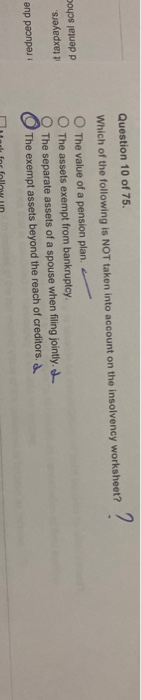

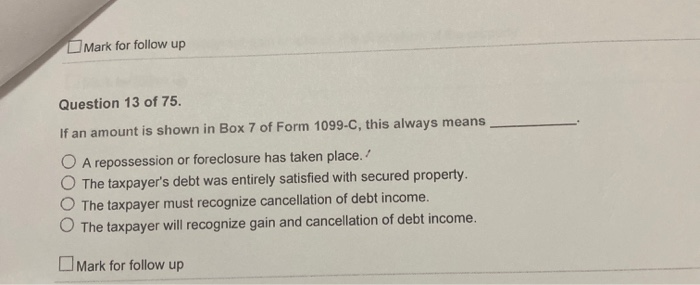

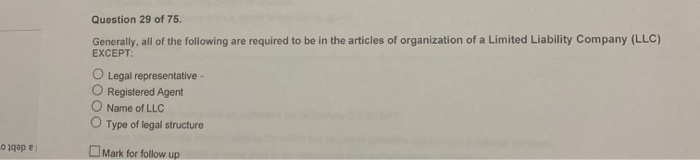

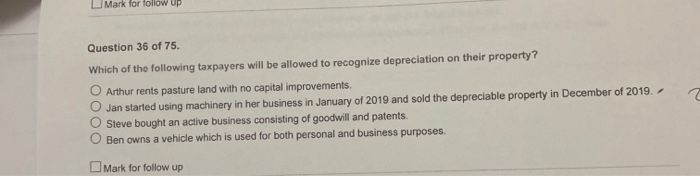

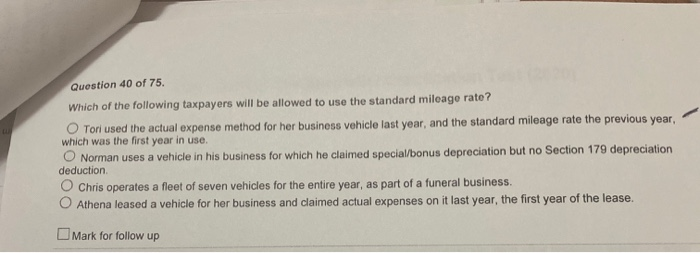

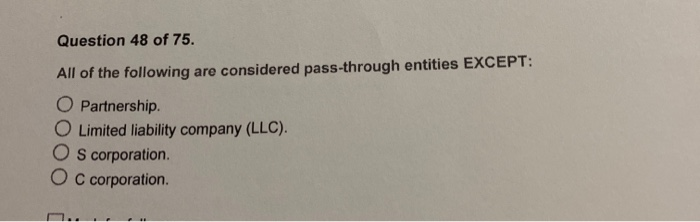

ps jguapp szakedxel Question 10 of 75. Which of the following is NOT taken into account on the insolvency worksheet? The value of a pension plan, The assets exempt from bankruptcy. The separate assets of a spouse when filing jointly The exempt assets beyond the reach of creditors. np paonpaid Plated for follow un Mark for follow up Question 13 of 75. If an amount is shown in Box 7 of Form 1099-C, this always means O A repossession or foreclosure has taken place.' The taxpayer's debt was entirely satisfied with secured property O The taxpayer must recognize cancellation of debt income. The taxpayer will recognize gain and cancellation of debt income Mark for follow up Question 29 of 75. Generally, all of the following are required to be in the articles of organization of a Limited Liability Company (LLC) EXCEPT: Legal representative- Registered Agent Name of LLC Type of legal structure oqope Mark for follow up Question 36 of 75. Which of the following taxpayers will be allowed to recognize depreciation on their property? 1 O Arthur rents pasture land with no capital improvements. Jan started using machinery in her business in January of 2019 and sold the depreciable property in December of 2019. - Steve bought an active business consisting of goodwill and patents. O Ben owns a vehicle which is used for both personal and business purposes. Mark for follow up Question 40 of 75. Which of the following taxpayers will be allowed to use the standard mileage rate? Toni used the actual expense method for her business vehicle last year, and the standard mileage rate the previous year, which was the first year in use. Norman uses a vehicle in his business for which he claimed special bonus depreciation but no Section 179 depreciation deduction Chris operates a fleet of seven vehicles for the entire year, as part of a funeral business. Athena leased a vehicle for her business and claimed actual expenses on it last year, the first year of the lease. Mark for follow up Question 48 of 75. All of the following are considered pass-through entities EXCEPT: O Partnership O Limited liability company (LLC). O S corporation O c corporation