Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Suppose your subordinate gave you financial figures for the following three companies: Alltel: a leading provider of telecommunications service. Caremark: a leader in prescription benefit

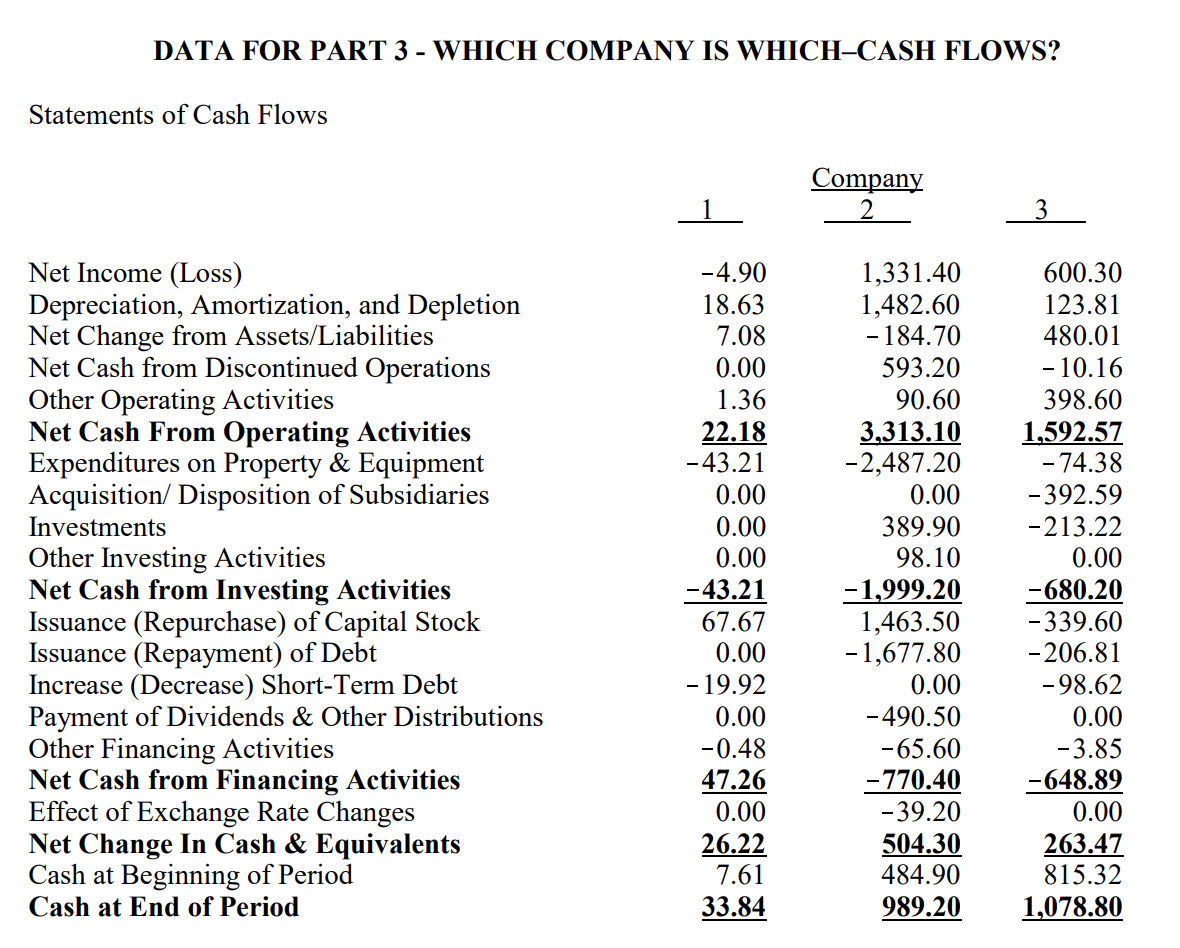

Suppose your subordinate gave you financial figures for the following three companies:

- Alltel: a leading provider of telecommunications service.

- Caremark: a leader in prescription benefit (basically, prescription drug insurance) management. Caremark acquired a major subsidiary during the year.

- Caribou Coffee: the second largest company-owned gourmet coffeehouse operator in the United States based on the number of coffeehouses. Still, it is a very new company, with very high growth expected over the next few years.

PLEASE USE THE FIGURES TO DETERMINE WHICH COMPANY IS WHICH. GIVE ONE REASON WHY.

DATA FOR PART 3 - WHICH COMPANY IS WHICH-CASH FLOWS? Statements of Cash Flows Company 3 Net Income (Loss) Depreciation, Amortization, and Depletion Net Change from Assets/Liabilities Net Cash from Discontinued Operations Other Operating Activities Net Cash From Operating Activities Expenditures on Property & Equipment Acquisition/ Disposition of Subsidiaries Investments Other Investing Activities Net Cash from Investing Activities Issuance (Repurchase) of Capital Stock Issuance (Repayment) of Debt Increase (Decrease) Short-Term Debt Payment of Dividends & Other Distributions Other Financing Activities Net Cash from Financing Activities Effect of Exchange Rate Changes Net Change In Cash & Equivalents Cas at Beginning of Period Cash at End of Period -4.90 18.63 7.08 0.00 1.36 22.18 -43.21 0.00 0.00 0.00 -43.21 67.67 0.00 - 19.92 0.00 -0.48 47.26 0.00 26.22 7.61 33.84 1,331.40 1,482.60 - 184.70 593.20 90.60 3,313.10 -2,487.20 0.00 389.90 98.10 -1,999.20 1,463.50 -1,677.80 0.00 -490.50 -65.60 - 770.40 -39.20 504.30 484.90 989.20 600.30 123.81 480.01 -10.16 398.60 1,592.57 - 74.38 -392.59 -213.22 0.00 -680.20 -339.60 -206.81 -98.62 0.00 -3.85 -648.89 0.00 263.47 815.32 1,078.80

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started