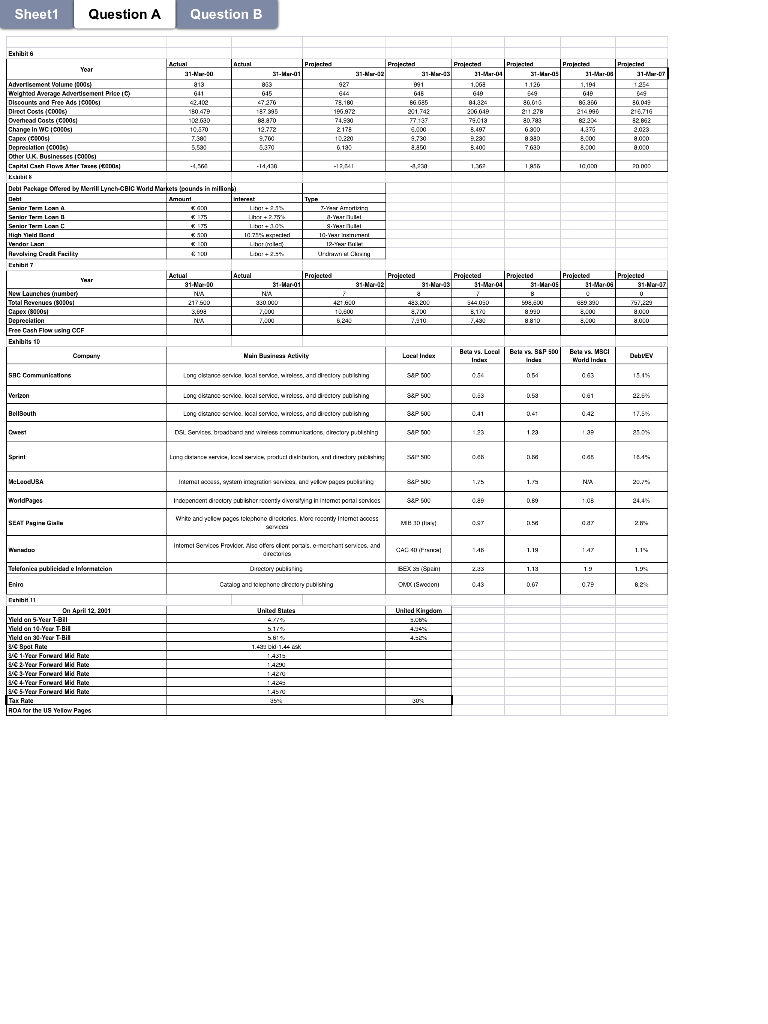

Utilize all assumptions in Exhibit 6 with the exception of Weighted Average Advertisement Price (WAAP) and those mentioned below.

o Calculate WAAP using information and assumptions provided on page 5.

o For 2002 and beyond assume Direct Costs and Overhead Costs to be 37.5% and 15.0% of Net Revenues.

o For Change in WC for 2006 and beyond assume 35% of Net Revenues.

Utilize Exhibit 8 to calculate interest expense:

o The Vendor Loan is a rolled loan, meaning there is no explicit interest expense annually, but that the principal of the loan increases every year by the equivalent of the interest payment and therefore overall debt increases by this amount every year. For tax purposes however, even though the rollup is not paid out annually, it is tax deductible as if it was an interest payment.

Assumptions for Yellow Pages US:

All information necessary are found in Exhibit 7 and the text on page 6.

Utilize your lecture notes in calculating Free Cash Flow using the CCF methodology.

Utilize Exhibits 10 & 11 as discussed in class to calculate an appropriate Return on Assets for the British division and then adjust accordingly using the risk-free rates of the UK and US to get the ROA for the US Yellow Pages.

As discussed in the case use a growth rate of 2% and 5% for the UK and US businesses respectively.

Utilize the above information to calculate a valuation for each business (dont forget to calculate a terminal value for the businesses for year 2007).

Convert the US valuation to British Pound using the spot exchange rate given in the case.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started