Answered step by step

Verified Expert Solution

Question

1 Approved Answer

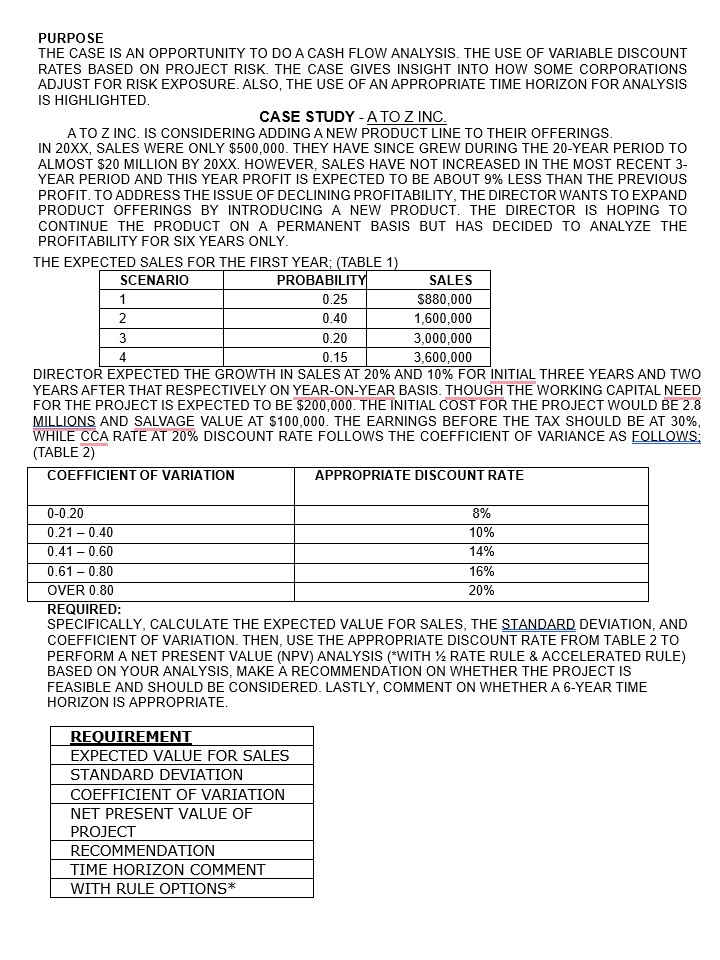

PURPOSE THE CASE IS AN OPPORTUNITY TO DO A CASH FLOW ANALYSIS. THE USE OF VARIABLE DISCOUNT RATES BASED ON PROJECT RISK. THE CASE GIVES

PURPOSE

THE CASE IS AN OPPORTUNITY TO DO A CASH FLOW ANALYSIS. THE USE OF VARIABLE DISCOUNT

RATES BASED ON PROJECT RISK. THE CASE GIVES INSIGHT INTO HOW SOME CORPORATIONS

ADJUST FOR RISK EXPOSURE. ALSO, THE USE OF AN APPROPRIATE TIME HORIZON FOR ANALYSIS

IS HIGHLIGHTED.

CASE STUDY ATO ZINC.

A TO Z INC. IS CONSIDERING ADDING A NEW PRODUCT LINE TO THEIR OFFERINGS.

IN XX SALES WERE ONLY $ THEY HAVE SINCE GREW DURING THE YEAR PERIOD TO

ALMOST $ MILLION BY XX HOWEVER, SALES HAVE NOT INCREASED IN THE MOST RECENT

YEAR PERIOD AND THIS YEAR PROFIT IS EXPECTED TO BE ABOUT LESS THAN THE PREVIOUS

PROFIT. TO ADDRESS THE ISSUE OF DECLINING PROFITABILITY, THE DIRECTOR WANTS TO EXPAND

PRODUCT OFFERINGS BY INTRODUCING A NEW PRODUCT. THE DIRECTOR IS HOPING TO

CONTINUE THE PRODUCT ON A PERMANENT BASIS BUT HAS DECIDED TO ANALYZE THE

PROFITABILITY FOR SIX YEARS ONLY.

THE EXPECTED SALES FOR THE FIRST YEAR; TABLE Please see the attached

DIRECTOR EXPECTED THE GROWTH IN SALES AT AND FOR INITIAL THREE YEARS AND TWO

YEARS AFTER THAT RESPECTIVELY ON YEARONYEAR BASIS. THOUGH THE WORKING CAPITAL NEED

FOR THE PROJECT IS EXPECTED TO BE $ THE INITIAL COST FOR THE PROJECT WOULD BE

MILLIONS AND SALVAGE VALUE AT $ THE EARNINGS BEFORE THE TAX SHOULD BE AT

WHILE CCA RATE AT DISCOUNT RATE FOLLOWS THE COEFFICIENT OF VARIANCE AS FOLLOWS:

TABLE Please see the attached

REQUIRED:

SPECIFICALLY, CALCULATE THE EXPECTED VALUE FOR SALES, THE STANDARD DEVIATION, AND

COEFFICIENT OF VARIATION. THEN, USE THE APPROPRIATE DISCOUNT RATE FROM TABLE TO

PERFORM A NET PRESENT VALUE NPV ANALYSIS WITH RATE RULE & ACCELERATED RULE

BASED ON YOUR ANALYSIS, MAKE A RECOMMENDATION ON WHETHER THE PROJECT IS

FEASIBLE AND SHOULD BE CONSIDERED. LASTLY, COMMENT ON WHETHER A YEAR TIME

HORIZON IS APPROPRIATE.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started