Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Provide the information required by the following exercises. In 2023, Mr. Shane Bodnar is provided with an automobile that is leased by his employer. The

Provide the information required by the following exercises.

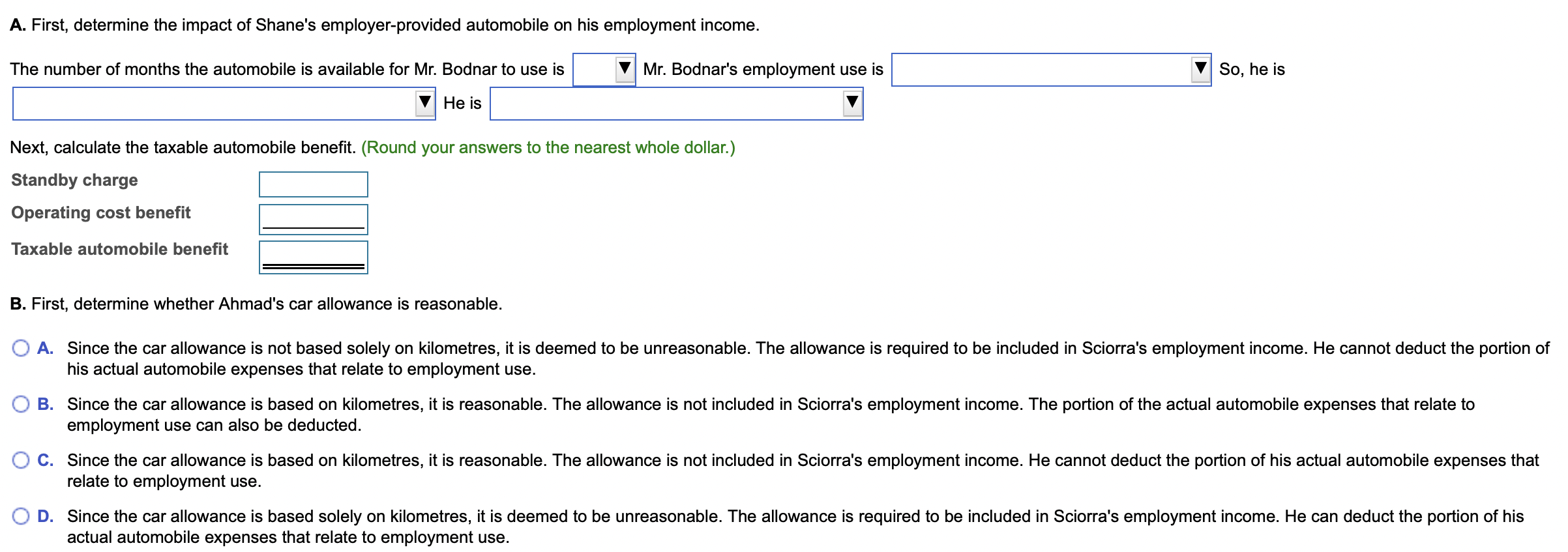

- In 2023, Mr. Shane Bodnar is provided with an automobile that is leased by his employer. The monthly payment on this lease is $509, including $59 of HST. In 2023, he drives the automobile a total of 35,000 kilometres, of which 27,600 are for employment purposes with 7,400 for personal use. The automobile is available for use by Mr. Bodnar for a total of 265 days in 2023. When the automobile is not being used by Mr. Bodnar, it must be returned to the employer's premises in accordance with company policy. Calculate Mr. Bodnar's minimum taxable benefit for the use of the automobile.

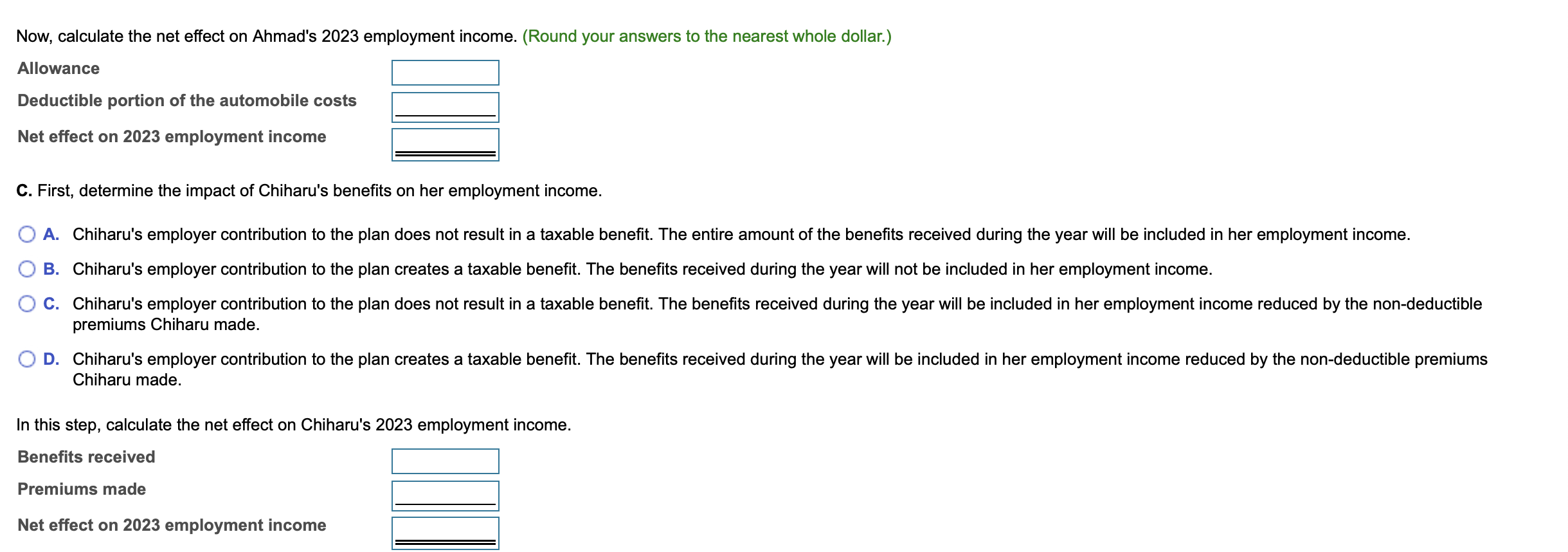

- Mr. Ahmad Sciorra is required by his employer to use his own automobile in the performance of his employment duties. His total automobile expenses for the year, including lease expenses, are $11,400. To compensate him, his employer provides a flat-rate annual allowance of $12,800. In 2023, he drove a total of 48,410 kilometres, of which 19,860 were employment related and 28,550 for personal use. Determine the impact of the allowance and automobile related expenses on his 2023 employment income.

- Ms. Chiharu Felt is a member of a group disability plan sponsored by her employer. The plan provides periodic benefits that compensate for lost employment income. The cost of the plan is shared with her employer. Her share of the plan premiums was $450 in 2022 and $525 in 2023. In 2023, Ms. Felt was hospitalized for a period of two weeks, resulting in her receiving $7,200 in disability plan benefits. What amount, if any, will Ms. Fernandes include in her 2023 employment income with respect to the receipt of the disability benefits?

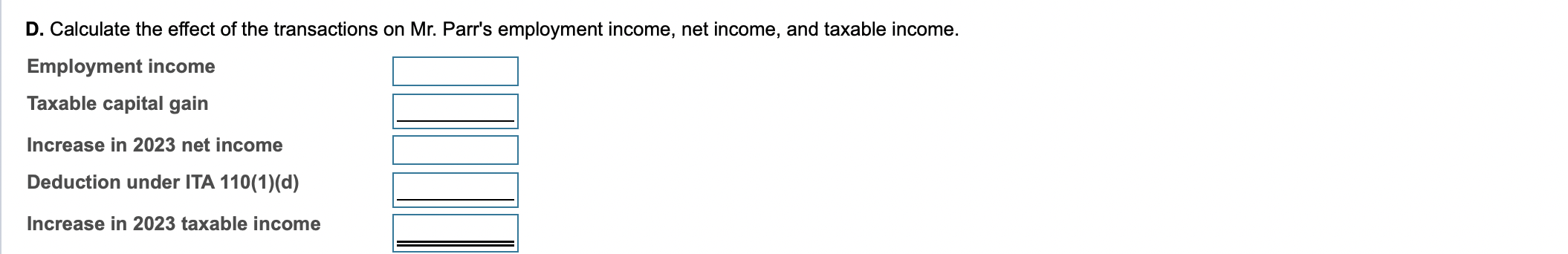

- In March of 2021, Mr. Jiro Parr's employer, a publicly traded company with gross revenues in excess of $500 million, granted him options to purchase 1,350 shares of the employer's stock at a price of $19 per share. The shares were vested immediately. At that time, the shares were trading at $18 per share. In July 2023, Mr. Parr exercises the options. At this time, the shares are trading at $23 per share. In December 2023, all the shares are sold for $25 per share. Determine the effect of these transactions on Mr. Parr's employment income, net income, and taxable income.

A. First, determine the impact of Shane's employer-provided automobile on his employment income. The number of months the automobile is available for Mr. Bodnar to use is He is Mr. Bodnar's employment use is So, he is Next, calculate the taxable automobile benefit. (Round your answers to the nearest whole dollar.) B. First, determine whether Ahmad's car allowance is reasonable. his actual automobile expenses that relate to employment use. employment use can also be deducted. relate to employment use. actual automobile expenses that relate to employment use. D. Calculate the effect of the transactions on Mr. Parr's employment income, net income, and taxable income. Employment income Taxable capital gain Increase in 2023 net income Deduction under ITA 110(1)(d) Increase in 2023 taxable income C. First, determine the impact of Chiharu's benefits on her employment income. A. Chiharu's employer contribution to the plan does not result in a taxable benefit. The entire amount of the benefits received during the year will be included in her employment income. B. Chiharu's employer contribution to the plan creates a taxable benefit. The benefits received during the year will not be included in her employment income. C. Chiharu's employer contribution to the plan does not result in a taxable benefit. The benefits received during the year will be included in her employment income reduced by the non-deductible premiums Chiharu made. D. Chiharu's employer contribution to the plan creates a taxable benefit. The benefits received during the year will be included in her employment income reduced by the non-deductible premiums Chiharu made. In this step. calculate the net effect on Chiharu's 2023 emblovment income

A. First, determine the impact of Shane's employer-provided automobile on his employment income. The number of months the automobile is available for Mr. Bodnar to use is He is Mr. Bodnar's employment use is So, he is Next, calculate the taxable automobile benefit. (Round your answers to the nearest whole dollar.) B. First, determine whether Ahmad's car allowance is reasonable. his actual automobile expenses that relate to employment use. employment use can also be deducted. relate to employment use. actual automobile expenses that relate to employment use. D. Calculate the effect of the transactions on Mr. Parr's employment income, net income, and taxable income. Employment income Taxable capital gain Increase in 2023 net income Deduction under ITA 110(1)(d) Increase in 2023 taxable income C. First, determine the impact of Chiharu's benefits on her employment income. A. Chiharu's employer contribution to the plan does not result in a taxable benefit. The entire amount of the benefits received during the year will be included in her employment income. B. Chiharu's employer contribution to the plan creates a taxable benefit. The benefits received during the year will not be included in her employment income. C. Chiharu's employer contribution to the plan does not result in a taxable benefit. The benefits received during the year will be included in her employment income reduced by the non-deductible premiums Chiharu made. D. Chiharu's employer contribution to the plan creates a taxable benefit. The benefits received during the year will be included in her employment income reduced by the non-deductible premiums Chiharu made. In this step. calculate the net effect on Chiharu's 2023 emblovment income Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started