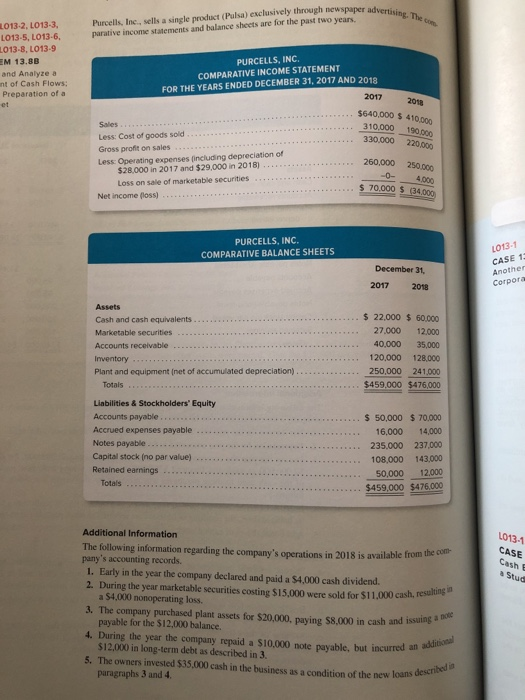

Purcells, Inc, sells a single product (Pulsa) exclusively through newspaper advertisine parative income statements and balance sheets are for the past two years L013-2. L0133, L013-5, LO13-6 013-8, LO13-9 M 13.88 and Analyze a nt of Cash Flows Preparation of a PURCELLS, INC. COMPARATIVE INCOME STATEMENT FOR THE YEARS ENDED DECEMBER 31, 2017 AND 2018 2017 2018 Sales Less: Cost of goods sold Gross profit on sales Less Operating expenses (including depreciation of $640,000 $ 410,000 310,000 190000 330,000 220,000 $28,000 in 2017 and $29,000 in 2018) Loss on sale of marketable securities 260,000 250,000 0-4,000 70,000$ Net income (loss) PURCELLS, INC. COMPARATIVE BALANCE SHEETS L013-1 CASE 1 Another December 31, 2017 2018 Corpora Assets Cash and cash equivalents Marketable securities Accounts receivable Inventory Plant and equipment (net of accumulated depreciation) . $ 22,000 $ 60.000 27,000 12.000 40,000 35,000 120,000 128,000 250,000 241,000 $459,000 $476,000 Totals Liabilities & Stockholders Equity Accounts payable Accrued expenses payable Notes payable Capital stock (no par value) .. Retained earnings - ...$ 50,000 $ 70,000 16,000 14,000 235.000 237,000 108,000 143,000 50,000 12,000 $459,000 $476000 Totals Additional Information The following information regarding the company's operations in 2018 is available from the pany's accounting records. 1. Early in the year the company declared and paid a $4,000 cash dividend. 2. During the year marketable securities costing $15,000 were sold for $11.000 cash, com- CASE 3. The company purchased plant assets for $20,000, paying $8,000 in cash and issi 4. During the year the company repaid a $10,000 note payable, but incurred an 5. The owners invested $35,000 cash in the business as a condition of the new loans a $4,000 nonoperating loss. payable for the $12,000 balance. $12,000 in long-term debt as described in 3. paragraphs 3 and 4 ing a 619 Instructions a. Prepare a worksheet f or a statement of cash flows, following the example shown in of 3-8. Cash Exhibit 13-7 b. Prepare a formal statement of cash flows for 2 018, including a supplementary schedule noncash investing and financing activities. (Use the format illustrate d in Exhibit 1 provided by operating activities is to be presented by the indirect meth od.) c. Explain how Purcells, Inc., achieved positive cash flows from operating activities, despite incurring a net loss for the year. d. Does the c Explain. should be made and what actions (if any) should be taken? Explain. ompany's financial position appear to be improving or deteriorating? Explain S. Inc, appear to be a company whose operations are growing or contracting? e that management agrees with your conclusions in parts c, d, and e. What decisions f. Assume