Answered step by step

Verified Expert Solution

Question

1 Approved Answer

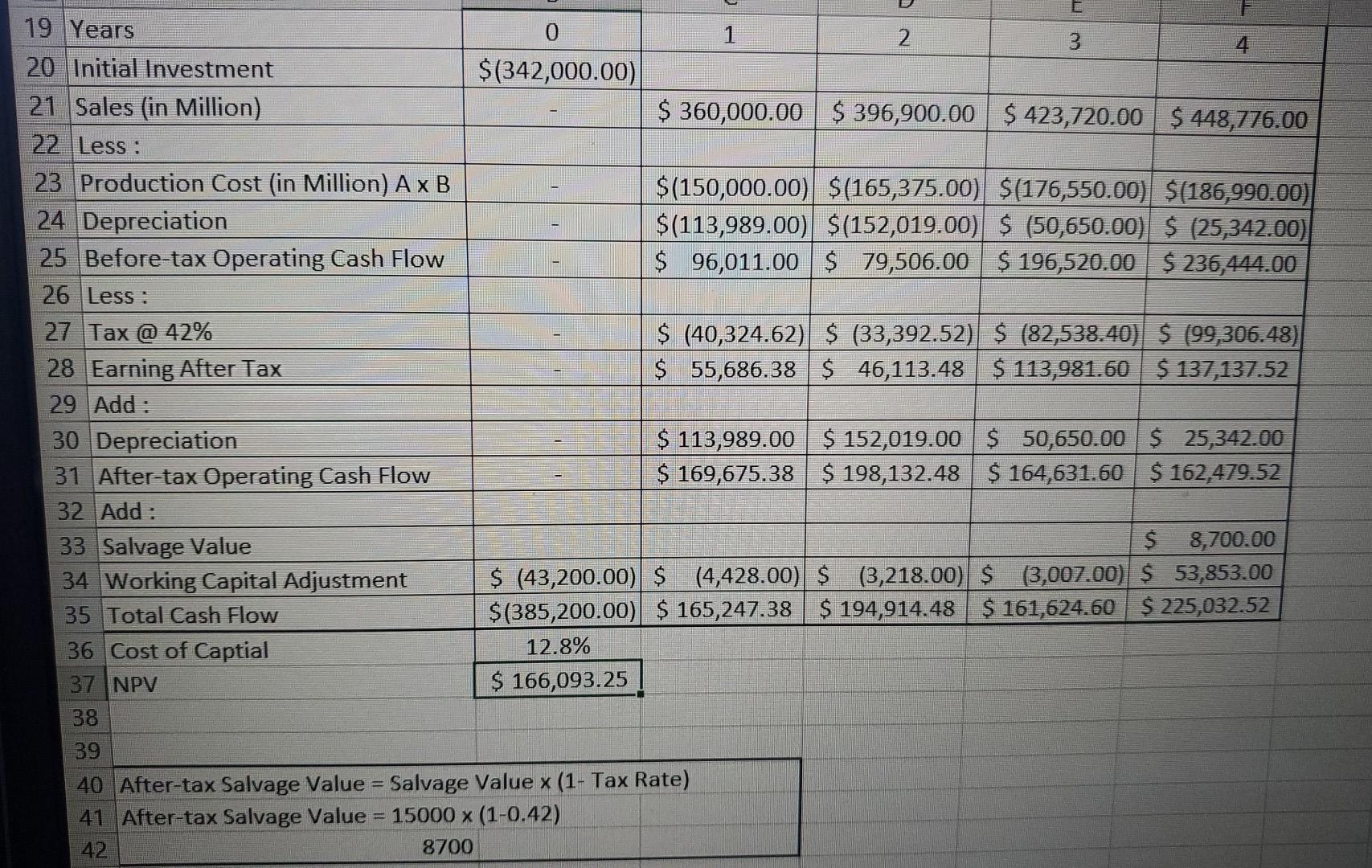

Provide rationale explaining why the company should purchase this equipment. I have a positive NPV so that would be one reason. What else would be

Provide rationale explaining why the company should purchase this equipment.

I have a positive NPV so that would be one reason. What else would be useful to justify this project?

Thanks!

19 Years 1 2 3 4 20 Initial Investment $(342,000.00) 21 Sales (in Million) $360,000.00 $ 396,900.00 $ 423,720.00 $ 448,776.00 22 Less : 23 Production Cost (in Million) Ax B $(150,000.00) $(165,375.00) $(176,550.00) $(186,990.00) 24 Depreciation $(113,989.00) $(152,019.00) $ (50,650.00) $ (25,342.00) 25 Before-tax Operating Cash Flow $ 96,011.00 $ 79,506.00 $ 196,520.00 $ 236,444.00 26 Less : 27 Tax @ 42% $ (40,324.62) $ (33,392.52) $ (82,538.40) S (99,306.48) 28 Earning After Tax $ 55,686.38 $ 46,113.48 $ 113,981.60 $ 137,137.52 29 Add : 30 Depreciation $ 113,989.00 $ 152,019.00 $ 50,650.00 $ 25,342.00 31 After-tax Operating Cash Flow $ 169,675.38 $ 198,132.48 $ 164,631.60 $ 162,479.52 32 Add: 33 Salvage Value $ 8,700.00 34 Working Capital Adjustment $ (43,200.00) $ (4,428.00) $ (3,218.00) $ (3,007.00) S 53,853.00 35 Total Cash Flow $(385,200.00) $ 165,247.38 $ 194,914.48 $ 161,624.60 $ 225,032.52 36 Cost of Captial 12.8% 37 NPV $ 166,093.25 38 39 40 After-tax Salvage Value = Salvage Value x (1- Tax Rate) 41 After-tax Salvage Value = 15000 x (1-0.42) 42 8700

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started