Provide the answers for the multiple choice questions attached.

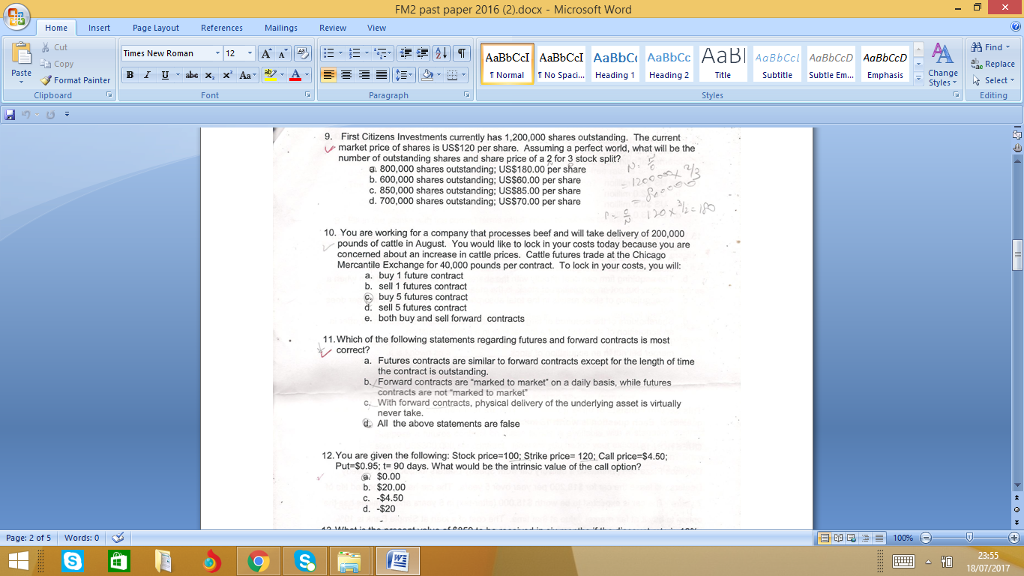

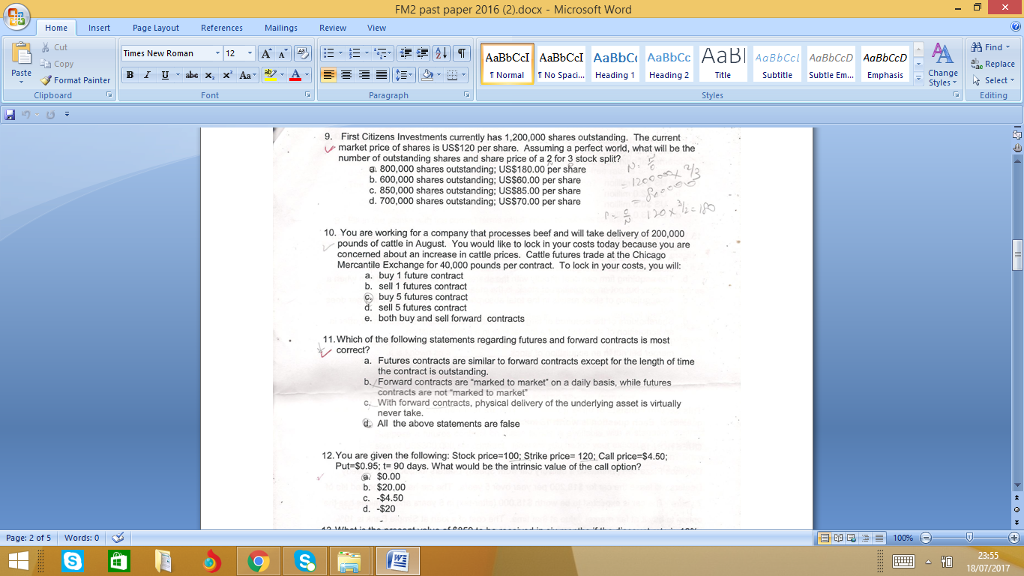

FM2 past paper 2016 (2).docx - Microsoft Word Insert Page Layout Reterences Mailings Review View Home Find- a" . . i IT AaBbCcII AaBbCcI AaBbCr AaBbCc AaB AaBbCcIAoBbCoD AaBbCoD Times New Roman -12-1 A Paste Copy pastomat ac Replace x' Aa ti. Paragraph Emphasis Styles Paste E Blu-abcx, x da'y. LNornal Heading 1 Heading 2 Title Subtitle Subtle Em... Emphasis subtitle subtle En Emphasis -Change Title Styles !. :. T No Spaci Heading 1 Heading 2 Styles- Select Editing Format Painter Clipboard Font 9. First Citizens Investments currently has 1,200,000 shares outstanding. The current market price of shares is US$120 per share. Assuming a perfect world, what will be the naros outstanding Us1 ck Srbar2 number of outstanding shares and share price of a 2 for 3 stock split? a. 800,000 shares outstanding: US$180.00 per share b. 600,000 shares outstanding; US$60.00 per share c. 850,000 shares outstanding: USS85.00 per share d. 700,000 shares outstanding: US$70.00 per share 10. You are working for a company that processes beef and will take delivery of 200,000 Corcamile Bxoang or 0. pounds of cattle in August. You would like to lock in your costs today because you are concerned about an increase in cattle prices. Cattle futures trade at the Chicago Mercantile Exchange for 40,000 pounds per contract. To lock in your costs, you will: pper centract. a. buy 1 future contract b. sell 1 futures contract buy 5 futures contract d. sell 5 futures contract e. both buy and sell forward contracts 11. Which of the following statements regarding futures and forward contracts is most correct? Futures contracts are similar to forward contracts except for the length of time a. b. Forward contracts are "marked to market on a daily basis, while futures c With forward contracts, physical delivery of the underlying asset is virtually d All the above statements are false the contract is outstanding. contracts are not "marked to market never take. 12.You are given the following: Stock price-100; Strike price 120; Call price $4.50: Put-s0.95; t= 90 days, what would be the intrinsic value of the call option? , $0.00 b. $20.00 C. -$4.50 d. -$20 Page 2 of 5 words: 0 | 23:55 L 18/07/2017