Answered step by step

Verified Expert Solution

Question

1 Approved Answer

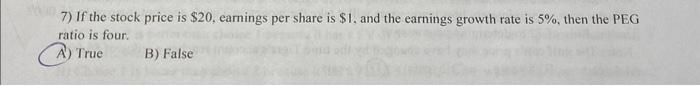

provide solutions 7) If the stock price is $20, earnings per share is $1, and the earnings growth rate is 5%, then the PEG ratio

provide solutions

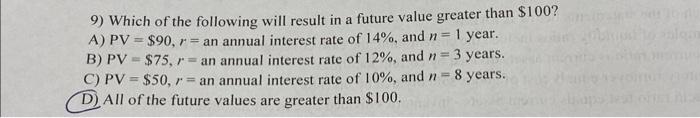

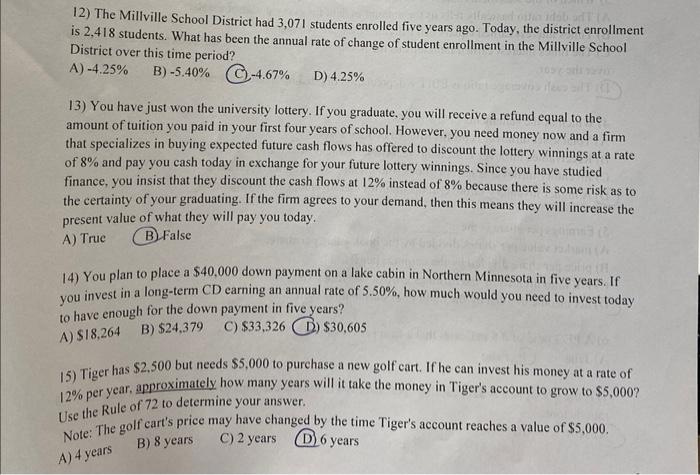

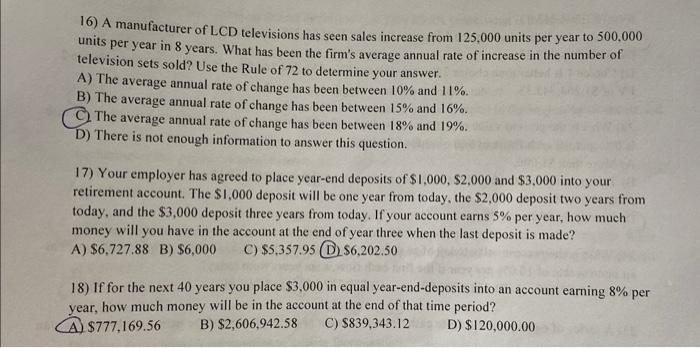

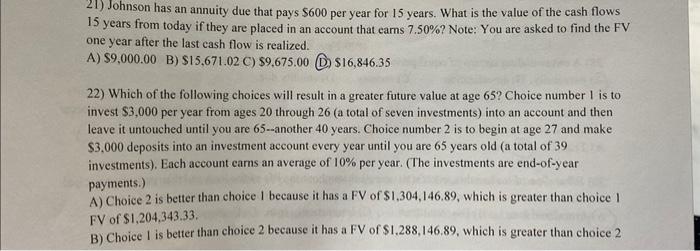

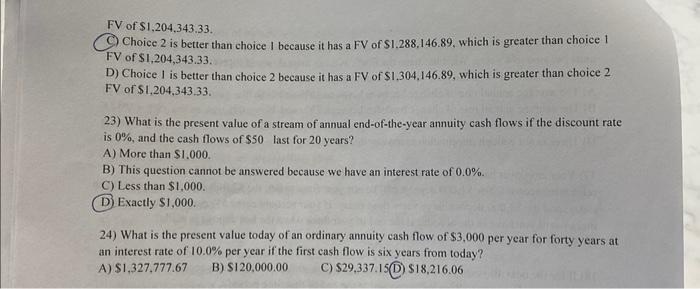

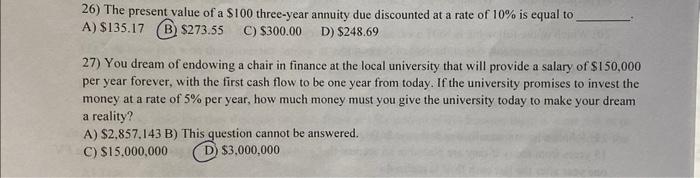

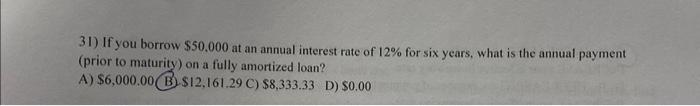

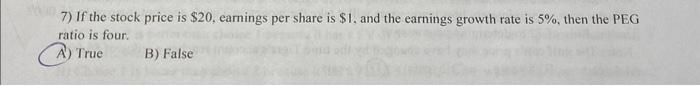

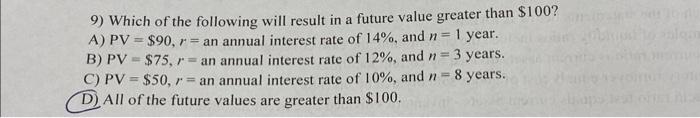

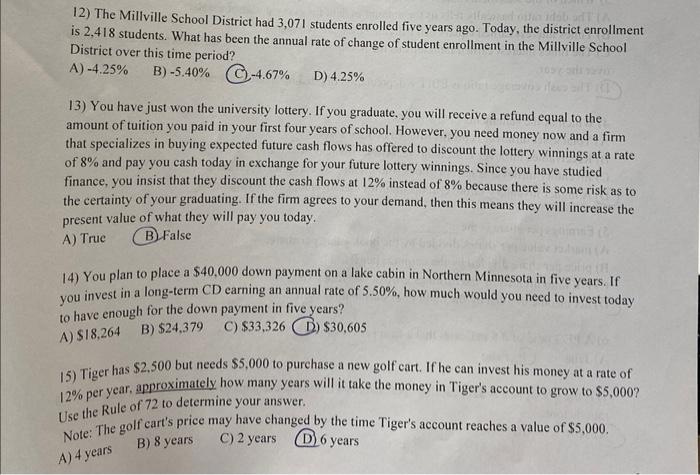

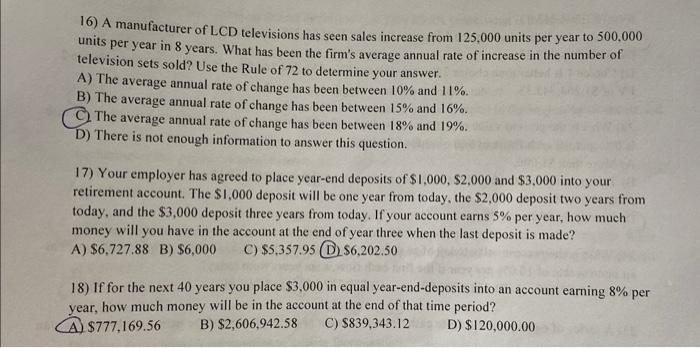

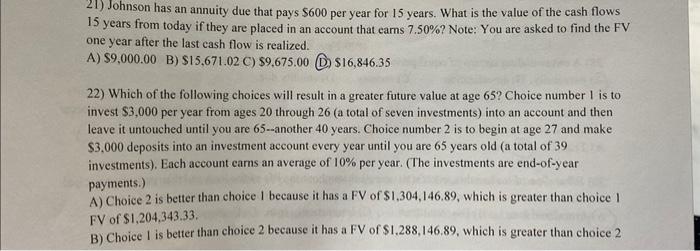

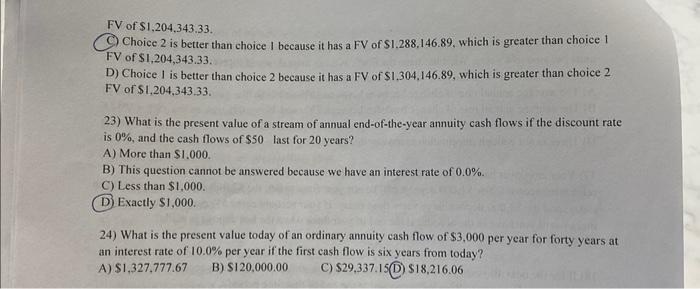

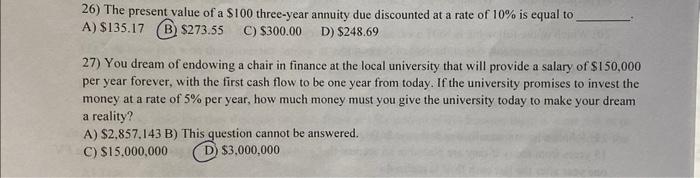

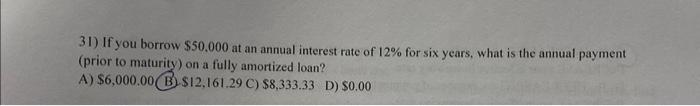

7) If the stock price is $20, earnings per share is $1, and the earnings growth rate is 5%, then the PEG ratio is four. A) True B) False 9) Which of the following will result in a future value greater than $100 ? A) PV=$90,r= an annual interest rate of 14%, and n=1 year. B) PV=$75,r= an annual interest rate of 12%, and n=3 years. C) PV=$50,r= an annual interest rate of 10%, and n=8 years. D) All of the future values are greater than $100. 12) The Millville School District had 3,071 students enrolled five years ago. Today, the district enrollment is 2,418 students. What has been the annual rate of change of student enrollment in the Millville School District over this time period? A) 4.25% B) 5.40% (C) 4.67% D) 4.25% 13) You have just won the university lottery. If you graduate, you will receive a refund equal to the amount of tuition you paid in your first four years of school. However, you need money now and a firm that specializes in buying expected future cash flows has offered to discount the lottery winnings at a rate of 8% and pay you cash today in exchange for your future lottery winnings. Since you have studied finance, you insist that they discount the cash flows at 12% instead of 8% because there is some risk as to the certainty of your graduating. If the firm agrees to your demand, then this means they will increase the present value of what they will pay you today. A) True (B) False 14) You plan to place a $40,000 down payment on a lake cabin in Northern Minnesota in five years. If you invest in a long-term CD earning an annual rate of 5.50%, how much would you need to invest today to have enough for the down payment in five years? A) $18,264 B) $24,379 C) $33,326 (D) $30,605 15) Tiger has $2.500 but needs $5,000 to purchase a new golf cart. If he can invest his money at a rate of 12% per year, approximately how many years will it take the money in Tiger's account to grow to $5,000 ? Use the Rule of 72 to determine your answer. Note: The golf cart's price may have changed by the time Tiger's account reaches a value of $5,000. A) 4 years B) 8 years C) 2 years D) 6 years 16) A manufacturer of LCD televisions has seen sales increase from 125,000 units per year to 500,000 units per year in 8 years. What has been the firm's average annual rate of increase in the number of television sets sold? Use the Rule of 72 to determine your answer. A) The average annual rate of change has been between 10% and 11%. B) The average annual rate of change has been between 15% and 16%. C) The average annual rate of change has been between 18% and 19%. D) There is not enough information to answer this question. 17) Your employer has agreed to place year-end deposits of $1,000,$2,000 and $3,000 into your retirement account. The $1,000 deposit will be one year from today, the $2,000 deposit two years from today, and the $3,000 deposit three years from today. If your account earns 5% per year, how much money will you have in the account at the end of year three when the last deposit is made? A) $6,727,88 B) $6,000 C) $5,357.95 (D) $6,202.50 18) If for the next 40 years you place $3,000 in equal year-end-deposits into an account earning 8% per year, how much money will be in the account at the end of that time period? A) $777,169.56 B) $2,606,942.58 C) $839,343.12 D) $120,000.00 21) Johnson has an annuity due that pays $600 per year for 15 years. What is the value of the cash flows 15 years from today if they are placed in an account that carns 7.50% ? Note: You are asked to find the FV one year after the last cash flow is realized. A) $9,000.00 B) $15,671.02 C) $9,675.00 (D) $16,846.35 22) Which of the following choices will result in a greater future value at age 65 ? Choice number 1 is to invest $3,000 per year from ages 20 through 26 (a total of seven investments) into an account and then leave it untouched until you are 65 --another 40 years. Choice number 2 is to begin at age 27 and make $3,000 deposits into an investment account every year until you are 65 years old (a total of 39 investments). Each account eams an average of 10% per year. (The investments are end-of-year payments.) A) Choice 2 is better than choice I because it has a FV of $1,304,146.89, which is greater than choice 1 FV of $1,204,343,33. B) Choice I is better than choice 2 because it has a FV of $1,288,146.89, which is greater than choice 2 FV of $1,204,343.33. C) Choice 2 is better than choice I because it has a FV of $1,288,146.89, which is greater than choice 1 FV of $1,204,343.33. D) Choice 1 is better than choice 2 because it has a FV of $1,304,146.89, which is greater than choice 2 FV of $1,204,34333. 23) What is the present value of a stream of annual end-of-the-year annuity cash flows if the discount rate is 0%, and the cash flows of $50 last for 20 years? A) More than $1.000. B) This question cannot be answered because we have an interest rate of 0.0%. C) Less than $1,000. (D) Exactly $1,000. 24) What is the present value today of an ordinary annuity cash flow of $3,000 per year for forty years at an interest rate of 10.0% per year if the first cash flow is six years from today? A) $1,327,777.67 B) $120,000.00 C) $29,337.15 (D) $18,216.06 26) The present value of a $100 three-year annuity due discounted at a rate of 10% is equal to A) $135.17 (B) $273.55 C) $300.00 D) $248.69 27) You dream of endowing a chair in finance at the local university that will provide a salary of $150,000 per year forever, with the first cash flow to be one year from today. If the university promises to invest the money at a rate of 5% per year, how much money must you give the university today to make your dream a reality? A) $2,857.143B ) This question cannot be answered. C) $15,000,000 D) $3,000,000 31) If you borrow $50.000 at an annual interest rate of 12% for six years, what is the annual payment (prior to maturity) on a fully amortized loan? A) $6,000.00 B. $12,161.29C)$8,333.33 D) $0.00

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started