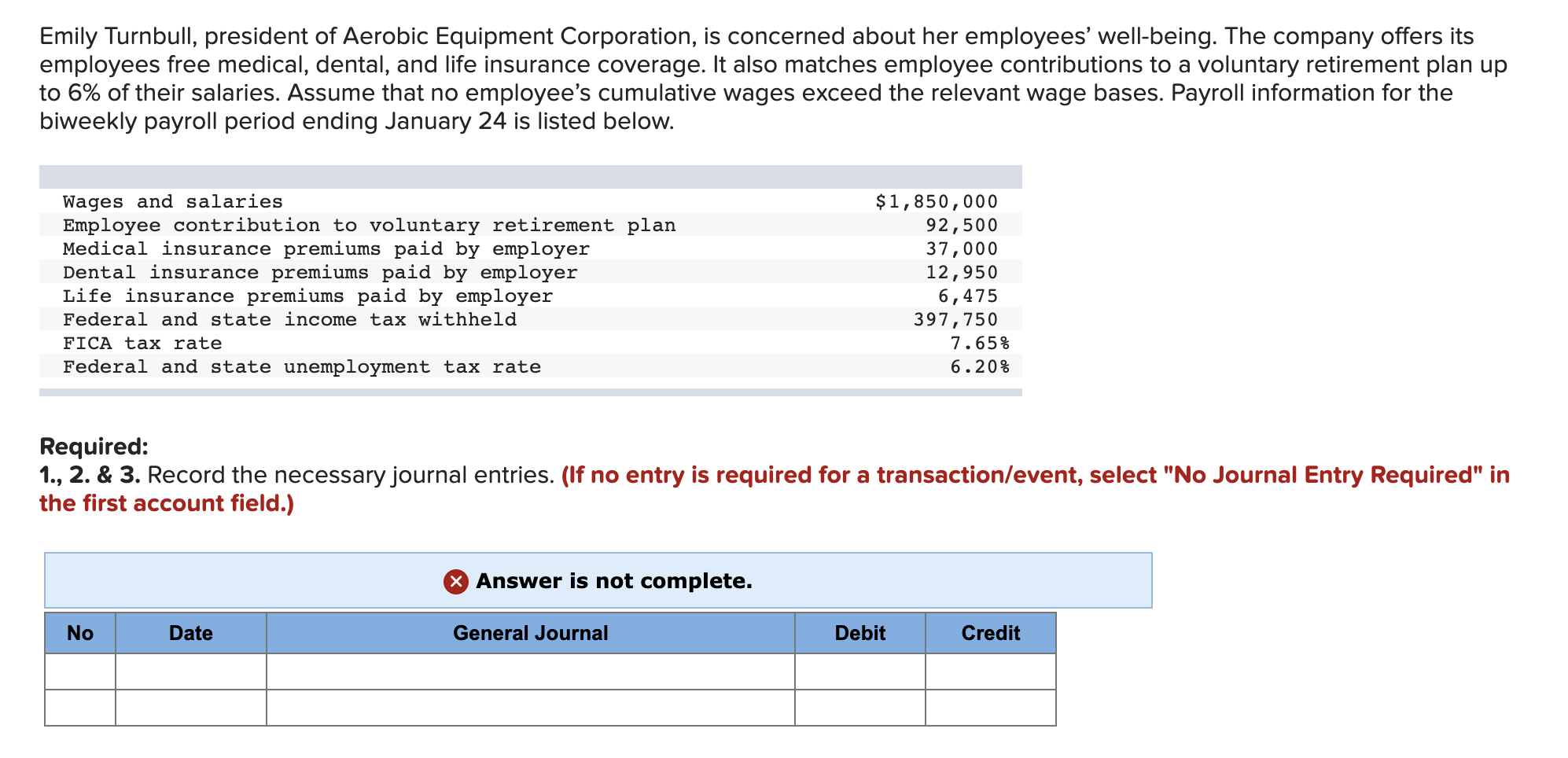

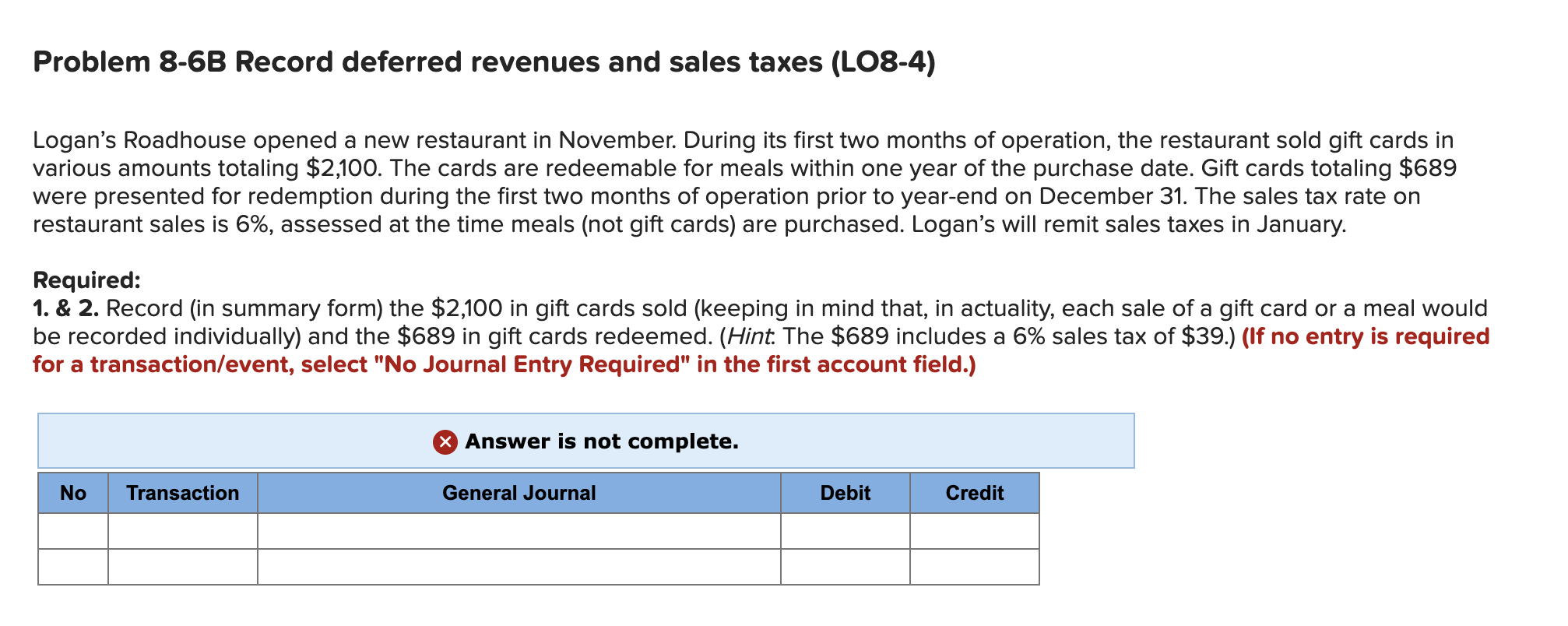

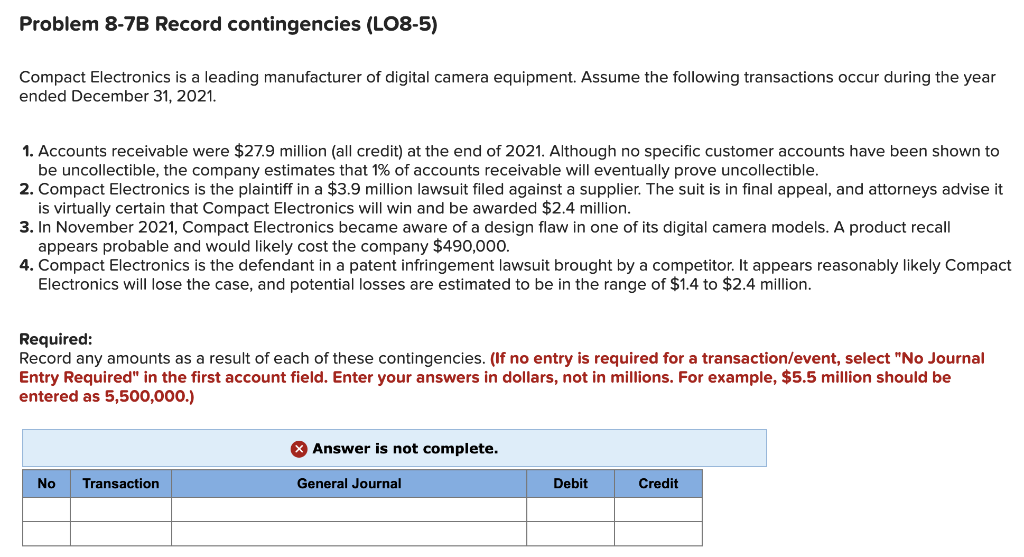

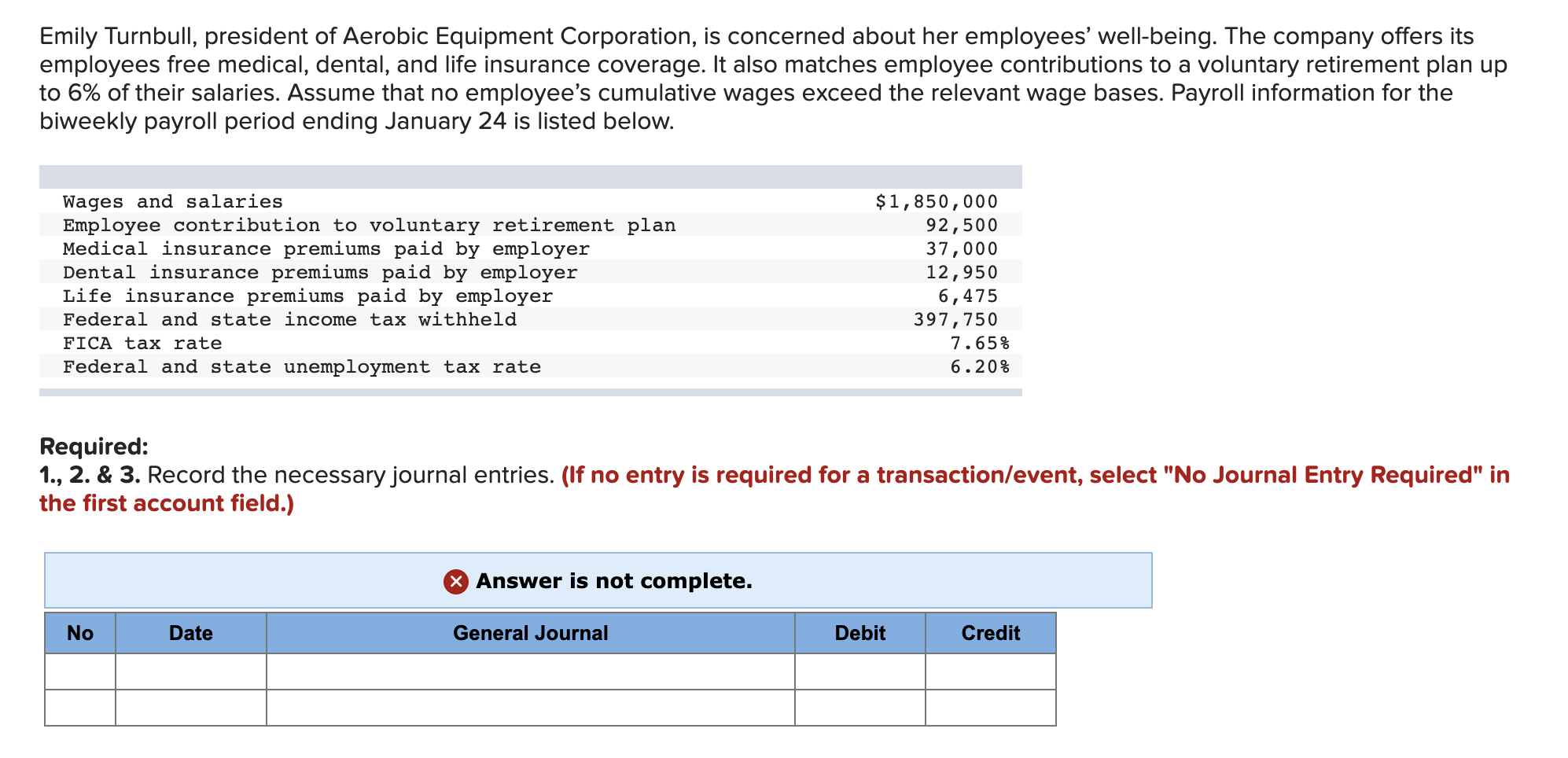

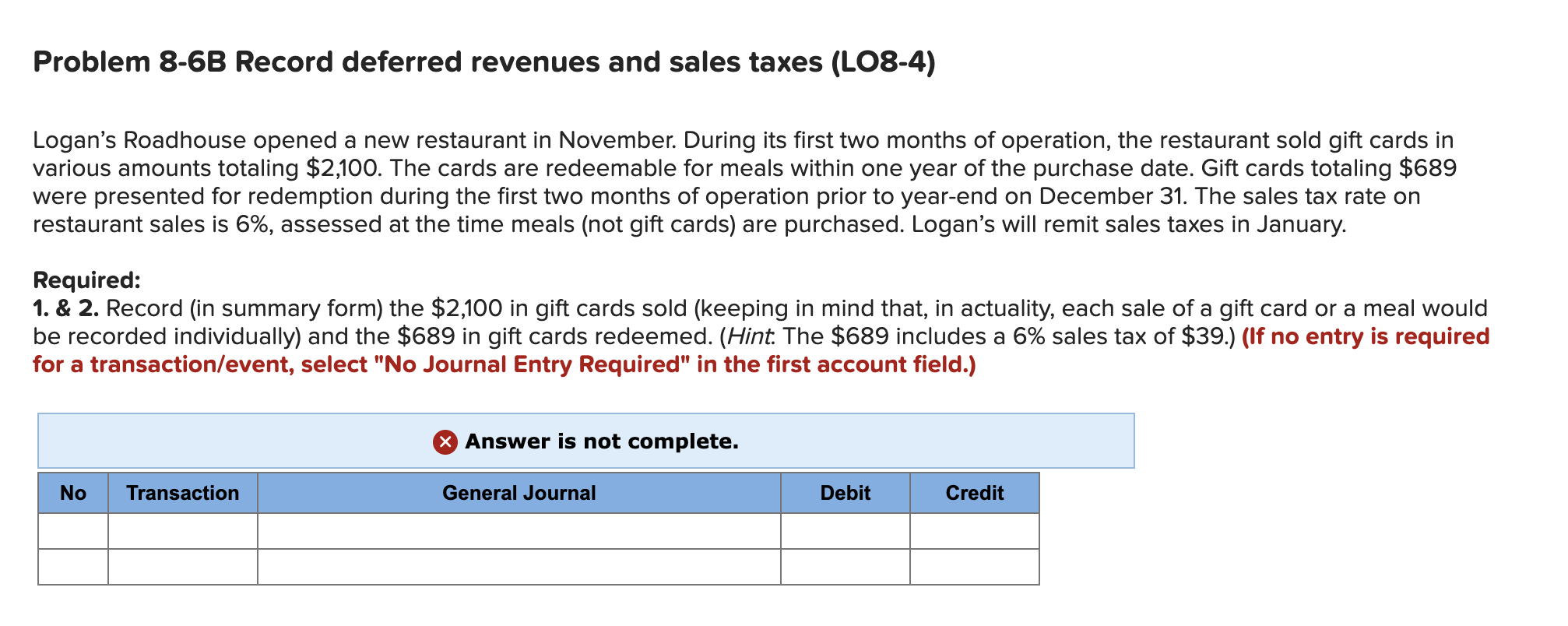

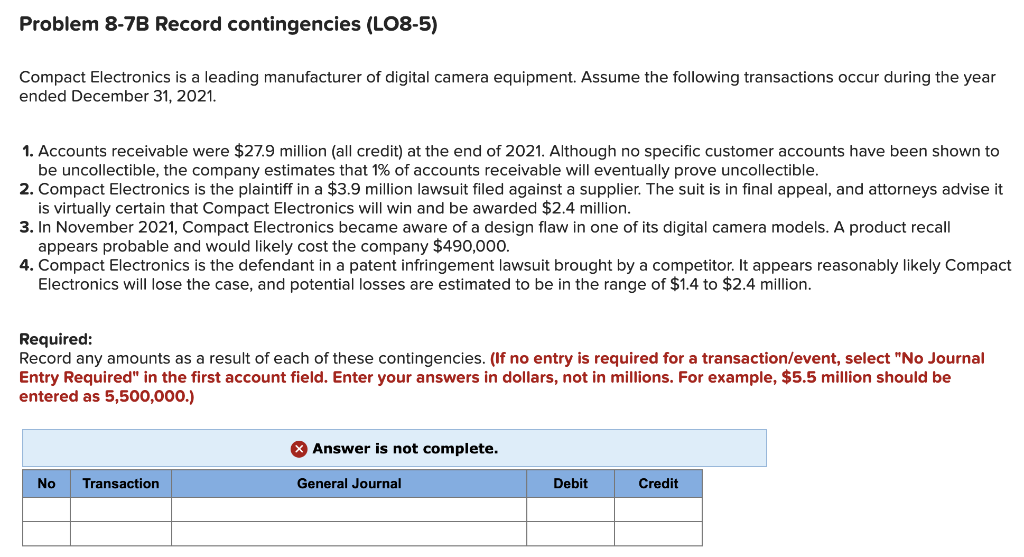

Emily Turnbull, president of Aerobic Equipment Corporation, is concerned about her employees' well-being. The company offers its employees free medical, dental, and life insurance coverage. It also matches employee contributions to a voluntary retirement plan up to 6% of their salaries. Assume that no employee's cumulative wages exceed the relevant wage bases. Payroll information for the biweekly payroll period ending January 24 is listed below. Wages and salaries Employee contribution to voluntary retirement plan Medical insurance premiums paid by employer Dental insurance premiums paid by employer Life insurance premiums paid by employer Federal and state income tax withheld FICA tax rate Federal and state unemployment tax rate $1,850,000 92,500 37,000 12,950 6,475 397,750 7.65% 6.20% Required: 1., 2. & 3. Record the necessary journal entries. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) & Answer is not complete. No Date General Journal Debit Credit Problem 8-6B Record deferred revenues and sales taxes (LO8-4) Logan's Roadhouse opened a new restaurant in November. During its first two months of operation, the restaurant sold gift cards in various amounts totaling $2,100. The cards are redeemable for meals within one year of the purchase date. Gift cards totaling $689 were presented for redemption during the first two months of operation prior to year-end on December 31. The sales tax rate on restaurant sales is 6%, assessed at the time meals (not gift cards) are purchased. Logan's will remit sales taxes in January. Required: 1. & 2. Record (in summary form) the $2,100 in gift cards sold (keeping in mind that, in actuality, each sale of a gift card or a meal would be recorded individually) and the $689 in gift cards redeemed. (Hint. The $689 includes a 6% sales tax of $39.) (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) & Answer is not complete. No Transaction General Journal Debit Credit Problem 8-7B Record contingencies (LO8-5) Compact Electronics is a leading manufacturer of digital camera equipment. Assume the following transactions occur during the year ended December 31, 2021. 1. Accounts receivable were $27.9 million (all credit) at the end of 2021. Although no specific customer accounts have been shown to be uncollectible, the company estimates that 1% of accounts receivable will eventually prove uncollectible. 2. Compact Electronics is the plaintiff in a $3.9 million lawsuit filed against a supplier. The suit is in final appeal, and attorneys advise it is virtually certain that Compact Electronics will win and be awarded $2.4 million. 3. In November 2021, Compact Electronics became aware of a design flaw in one of its digital camera models. A product recall appears probable and would likely cost the company $490,000. 4. Compact Electronics is the defendant in a patent infringement lawsuit brought by a competitor. It appears reasonably likely Compact Electronics will lose the case, and potential losses are estimated to be in the range of $1.4 to $2.4 million. Required: Record any amounts as a result of each of these contingencies. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field. Enter your answers in dollars, not in millions. For example, $5.5 million should be entered as 5,500,000.) Answer is not complete. No Transaction General Journal Debit Credit