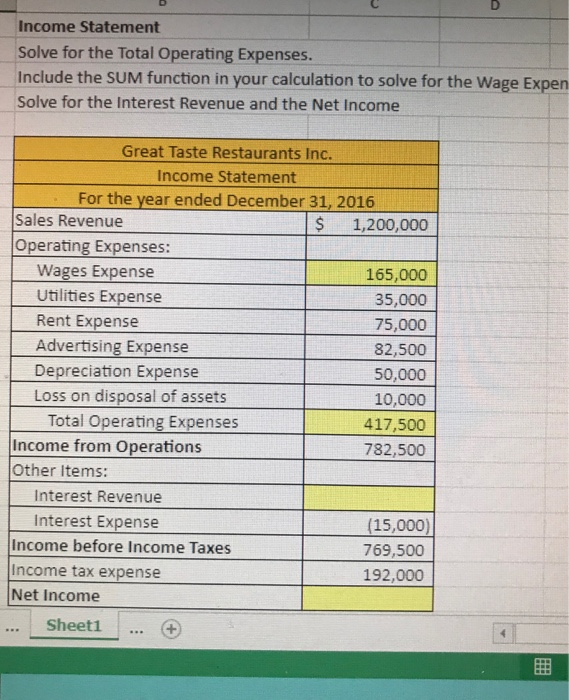

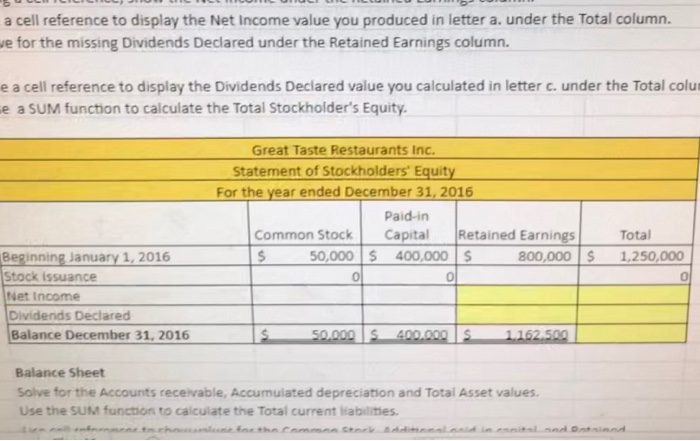

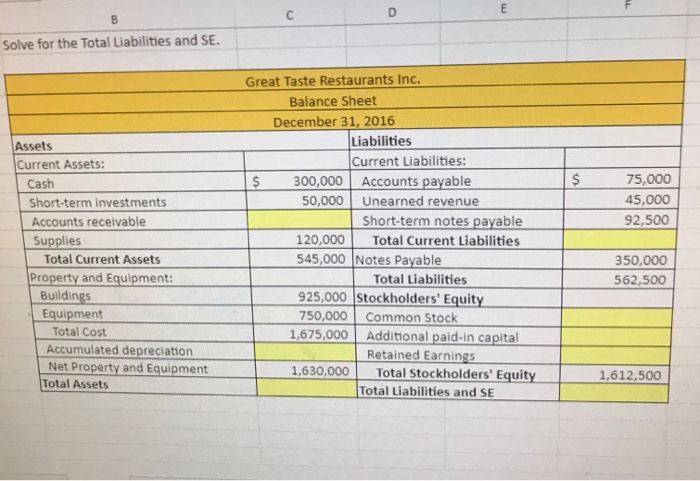

Income Statement Solve for the Total Operating Expenses. Include the SUM function in your calculation to solve for the Wage Expen Solve for the Interest Revenue and the Net Income Great Taste Restaurants Inc. Income Statement For the year ended December 31, 2016 Sales Revenue $ 1,200,000 Operating Expenses: Wages Expense 165,000 | Utilities Expense 35,000 Rent Expense 75,000 Advertising Expense 82,500 Depreciation Expense 50,000 Loss on disposal of assets 10,000 Total Operating Expenses 417,500 Income from Operations 782,500 Other Items: Interest Revenue Interest Expense (15,000) Income before Income Taxes 769,500 Income tax expense 192,000 Net Income Sheet1 a cell reference to display the Net Income value you produced in letter a. under the total column. ve for the missing Dividends Declared under the Retained Earnings column. e a cell reference to display the Dividends Declared value you calculated in letter c. under the total colu e a SUM function to calculate the Total Stockholder's Equity Great Taste Restaurants Inc. Statement of Stockholders' Equity For the year ended December 31, 2016 Paid-in Common Stock Capital Retained Earnings S 50,000 $ 400,000S 800,000 Total 1,250,000 Beginning January 1, 2016 Stock Issuance Net Income Dividends Declared Balance December 31, 2016 50.000 400.000 1.162.500 Balance Sheet Solve for the Accounts receivable, Accumulated depreciation and Total Asset values. Use the SUM function to calculate the Total current liabilities Solve for the Total Liabilities and SE. 75,000 45,000 92,500 Assets Current Assets: Cash Short-term investments Accounts receivable Supplies Total Current Assets Property and Equipment: Buildings Equipment Total Cost Accumulated depreciation Net Property and Equipment Total Assets Great Taste Restaurants Inc. Balance Sheet December 31, 2016 Liabilities Current Liabilities: $ 300,000 Accounts payable 50,000 Unearned revenue Short-term notes payable 120,000 Total Current Liabilities 545,000 Notes Payable Total Liabilities 925,000 Stockholders' Equity 750,000 Common Stock 1,675,000 Additional paid-in capital Retained Earnings 1,630,000 Total Stockholders' Equity Total Liabilities and SE 350,000 562,500 1,612,500