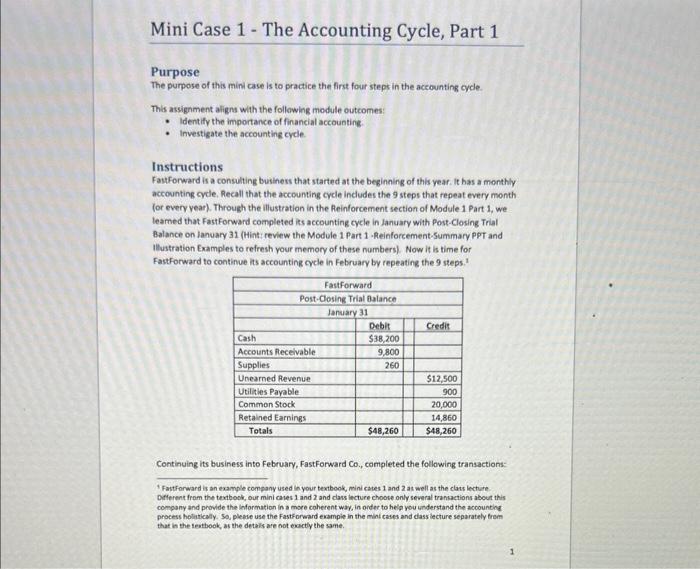

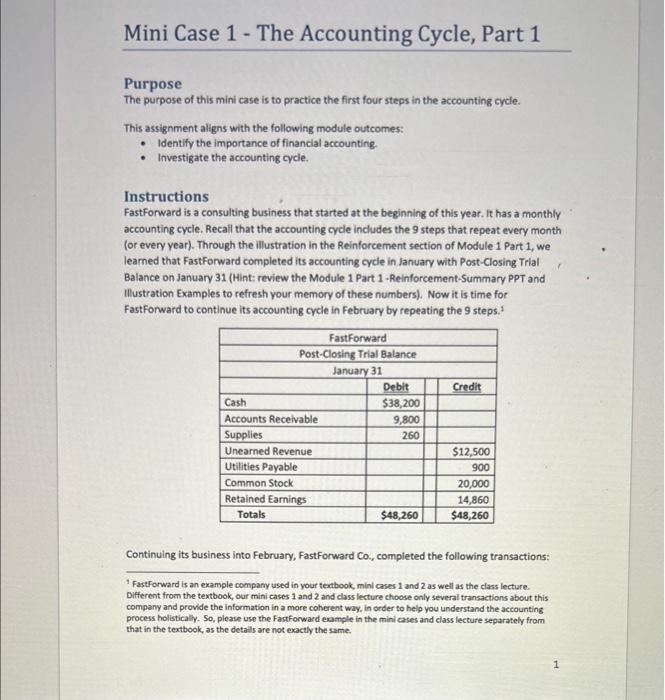

Purpose The purpose of this minl case is to practice the first four steps in the accounting cycle. This assignment aligns wh the following module outcomes: - Identify the importance of financial accoustine. - Investigate the accountine cycle. Instructions Fasforward is a consulting business that started at the beginning of this year. It has a monthly accounting cycle, Recall that the accounting cycle indudes the 9 steps that repeat every month (or every vear). Through the illustration in the Reinforcement section of Module 1 Part 1, we learned that Fastforward completed ies accounting cycle in January with Post-Closing Trial Balance on January 31 (Hint: review the Module 1 Part 1 -Reinforcement-Summary PPT and Illustration Examples to refresh your memory of these numbers). Now it is time for Fastforward to continue its accounting cycle in February by repeating the 9 steps. 1 Continuing its business into February, FastForward Co., completed the following transactions: 'Fastforward is an example company used lin your texibook, mini cates 1 and 2 as well as the clast lecture. Deflerment from the tentbook, our mini caves 1 and 2 and class iecture choote only several trancactions about this company and provide the information in a more coherent way, in order to help you saderstand the accounting process holiticaly, So, please use the fastforward exampie in the mini cases and dass lecture separately frem that in the teatbook, as the detals are not eactly the same. Purpose The purpose of this mini case is to practice the first four steps in the accounting cycle. This assignment aligns with the following module outcomes: - Identify the importance of financial accounting. - Investigate the accounting cycle. Instructions Fastforward is a consulting business that started at the beginning of this year. It has a monthly accounting cycle. Recall that the accounting cycle includes the 9 steps that repeat every month (or every year). Through the illustration in the Reinforcement section of Module 1 Part 1, we learned that FastForward completed its accounting cycle in January with Post-Closing Trial Balance on January 31 (Hint: review the Module 1 Part 1 - Reinforcement-Summary PPT and Illustration Examples to refresh your memory of these numbers). Now it is time for Fastforward to continue its accounting cycle in February by repeating the 9 steps. 1 Continuing its business into February, FastForward Co, completed the following transactions: 1 Fastiforward is an example company used in your textbook, mini cases 1 and 2 as well as the class lecture. Different from the textbook, our mini cases 1 and 2 and class lecture choose only several transactions about this company and provide the information in a more coherent way, in order to help you understand the accounting process holistically. So, please use the Fastforward example in the mini cases and class lecture separately from that in the textbook, as the detalls are not exactly the same. - On february 1, paid $12,000 cash for a one-year rent of office space. The rent payment will cover from February 1 of this year to January 31 of the next year. - On February 4, purchased computers from Dell Co. for $19,000 on credit (payment due to Dell Co, in 90 days). Fastforward estimated to use the computers for five vears with a salvage value of $3,000. - On February 9, provided consulting service of $30,600 to a customer, Well inc., on credit: - On February 10, paid the utility bill of $900 received on January 28. (Hint: review the illustration Example in the Reinforcement of Module 1, Part 1-Fastforward has recorded January's utilities in January's accounting book through an adjusting journal entry). - On February 20, collected cash of \$25,000 from the customer, Well inc, for the work on February 9. - On February 29, paid $7,000 cash for employee salary for the first time. - On February 30 , paid $500 cash for dividends to the shareholders. Different from the textbook, our mini cases 1 and 2 and class lecture choose only several transactions about this company and provide the information in a more coherent way, in order to help you understand the accounting process holistically. So, please use the fastforward example in the mini cases and class lecture separately from that in the textbook, as the details are not exactly the same. 1 - On February 1, paid $12,000 cash for a one-year rent of office space. The rent payment will cover from February 1 of this year to January 31 of the next year. - On February 4, purchased computers from Dell Co. for $19,000 on credit (payment due to Dell Co, in 90 days). FastFonward estimated to use the computers for five years with a salvage value of $3,000. - On February 9, provided consulting service of $30,600 to a customer, Well Inc., on credit. - On February 10, paid the utility bill of $900 received on January 28. (Hint: review the illustration Example in the Reinforcement of Module 1, Part 1-FastForward has recorded January's utilities in January's accounting book through an adjusting journal entry). - On February 20, collected cash of $25,000 from the customer, Well inc. for the work on February 9. - On February 29 , paid $7,000 cash for employee salary for the first time. - On February 30 , paid $500 cash for dividends to the shareholders. Requirements: Step 1: Analyze the above transactions; Step 2: Record the above transactions; Step 3: Post the above transactions; Step 4: Prepare the unadjusted trial balance as of 2/28