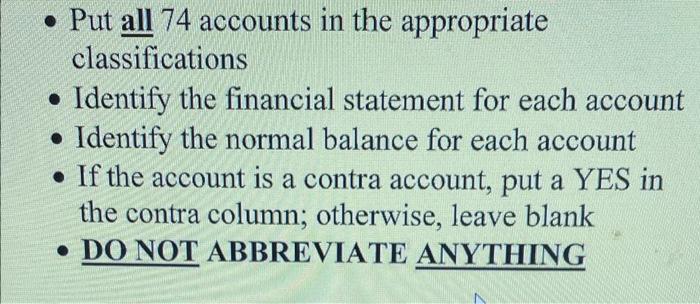

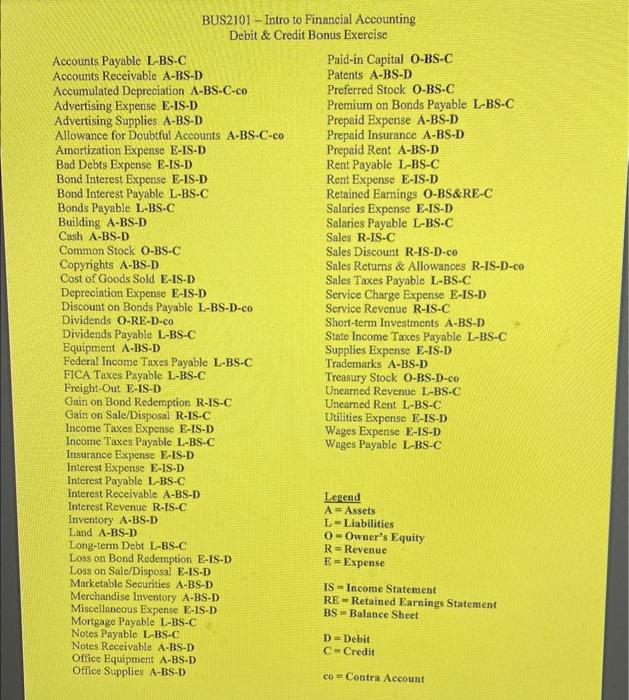

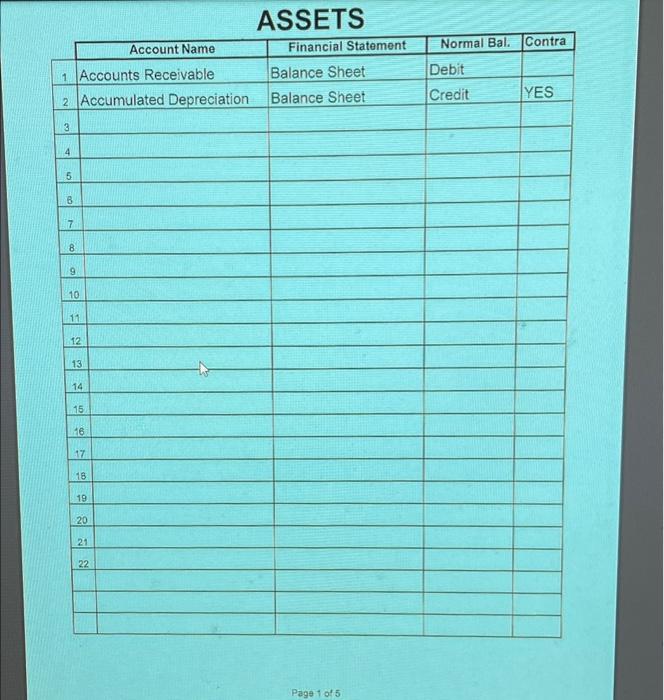

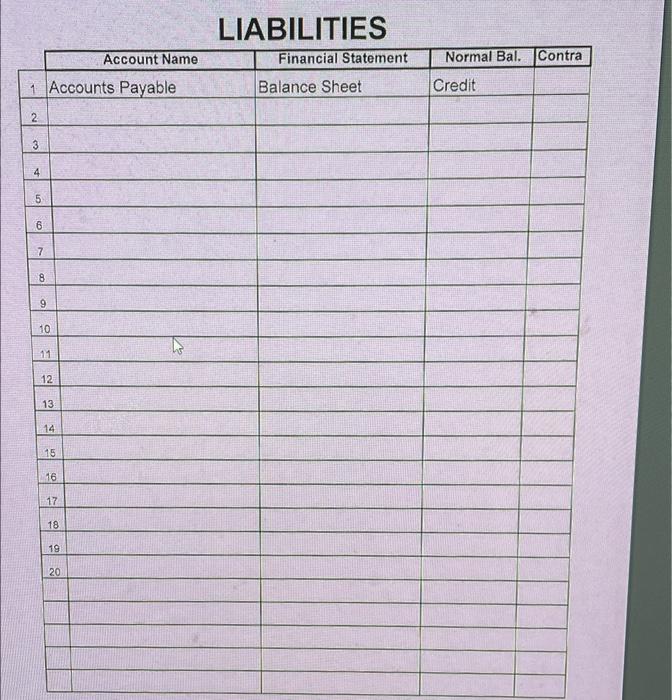

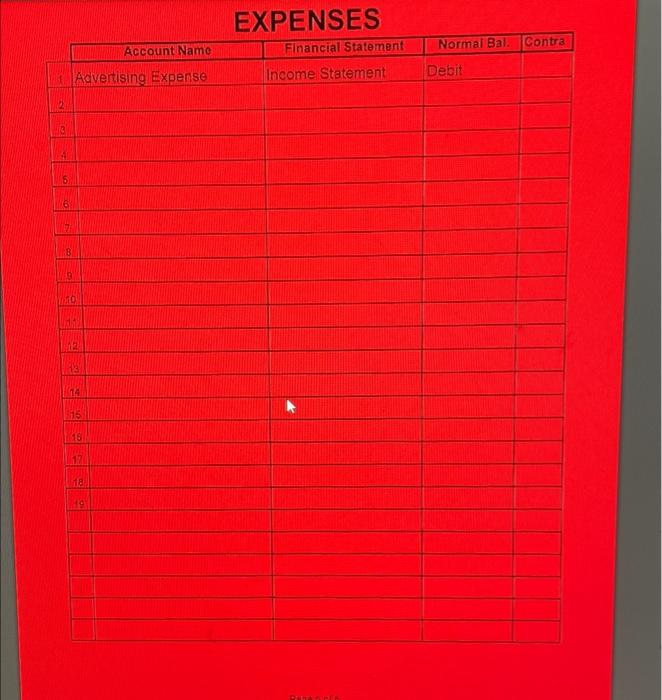

- Put all 74 accounts in the appropriate classifications - Identify the financial statement for each account - Identify the normal balance for each account - If the account is a contra account, put a YES in the contra column; otherwise, leave blank - DO NOT ABBREVIATE ANYTHING BUS2101 - Intro to Financial Accounting Debit & Credit Bonus Exercise Accounts Payable L-BS-C Paid-in Capital O-BS-C Accounts Receivable A-BS-D Patents A-BS-D Accumulated Depreciation A-BS-C-co Preferred Stock O-BS-C Advertising Expense E-IS-D Premium on Bonds Payable L-BS-C Advertising Supplies A-BS-D Prepaid Expense A-BS-D Allowance for Doubtful Accounts A-BS-C-co Prepaid Insurance A-BS-D Amortization Expense E-IS-D Prepaid Rent A-BS-D Bad Debts Expense E-IS-D Rent Payable L-BS-C Bond Interest Expense E-IS-D Rent Expense E-IS-D Bond Interest Payable L-BS-C Retained Earnings O-BS\&RE-C Bonds Payable L-BS-C Salaries Expense E-IS-D Building A-BS-D Salaries Payable L-BS-C Cash A-BS-D Sales R-IS-C Common Stock O-BS-C Sales Discount R-IS-D-ce Copyrights A-BS-D Sales Returns \& Allowances R-IS-D-co Cost of Goods Sold. E-IS-D Sales Taxes Payable L-BS-C Depreciation Expense E-IS-D Service Charge Expense E-IS-D Discount on Bonds Payable L-BS-D-co Service Revenue R-IS-C Dividends O-RE-D-co Short-term Investments A-BS-D Dividends Payable L-BS-C State Income Taxes Payable L-BS-C Equipment A-BS-D Supplies Expense E-IS-D Federal Income Taxes Payable L-BS-C Trademarks A-BS-D FICA Taxes Payable L-BS-C Freight-Out E-IS-D Gain on Bond Redemption R-IS-C Gain on Sale/Disposal R-IS-C Income Taxes Expense E-IS-D Income Taxes Payable L-BS-C Treasury Stock O-BS-D-co Unearned Revenue L-BS-C Unearned Rent L-BS-C Utilities Expense E-IS-D Wages Expense E-IS-D Wages Payable L-BS-C Insurance Expense E-IS-D Interest Expense E-1S-D Interest Payable L-BS-C Interest Receivable A-BS-D Legend Interest Revenue R-IS-C A= Assets Inventory A-BS-D L=L iabilities Land A-BS-D O= Owner's Equity Long-term Debt L-BS-C R= Revenue Loss on Bond Redemption E-IS-D E= Expense Loss on Sale/Disposal E-IS-D Marketable Securities A-BS-D IS = Income Statement Merchandise laventory A-BS-D Miscellaneous Expense E-IS-D RE = Retained Earnings Statement Mortgage Payable L-BS-C BS = Balance Sheet Notes Payable L-BS-C D= Debit Notes Receivable A-BS-D C= Credit Office Equipment A-BS-D Office Supplies A-BS-D co= Contra Account ASSETS \begin{tabular}{|l|l|l|l|l|} \hline \multicolumn{1}{|c|}{ Account Name } & Financial Statement & Normal Bal. & Contra \\ \hline 1 & Accounts Receivable & Balance Sheet & Debit & \\ \hline 2 & Accumulated Depreciation & Balance Sheet & Credit & YES \\ \hline 3 & & & & \\ \hline 4 & & & \\ \hline 5 & & & & \\ \hline 6 & & & & \\ \hline 7 & & & \\ \hline 8 & & & \\ \hline 9 & & & \\ \hline 10 & & & \\ \hline 11 & & & \\ \hline 12 & & & \\ \hline 13 & & & \\ \hline 14 & & & \\ \hline 15 & & & \\ \hline 16 & & & \\ \hline 17 & & & \\ \hline 18 & & & \\ \hline 19 & & & \\ \hline 20 & & & \\ \hline 21 & & & \\ \hline 22 & & & \\ \hline & & & \\ \hline \end{tabular} LIABILITIES OWNER'S EQUITY DEVIENIIIES EXPENSES