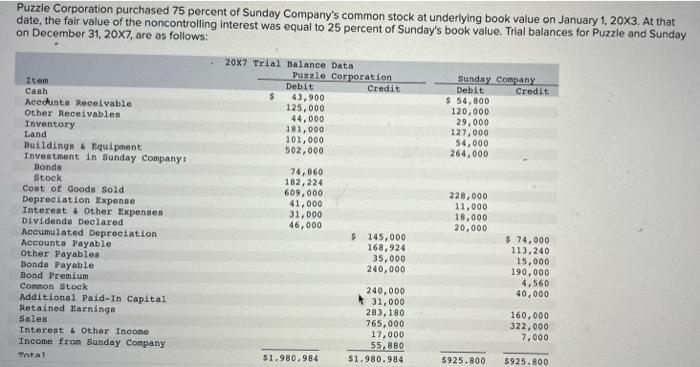

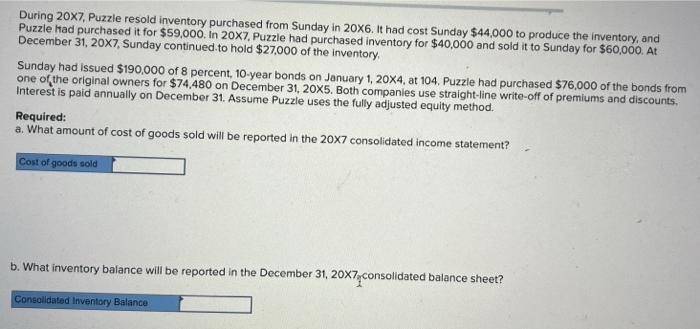

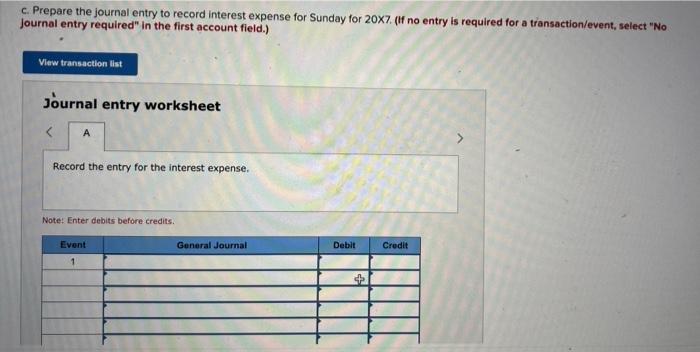

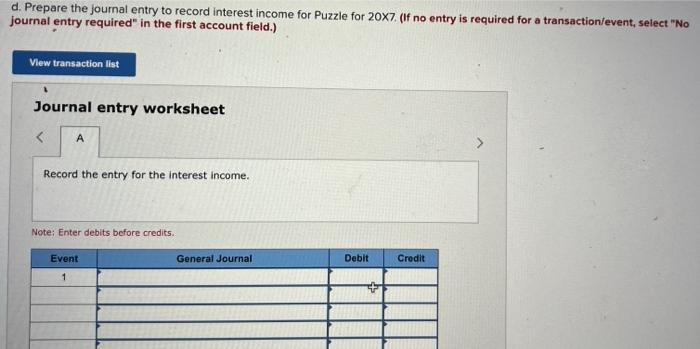

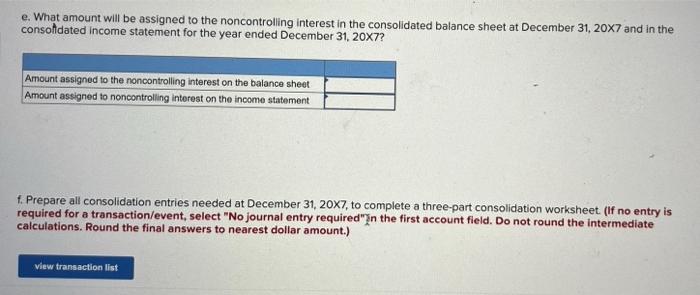

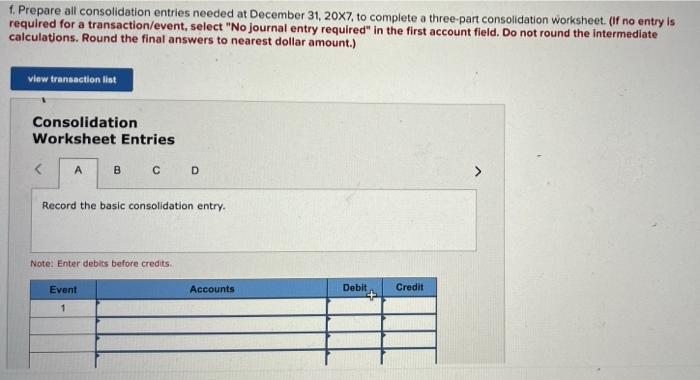

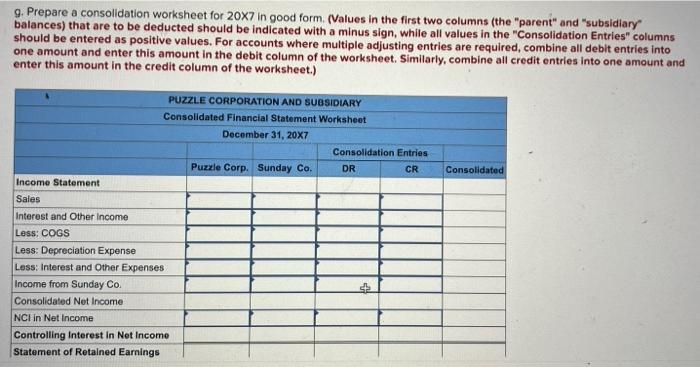

Puzzle Corporation purchased 75 percent of Sunday Company's common stock at underlying book value on January 1, 20x 3 . At that date, the fair value of the noncontrolling interest was equal to 25 percent of Sunday's book value. Trial balances for Puzzle and Sunday on December 31, 20x7, are as follows: During 20X7, Puzzle resold inventory purchased from Sunday in 20X6. It had cost Sunday $44,000 to produce the inventory, and Puzzle had purchased it for $59,000. In 20X7. Puzzle had purchased inventory for $40,000 and sold it to Sunday for $60,000. At December 31,207, Sunday continued. to hold $27,000 of the inventory. Sunday had issued $190,000 of 8 percent, 10 -year bonds on January 1,204, at 104 . Puzzle had purchased $76,000 of the bonds from one of the original owners for $74,480 on December 31,205. Both companies use straight-line write-off of premiums and discounts. Interest is paid annually on December 31. Assume Puzzle uses the fully adjusted equity method. Required: a. What amount of cost of goods sold will be reported in the 207 consolidated income statement? b. What inventory balance will be reported in the December 31,207 consolidated balance sheet? c. Prepare the journal entry to record interest expense for Sunday for 20X7. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) Journal entry worksheet d. Prepare the journal entry to record interest income for Puzzle for 207. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) Journal entry worksheet Note: knter debits before credits. e. What amount will be assigned to the noncontrolling interest in the consolidated balance sheet at December 31,207 and in the consolfdated income statement for the year ended December 31,207? f. Prepare all consolidation entries needed at December 31,207, to complete a three-part consolidation worksheet. (If no entry is required for a transaction/event, select "No journal entry required"'n the first account field. Do not round the intermediate calculations. Round the final answers to nearest dollar amount.) f. Prepare all consolidation entries needed at December 31,207, to complete a three-part consolidation worksheet. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Do not round the intermediate calculations. Round the final answers to nearest dollar amount.) Consolidation Worksheet Entries Note: Enter debits before credits. 9. Prepare a consolidation worksheet for 207 in good form. (Values in the first two columns (the "parent" and "subsidiary" balances) that are to be deducted should be indicated with a minus sign, while all values in the "Consolidation Entries" columns should be entered as positive values. For accounts where multiple adjusting entries are required, combine all debit entries into one amount and enter this amount in the debit column of the worksheet. Similarly, combine all credit entries into one amount and enter this amount in the credit column of the worksheet.) Puzzle Corporation purchased 75 percent of Sunday Company's common stock at underlying book value on January 1, 20x 3 . At that date, the fair value of the noncontrolling interest was equal to 25 percent of Sunday's book value. Trial balances for Puzzle and Sunday on December 31, 20x7, are as follows: During 20X7, Puzzle resold inventory purchased from Sunday in 20X6. It had cost Sunday $44,000 to produce the inventory, and Puzzle had purchased it for $59,000. In 20X7. Puzzle had purchased inventory for $40,000 and sold it to Sunday for $60,000. At December 31,207, Sunday continued. to hold $27,000 of the inventory. Sunday had issued $190,000 of 8 percent, 10 -year bonds on January 1,204, at 104 . Puzzle had purchased $76,000 of the bonds from one of the original owners for $74,480 on December 31,205. Both companies use straight-line write-off of premiums and discounts. Interest is paid annually on December 31. Assume Puzzle uses the fully adjusted equity method. Required: a. What amount of cost of goods sold will be reported in the 207 consolidated income statement? b. What inventory balance will be reported in the December 31,207 consolidated balance sheet? c. Prepare the journal entry to record interest expense for Sunday for 20X7. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) Journal entry worksheet d. Prepare the journal entry to record interest income for Puzzle for 207. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) Journal entry worksheet Note: knter debits before credits. e. What amount will be assigned to the noncontrolling interest in the consolidated balance sheet at December 31,207 and in the consolfdated income statement for the year ended December 31,207? f. Prepare all consolidation entries needed at December 31,207, to complete a three-part consolidation worksheet. (If no entry is required for a transaction/event, select "No journal entry required"'n the first account field. Do not round the intermediate calculations. Round the final answers to nearest dollar amount.) f. Prepare all consolidation entries needed at December 31,207, to complete a three-part consolidation worksheet. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Do not round the intermediate calculations. Round the final answers to nearest dollar amount.) Consolidation Worksheet Entries Note: Enter debits before credits. 9. Prepare a consolidation worksheet for 207 in good form. (Values in the first two columns (the "parent" and "subsidiary" balances) that are to be deducted should be indicated with a minus sign, while all values in the "Consolidation Entries" columns should be entered as positive values. For accounts where multiple adjusting entries are required, combine all debit entries into one amount and enter this amount in the debit column of the worksheet. Similarly, combine all credit entries into one amount and enter this amount in the credit column of the worksheet.)