Answered step by step

Verified Expert Solution

Question

1 Approved Answer

PSG INSTITUTE OF MANAGEMENT: COIMBATORE UT MBA - Accounting for Managers Ratios - Problems to Solve in class 1. From the following data of

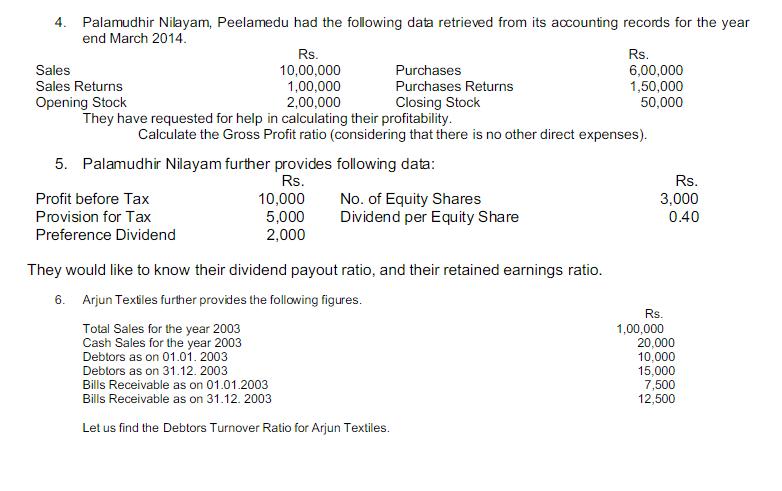

PSG INSTITUTE OF MANAGEMENT: COIMBATORE UT MBA - Accounting for Managers Ratios - Problems to Solve in class 1. From the following data of Sridevi Textiles, compute the 'Current Ratio. Particulars Sundry Debtors Prepaid Expenses. Short-term Investments Loose Tools Bills Payable To To To To Opening Stock Purchases Carriage Gross Profit Amount Rs. Rs. 40,000 20,000 10,000 5,000 10,000 2. The following is the Trading Account of Raaha Garments. Calculate the Stock Turnover Ratio and Gross profit ratio TRADING ACCOUNT Particulars Particulars Net profit before tax Rs. 1,00,000 Taxation at 50% of Net Profit 40,000 1,00,000 10,000 70,000 2,20,000 Particulars Sundry Creditors Debentures Inventories Outstanding Expenses By Sales By Closing stock 10% preference share capital (Rs. 10 each) Rs. 1,00,000 Equity Share capital (Rs. 10 share) Rs. 1,00,000 Market Price per Share Rs.80 Rs. 20,000 1,00,000 Calculate their earnings per share and Price Earnings Ratio 20,000 20,000 Amount Rs. 3. Net Solutions Ltd., Bangalore wants to know its position in the stock market. They have provided us the following data: 2,00,000 20,000 2,20,000 4. Palamudhir Nilayam, Peelamedu had the following data retrieved from its accounting records for the year end March 2014. Rs. 10,00,000 1,00,000 2,00,000 They have requested for help in calculating their profitability. Sales Sales Returns Opening Stock Purchases Purchases Returns Closing Stock Calculate the Gross Profit ratio (considering that there is no other direct expenses). 5. Palamudhir Nilayam further provides following data: Rs. Profit before Tax Provision for Tax Preference Dividend 10,000 5,000 2,000 No. of Equity Shares Dividend per Equity Share Rs. 6,00,000 1,50,000 50,000 They would like to know their dividend payout ratio, and their retained earnings ratio. 6. Arjun Textiles further provides the following figures. Total Sales for the year 2003 Cash Sales for the year 2003 Debtors as on 01.01.2003 Debtors as on 31.12.2003 Bills Receivable as on 01.01.2003 Bills Receivable as on 31.12.2003 Let us find the Debtors Turnover Ratio for Arjun Textiles. Rs. 3,000 0.40 Rs. 1,00,000 20,000 10,000 15,000 7,500 12,500

Step by Step Solution

★★★★★

3.39 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

1 Current Ratio Current Asset Current Liabilities Inventories Sundry Debtors Short term investment Prepaid Expenses Loose Tools Sundry Creditors Bill ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started