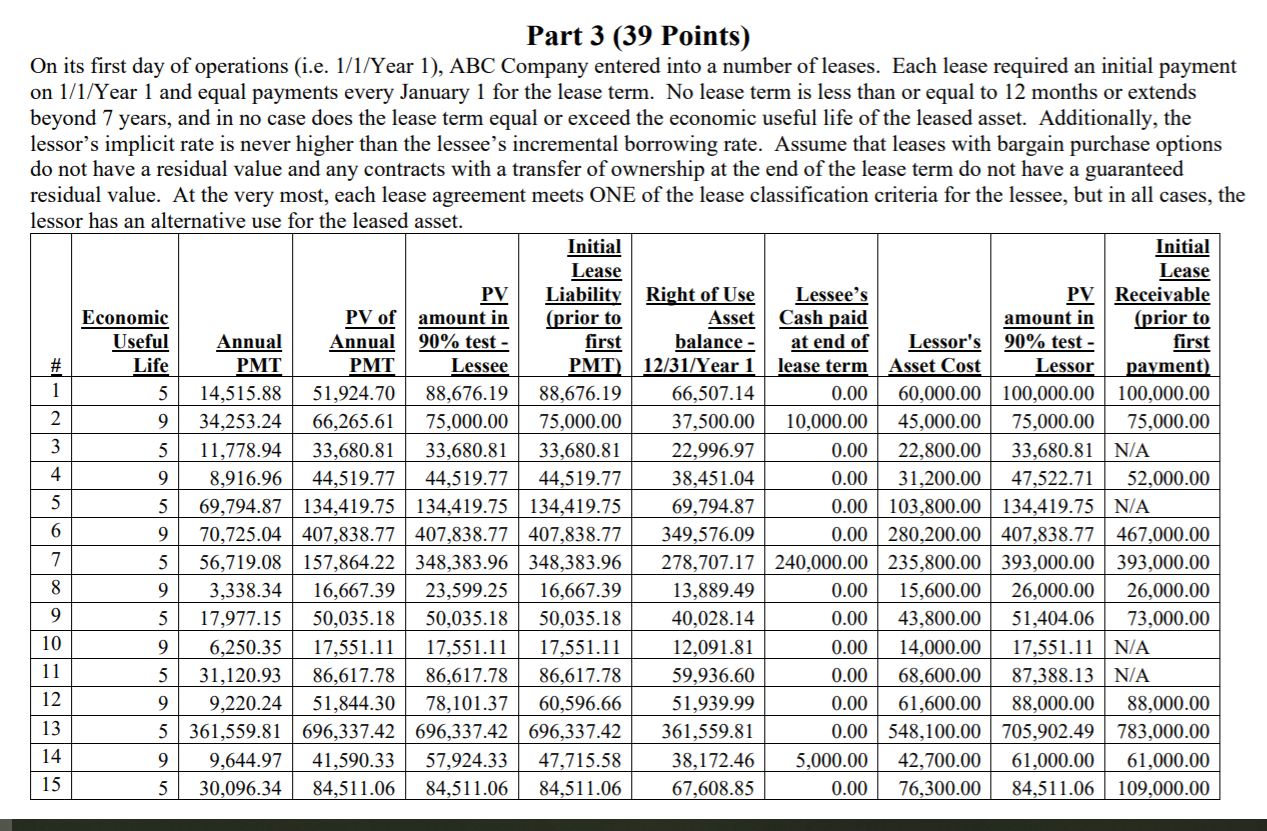

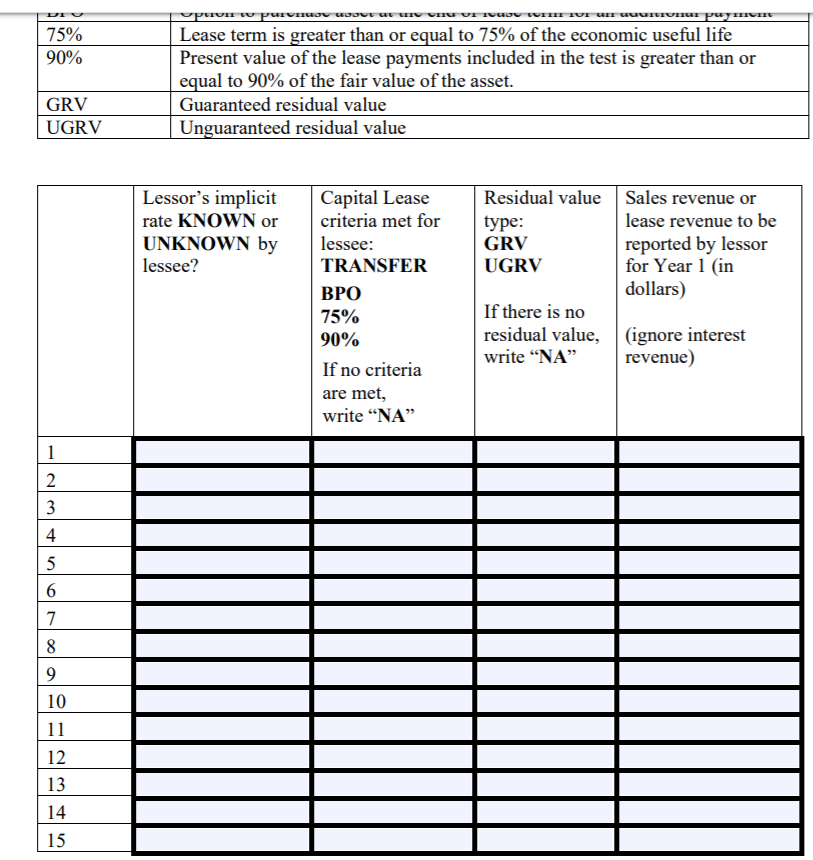

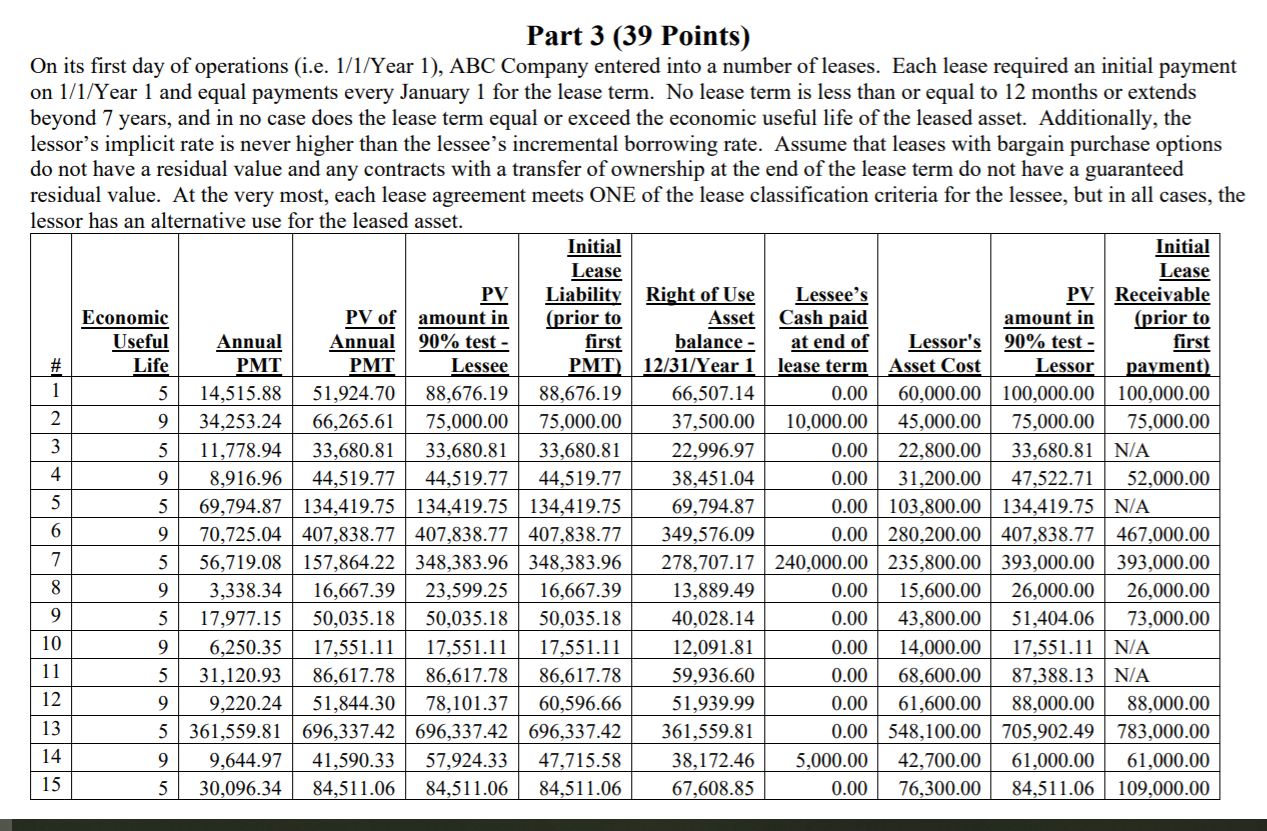

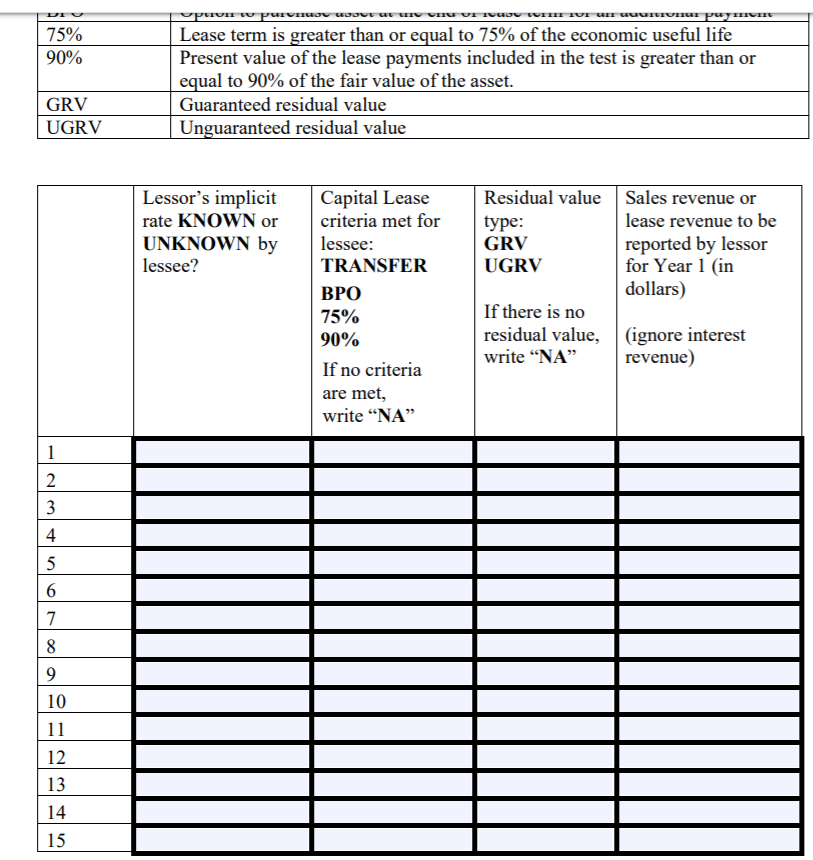

PV Part 3 (39 Points) On its first day of operations (i.e. 1/1/Year 1), ABC Company entered into a number of leases. Each lease required an initial payment on 1/1/Year 1 and equal payments every January 1 for the lease term. No lease term is less than or equal to 12 months or extends beyond 7 years, and in no case does the lease term equal or exceed the economic useful life of the leased asset. Additionally, the lessor's implicit rate is never higher than the lessee's incremental borrowing rate. Assume that leases with bargain purchase options do not have a residual value and any contracts with a transfer of ownership at the end of the lease term do not have a guaranteed residual value. At the very most, each lease agreement meets ONE of the lease classification criteria for the lessee, but in all cases, the lessor has an alternative use for the leased asset. Initial Initial Lease Lease Liability Right of Use Lessee's PV Receivable Economic PV of amount in (prior to Asset Cash paid amount in (prior to Useful Annual Annual 90% test - first balance - at end of Lessor's 90% test - first Life PMT PMT Lessee PMT) 12/31/Year 1 lease term Asset Cost Lessor payment) 5 14,515.88 51,924.70 88,676.19 88,676.19 66,507.14 0.00 60,000.00 100,000.00 100,000.00 9 34,253.24 66,265.61 75,000.00 75,000.00 37,500.00 10,000.00 45,000.00 75,000.00 75,000.00 5 11,778.94 33,680.81 33,680.81 | 33,680.81 22.996.97 0.00 22,800.00 33,680.81 N/A 9 8,916.96 44,519.77 44,519.77 44,519.77 38,451.04 0.00 31,200.00 47,522.71 52,000.00 5 69,794.87 | 134,419.75 | 134,419.75 | 134,419.75 69,794.87 0.00 103,800.00 134,419.75 N/A 9 70,725.04 407,838.77 407,838.77 407,838.77 349,576.09 0.00 280,200.00 407,838.77 | 467,000.00 5 56,719.08 157,864.22 348.383.96 | 348.383.96 278,707.17 240,000.00 235,800.00 393,000.00 393,000.00 3,338.34 16,667.39 23,599.25 16,667.39 13,889.49 0.00 15,600.00 26,000.00 26,000.00 5 17,977.15 50,035.18 50,035.18 50,035.18 40,028.14 0.00 43,800.00 51,404.06 73,000.00 6,250.35 17,551.11 17,551.11 17,551.11 12,091.81 0.00 14,000.00 17,551.11 NA 5 31,120.93 86,617.78 86,617.78 86,617.78 59,936.60 0.00 68,600.00 87,388.13 N/A 9 9.220.24 51,844.30 78,101.37 60,596.66 51.939.99 0.00 61,600.00 88,000.00 | 88,000.00 5 | 361,559.81 | 696,337.42 696,337.42 | 696,337.42 361,559.81 0.00 548,100.00 705,902.49783,000.00 9 9,644.97 41,590.33 57,924.33 | 47,715.58 38,172.46 5,000.00 42,700.00 61,000.00 61,000.00 | 15 | 5| 30,096.34 84,511.06 84,511.06 84,511.06 | 67,608.85 0 .00 76,300.00 84,511.06 | 109,000.00 75% 90% Lease term is greater than or equal to 75% of the economic useful life Present value of the lease payments included in the test is greater than or equal to 90% of the fair value of the asset. Guaranteed residual value Unguaranteed residual value GRV UGRV Lessor's implicit rate KNOWN or UNKNOWN by lessee? Residual value type: GRV UGRV Sales revenue or lease revenue to be reported by lessor for Year 1 (in dollars) Capital Lease criteria met for lessee: TRANSFER 75% 90% If no criteria are met, write "NA" If there is no residual value, write "NA" (ignore interest revenue) PV Part 3 (39 Points) On its first day of operations (i.e. 1/1/Year 1), ABC Company entered into a number of leases. Each lease required an initial payment on 1/1/Year 1 and equal payments every January 1 for the lease term. No lease term is less than or equal to 12 months or extends beyond 7 years, and in no case does the lease term equal or exceed the economic useful life of the leased asset. Additionally, the lessor's implicit rate is never higher than the lessee's incremental borrowing rate. Assume that leases with bargain purchase options do not have a residual value and any contracts with a transfer of ownership at the end of the lease term do not have a guaranteed residual value. At the very most, each lease agreement meets ONE of the lease classification criteria for the lessee, but in all cases, the lessor has an alternative use for the leased asset. Initial Initial Lease Lease Liability Right of Use Lessee's PV Receivable Economic PV of amount in (prior to Asset Cash paid amount in (prior to Useful Annual Annual 90% test - first balance - at end of Lessor's 90% test - first Life PMT PMT Lessee PMT) 12/31/Year 1 lease term Asset Cost Lessor payment) 5 14,515.88 51,924.70 88,676.19 88,676.19 66,507.14 0.00 60,000.00 100,000.00 100,000.00 9 34,253.24 66,265.61 75,000.00 75,000.00 37,500.00 10,000.00 45,000.00 75,000.00 75,000.00 5 11,778.94 33,680.81 33,680.81 | 33,680.81 22.996.97 0.00 22,800.00 33,680.81 N/A 9 8,916.96 44,519.77 44,519.77 44,519.77 38,451.04 0.00 31,200.00 47,522.71 52,000.00 5 69,794.87 | 134,419.75 | 134,419.75 | 134,419.75 69,794.87 0.00 103,800.00 134,419.75 N/A 9 70,725.04 407,838.77 407,838.77 407,838.77 349,576.09 0.00 280,200.00 407,838.77 | 467,000.00 5 56,719.08 157,864.22 348.383.96 | 348.383.96 278,707.17 240,000.00 235,800.00 393,000.00 393,000.00 3,338.34 16,667.39 23,599.25 16,667.39 13,889.49 0.00 15,600.00 26,000.00 26,000.00 5 17,977.15 50,035.18 50,035.18 50,035.18 40,028.14 0.00 43,800.00 51,404.06 73,000.00 6,250.35 17,551.11 17,551.11 17,551.11 12,091.81 0.00 14,000.00 17,551.11 NA 5 31,120.93 86,617.78 86,617.78 86,617.78 59,936.60 0.00 68,600.00 87,388.13 N/A 9 9.220.24 51,844.30 78,101.37 60,596.66 51.939.99 0.00 61,600.00 88,000.00 | 88,000.00 5 | 361,559.81 | 696,337.42 696,337.42 | 696,337.42 361,559.81 0.00 548,100.00 705,902.49783,000.00 9 9,644.97 41,590.33 57,924.33 | 47,715.58 38,172.46 5,000.00 42,700.00 61,000.00 61,000.00 | 15 | 5| 30,096.34 84,511.06 84,511.06 84,511.06 | 67,608.85 0 .00 76,300.00 84,511.06 | 109,000.00 75% 90% Lease term is greater than or equal to 75% of the economic useful life Present value of the lease payments included in the test is greater than or equal to 90% of the fair value of the asset. Guaranteed residual value Unguaranteed residual value GRV UGRV Lessor's implicit rate KNOWN or UNKNOWN by lessee? Residual value type: GRV UGRV Sales revenue or lease revenue to be reported by lessor for Year 1 (in dollars) Capital Lease criteria met for lessee: TRANSFER 75% 90% If no criteria are met, write "NA" If there is no residual value, write "NA" (ignore interest revenue)