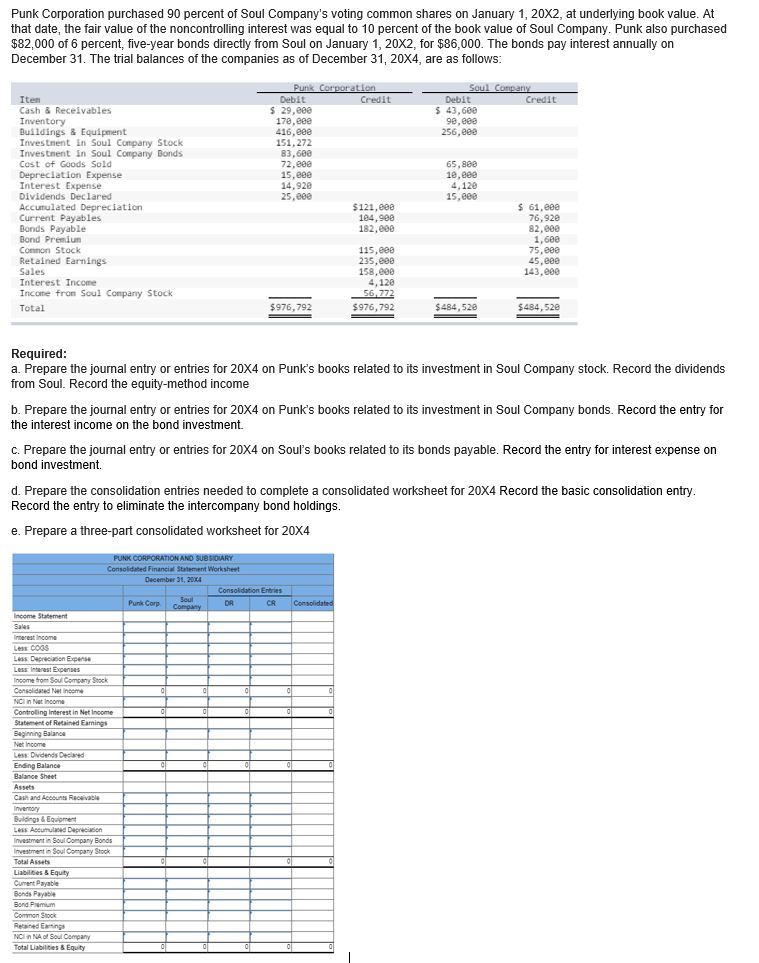

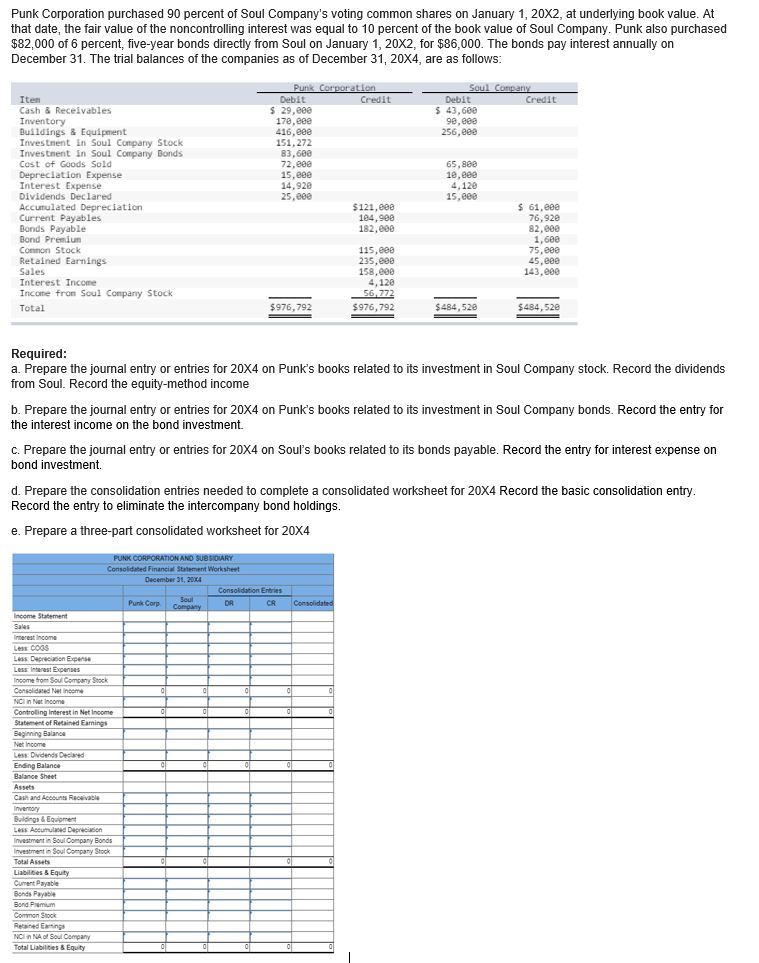

Punk Corporation purchased 90 percent of Soul Company's voting common shares on January 1, 20X2, at underlying book value. At that date, the fair value of the noncontrolling interest was equal to 10 percent of the book value of Soul Company. Punk also purchased directly from Soul on January 1, 20X2, for $86,000. The bonds pay interest annually on December 31. The trial balances of the companies as of December 31, 20X4, are as follows: Item Soul Company Debit Credit S43.600 90.000 256,eee Punk Corporation Debit Credit $ 29,000 17e, cee 416,eee 151,272 83,680 72,000 15.888 14,920 25, eee $121.ee 184,900 182.ee Cash & Receivables Inventory Buildings & Equipment Investment in Soul Company Stock Investment in Soul Company Bonds Cost of Goods Sold Depreciation Expense Interest Expense Dividends Declared Accurulated Depreciation Current Payables Bonds Payable Bond Premium Common Stock Retained Earnings Sales Interest Income Income from Soul Company Stock Total 65,888 10. eee 4,120 15.000 $61.ee 76,920 82.ee 1.688 75.ee 45,eee 143,000 115, eee 235,000 158,00 4,128 56,772 $976,792 $484,520 Required: a. Prepare the journal entry or entries for 20X4 on Punk's books related to its investment in Soul Company stock. Record the dividends from Soul. Record the equity-method income b. Prepare the journal entry or entries for 20x4 on Punk's books related to its investment in Soul Company bonds. Record the entry for the interest income on the bond investment. c. Prepare the journal entry or entries for 20X4 on Soul's books related to its bonds payable. Record the entry for interest expense on bond investment. d. Prepare the consolidation entries needed to complete a consolidated worksheet for 20X4 Record the basic consolidation entry. Record the entry to eliminate the intercompany bond holdings. e. Prepare a three-part consolidated worksheet for 20X4 PUNK CORPORATION AND SUBSCUARY Consolidated Financial Statement Worksheet December 31, 2014 Consolidation Entries Park Carp Soul DR C R Consolidated Les cous Less Depreciation Expense Income from Sour Company Stock Consolidated Net income NC income Controling Interest in Net Income Statement of Retained Earnings Beginning Balance Net Income Less Dividends Dead Ending Balance Balance Sheet Assets Cash and Accounts Receivable Inventory Buildings & Equipment Less Accurred Depresion Investment in Soul Company Bonds Investment in Soal Company Stock Total Assets Liabiles & Equity Current Payable Bends Payable Bond Premium Common Stock Reine Eings NENA of Soul Company Total abilities & Equity Punk Corporation purchased 90 percent of Soul Company's voting common shares on January 1, 20X2, at underlying book value. At that date, the fair value of the noncontrolling interest was equal to 10 percent of the book value of Soul Company. Punk also purchased directly from Soul on January 1, 20X2, for $86,000. The bonds pay interest annually on December 31. The trial balances of the companies as of December 31, 20X4, are as follows: Item Soul Company Debit Credit S43.600 90.000 256,eee Punk Corporation Debit Credit $ 29,000 17e, cee 416,eee 151,272 83,680 72,000 15.888 14,920 25, eee $121.ee 184,900 182.ee Cash & Receivables Inventory Buildings & Equipment Investment in Soul Company Stock Investment in Soul Company Bonds Cost of Goods Sold Depreciation Expense Interest Expense Dividends Declared Accurulated Depreciation Current Payables Bonds Payable Bond Premium Common Stock Retained Earnings Sales Interest Income Income from Soul Company Stock Total 65,888 10. eee 4,120 15.000 $61.ee 76,920 82.ee 1.688 75.ee 45,eee 143,000 115, eee 235,000 158,00 4,128 56,772 $976,792 $484,520 Required: a. Prepare the journal entry or entries for 20X4 on Punk's books related to its investment in Soul Company stock. Record the dividends from Soul. Record the equity-method income b. Prepare the journal entry or entries for 20x4 on Punk's books related to its investment in Soul Company bonds. Record the entry for the interest income on the bond investment. c. Prepare the journal entry or entries for 20X4 on Soul's books related to its bonds payable. Record the entry for interest expense on bond investment. d. Prepare the consolidation entries needed to complete a consolidated worksheet for 20X4 Record the basic consolidation entry. Record the entry to eliminate the intercompany bond holdings. e. Prepare a three-part consolidated worksheet for 20X4 PUNK CORPORATION AND SUBSCUARY Consolidated Financial Statement Worksheet December 31, 2014 Consolidation Entries Park Carp Soul DR C R Consolidated Les cous Less Depreciation Expense Income from Sour Company Stock Consolidated Net income NC income Controling Interest in Net Income Statement of Retained Earnings Beginning Balance Net Income Less Dividends Dead Ending Balance Balance Sheet Assets Cash and Accounts Receivable Inventory Buildings & Equipment Less Accurred Depresion Investment in Soul Company Bonds Investment in Soal Company Stock Total Assets Liabiles & Equity Current Payable Bends Payable Bond Premium Common Stock Reine Eings NENA of Soul Company Total abilities & Equity