Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Pudong Limited (Pudong) is a company listed on the Stock Exchange of Hong Kong. Its main business is the sales of fresh and canned

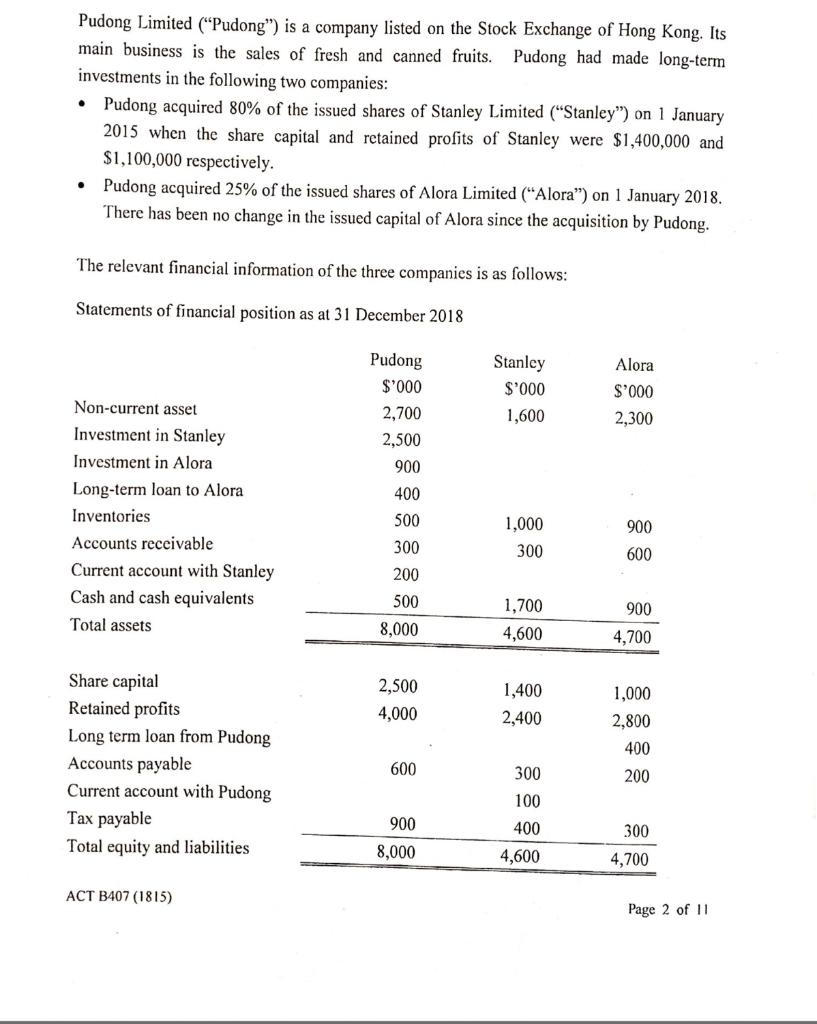

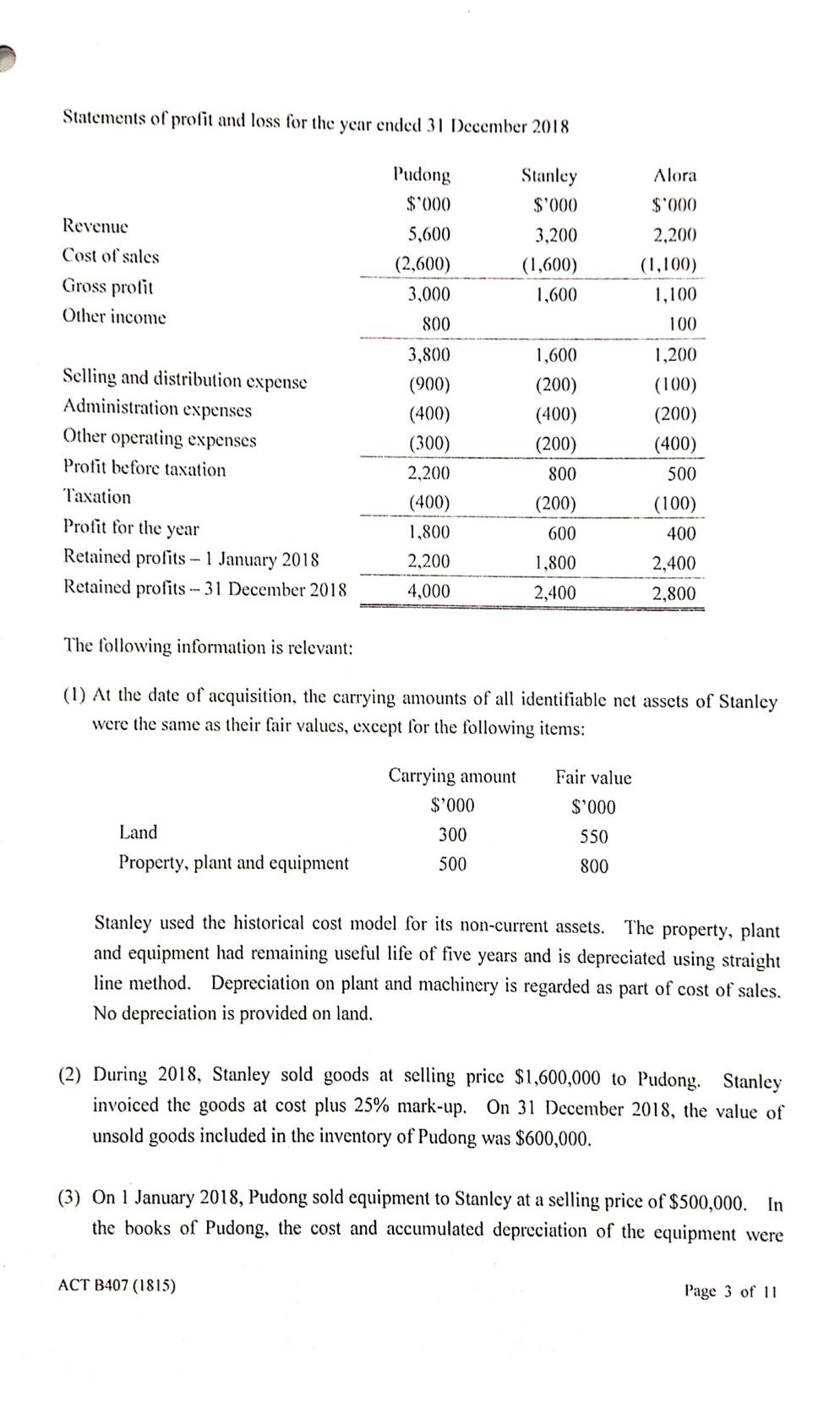

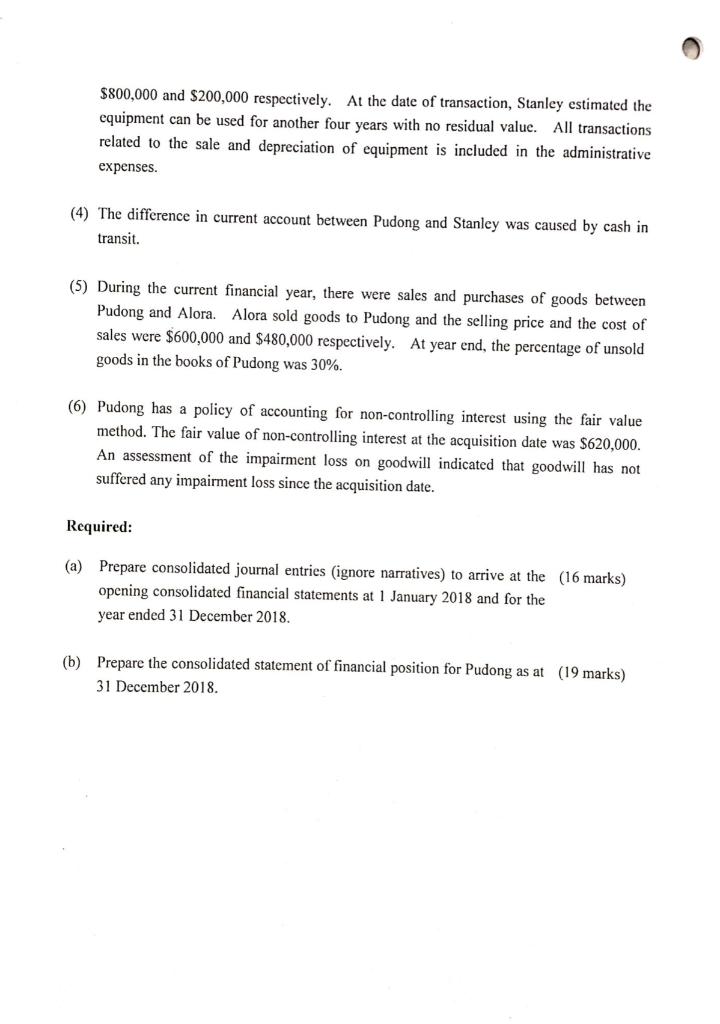

Pudong Limited ("Pudong") is a company listed on the Stock Exchange of Hong Kong. Its main business is the sales of fresh and canned fruits. Pudong had made long-term investments in the following two companies: Pudong acquired 80% of the issued shares of Stanley Limited ("Stanley") on 1 January 2015 when the share capital and retained profits of Stanley were $1,400,000 and $1,100,000 respectively. Pudong acquired 25% of the issued shares of Alora Limited ("Alora") on 1 January 2018. There has been no change in the issued capital of Alora since the acquisition by Pudong. The relevant financial information of the three companies is as follows: Statements of financial position as at 31 December 2018 Non-current asset Investment in Stanley Investment in Alora Long-term loan to Alora Inventories Accounts receivable Current account with Stanley Cash and cash equivalents Total assets Share capital Retained profits Long term loan from Pudong Accounts payable Current account with Pudong Tax payable Total equity and liabilities ACT B407 (1815) Pudong $'000 2,700 2,500 900 400 500 300 200 500 8,000 2,500 4,000 600 900 8,000 Stanley $'000 1,600 1,000 300 1,700 4,600 1,400 2,400 300 100 400 4,600 Alora $'000 2,300 900 600 900 4,700 1,000 2,800 400 200 300 4,700 Page 2 of 11 Statements of profit and loss for the year ended 31 December 2018 Stanley $'000 3,200 (1,600) 1,600 Revenue Cost of sales Gross profit Other income Selling and distribution expense Administration expenses Other operating expenses Profit before taxation Taxation Profit for the year Retained profits - 1 January 2018 Retained profits-31 December 2018 Land Property, plant and equipment Pudong $'000 5,600 (2,600) 3,000 800 3,800 (900) (400) (300) 2,200 (400) 1,800 2,200 4,000 1,600 (200) (400) (200) 800 (200) 600 1,800 2,400 Carrying amount $'000 300 500 The following information is relevant: (1) At the date of acquisition, the carrying amounts of all identifiable net assets of Stanley were the same as their fair values, except for the following items: ACT B407 (1815) Alora $'000 2,200 (1,100) 1,100 100 Fair value $'000 550 800 1,200 (100) (200) (400) 500 (100) 400 2,400 2,800 Stanley used the historical cost model for its non-current assets. The property, plant and equipment had remaining useful life of five years and is depreciated using straight line method. Depreciation on plant and machinery is regarded as part of cost of sales. No depreciation is provided on land. (2) During 2018, Stanley sold goods at selling price $1,600,000 to Pudong. Stanley invoiced the goods at cost plus 25% mark-up. On 31 December 2018, the value of unsold goods included in the inventory of Pudong was $600,000. (3) On 1 January 2018, Pudong sold equipment to Stanley at a selling price of $500,000. In the books of Pudong, the cost and accumulated depreciation of the equipment were Page 3 of 11 $800,000 and $200,000 respectively. At the date of transaction, Stanley estimated the equipment can be used for another four years with no residual value. All transactions related to the sale and depreciation of equipment is included in the administrative expenses. (4) The difference in current account between Pudong and Stanley was caused by cash in transit. (5) During the current financial year, there were sales and purchases of goods between Pudong and Alora. Alora sold goods to Pudong and the selling price and the cost of sales were $600,000 and $480,000 respectively. At year end, the percentage of unsold goods in the books of Pudong was 30%. (6) Pudong has a policy of accounting for non-controlling interest using the fair value method. The fair value of non-controlling interest at the acquisition date was $620,000. An assessment of the impairment loss on goodwill indicated that goodwill has not suffered any impairment loss since the acquisition date. Required: (a) Prepare consolidated journal entries (ignore narratives) to arrive at the (16 marks) opening consolidated financial statements at 1 January 2018 and for the year ended 31 December 2018. (b) Prepare the consolidated statement of financial position for Pudong as at (19 marks) 31 December 2018.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a Consolidated Journal Entries for 1 January 2018 1 Investment in Stanley Dr Investment in Stanley 2500 Cr Share Capital 1400 Cr Retained Earnings 1100 2 Investment in Alora Dr Investment in Alora 900 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started