Provident Company purchased an equipment on July 1, 2020 for P1,500,000 cash for the purpose of leasing it. The equipment has an estimated useful

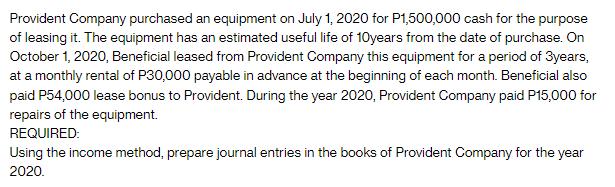

Provident Company purchased an equipment on July 1, 2020 for P1,500,000 cash for the purpose of leasing it. The equipment has an estimated useful life of 10years from the date of purchase. On October 1, 2020, Beneficial leased from Provident Company this equipment for a period of 3years, at a monthly rental of P30,000 payable in advance at the beginning of each month. Beneficial also paid P54,000 lease bonus to Provident. During the year 2020, Provident Company paid P15,000 for repairs of the equipment. REQUIRED: Using the income method, prepare journal entries in the books of Provident Company for the year 2020.

Step by Step Solution

3.44 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

Assuming straightline depreciation the annual depreciation expense for the equipment is calculated a...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started