provide the solutions for both questions with working notes if any

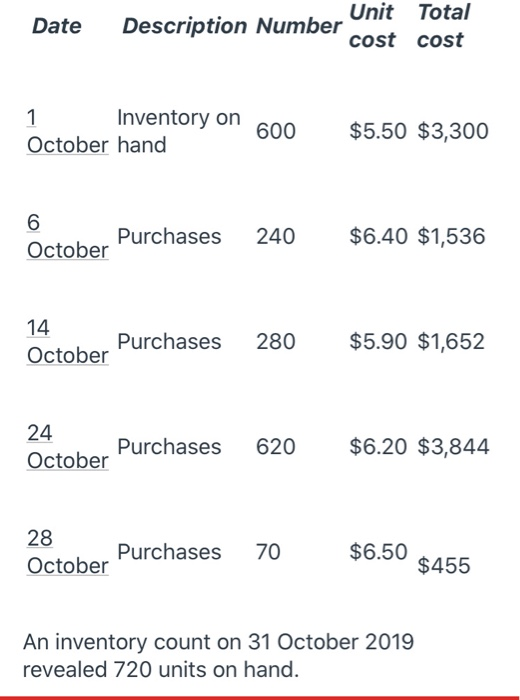

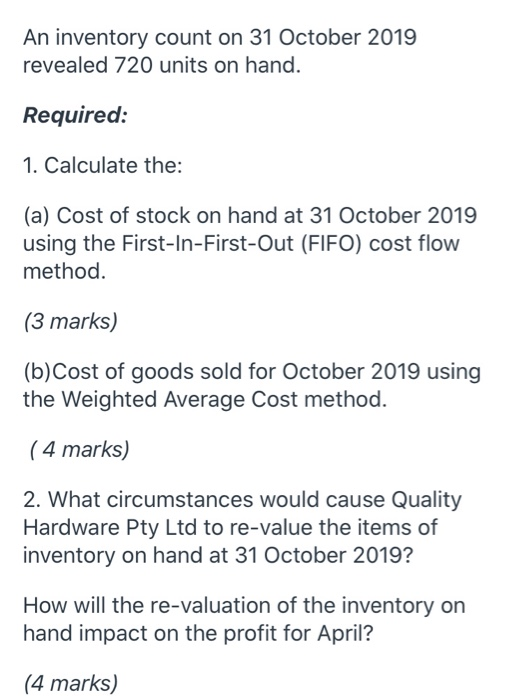

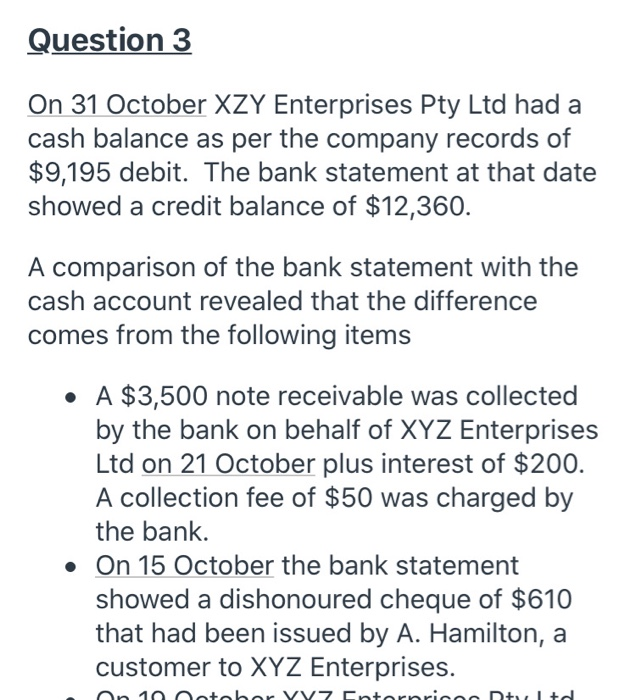

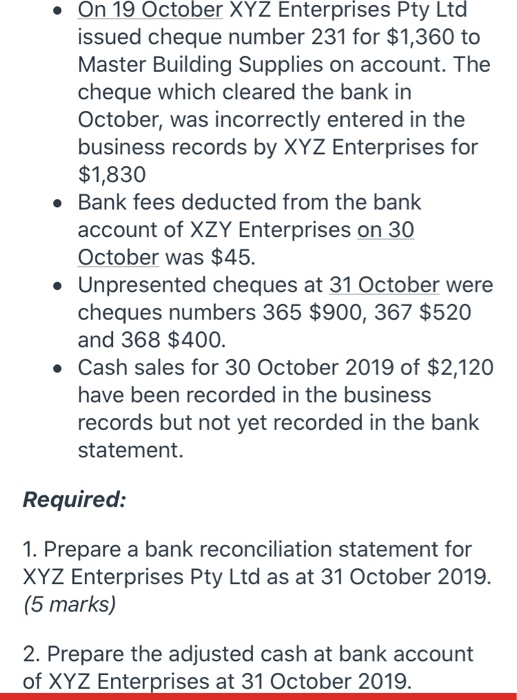

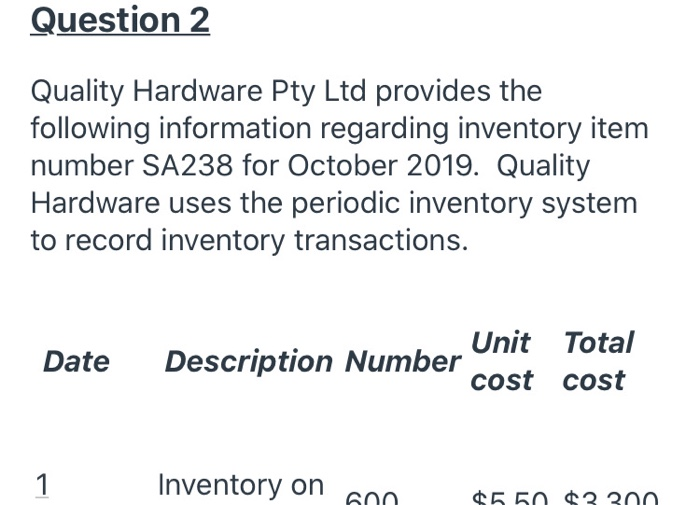

Question 2 Quality Hardware Pty Ltd provides the following information regarding inventory item number SA238 for October 2019. Quality Hardware uses the periodic inventory system to record inventory transactions. Date Unit Total Description Number cost cost 1 Inventory on ann $5.50 $3.300 Date Unit Total Description Number cost cost 1 Inventory on October hand 600 $5.50 $3,300 6 Purchases October 240 $6.40 $1,536 14 Purchases October 280 $5.90 $1,652 24 Purchases October 620 $6.20 $3,844 28 Purchases October 70 $6.50 $455 An inventory count on 31 October 2019 revealed 720 units on hand. An inventory count on 31 October 2019 revealed 720 units on hand. Required: 1. Calculate the: (a) Cost of stock on hand at 31 October 2019 using the First-In-First-Out (FIFO) cost flow method. (3 marks) (b)Cost of goods sold for October 2019 using the Weighted Average Cost method. (4 marks) 2. What circumstances would cause Quality Hardware Pty Ltd to re-value the items of inventory on hand at 31 October 2019? How will the re-valuation of the inventory on hand impact on the profit for April? (4 marks) Question 3 On 31 October XZY Enterprises Pty Ltd had a cash balance as per the company records of $9,195 debit. The bank statement at that date showed a credit balance of $12,360. A comparison of the bank statement with the cash account revealed that the difference comes from the following items A $3,500 note receivable was collected by the bank on behalf of XYZ Enterprises Ltd on 21 October plus interest of $200. A collection fee of $50 was charged by the bank. On 15 October the bank statement showed a dishonoured cheque of $610 that had been issued by A. Hamilton, a customer to XYZ Enterprises. latebar VV7 Cotorriaan DUtd On 19 October XYZ Enterprises Pty Ltd issued cheque number 231 for $1,360 to Master Building Supplies on account. The cheque which cleared the bank in October, was incorrectly entered in the business records by XYZ Enterprises for $1,830 Bank fees deducted from the bank account of XZY Enterprises on 30 October was $45. Unpresented cheques at 31 October were cheques numbers 365 $900, 367 $520 and 368 $400. Cash sales for 30 October 2019 of $2,120 have been recorded in the business records but not yet recorded in the bank statement. Required: 1. Prepare a bank reconciliation statement for XYZ Enterprises Pty Ltd as at 31 October 2019. (5 marks) 2. Prepare the adjusted cash at bank account of XYZ Enterprises at 31 October 2019