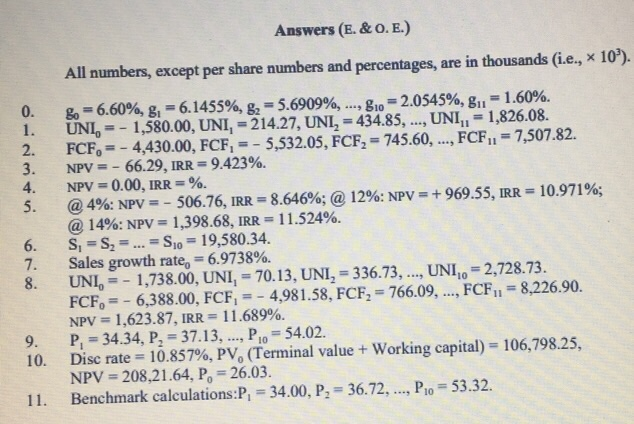

Answered step by step

Verified Expert Solution

Question

1 Approved Answer

very complex problem on Excel. Please show inputs. Ans-included Billingham Bags and Packaging (BBP) makes the best camera bags in the world. It is considering

very complex problem on Excel. Please show inputs. Ans-included

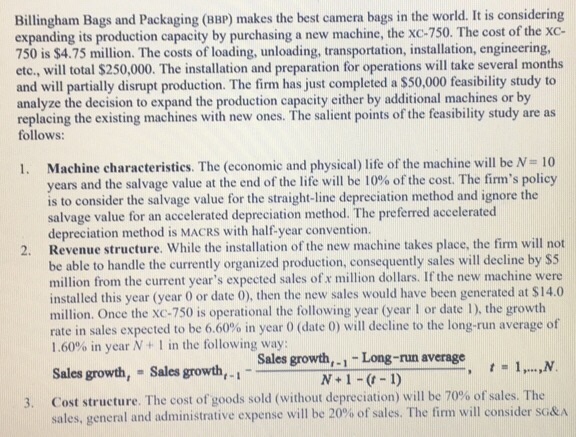

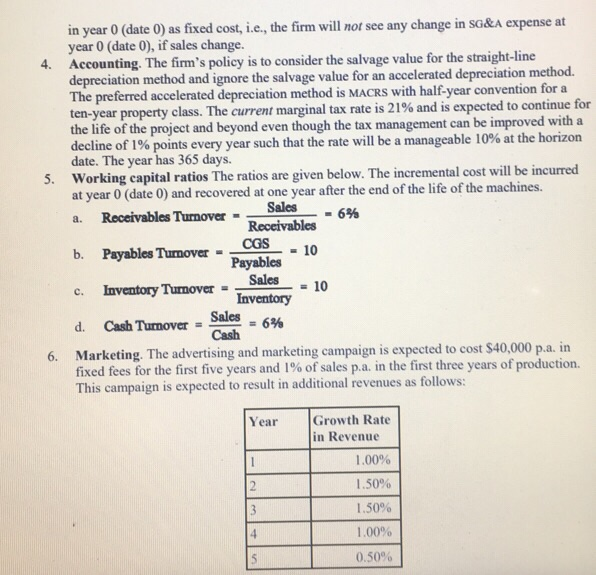

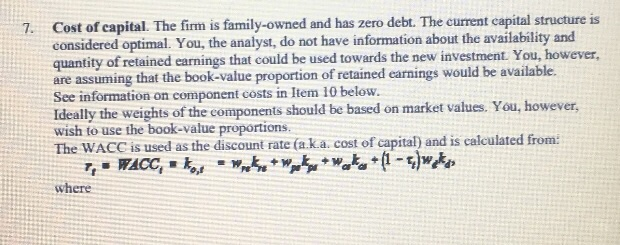

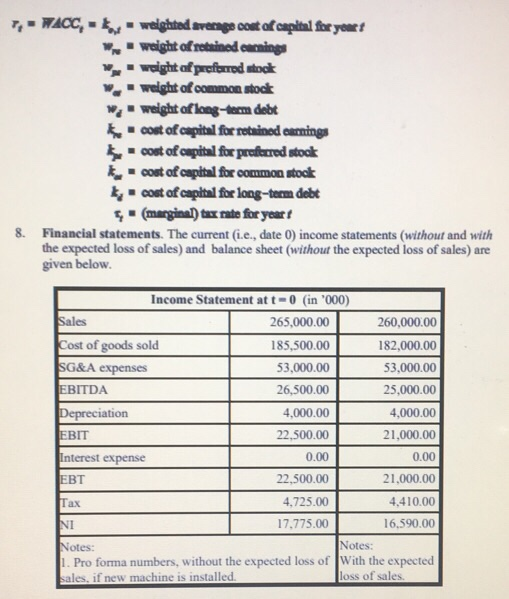

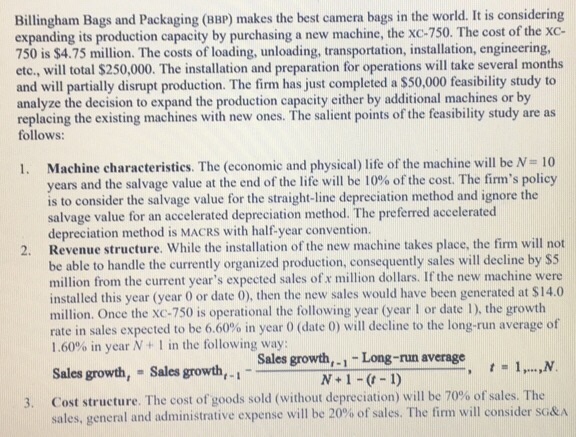

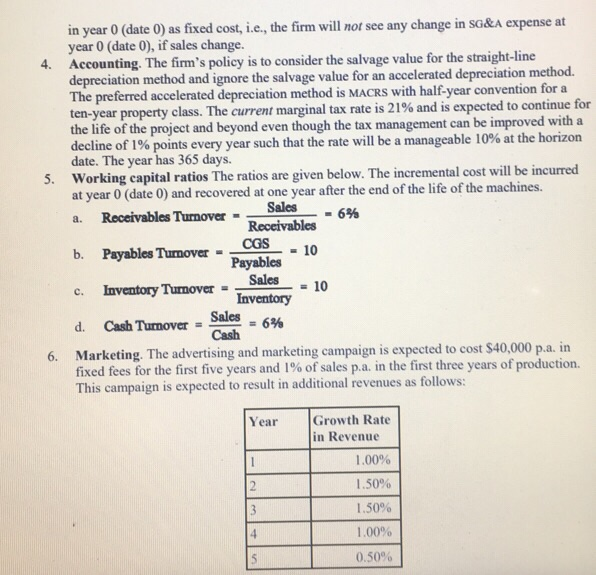

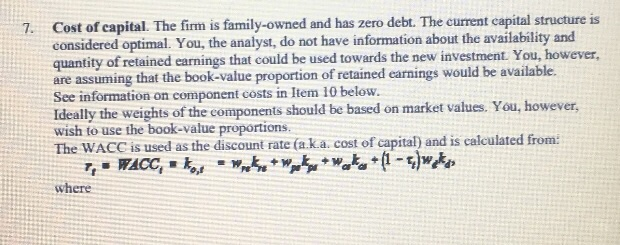

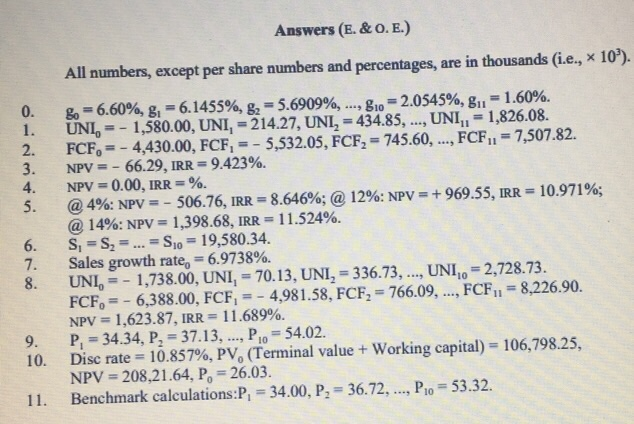

Billingham Bags and Packaging (BBP) makes the best camera bags in the world. It is considering expanding its production capacity by purchasing a new machine, the xc-750. The cost of the xC 750 is $4.75 million. The costs of loading, unloading, transportation, installation, engineering etc., will total $250,000. The installation and preparation for operations will take several months and will partially disrupt production. The firm has just completed a S50,000 feasibility study to analyze the decision to expand the production capacity either by additional machines or by replacing the existing machines with new ones. The salient points of the feasibility study are as follows: 1. Machine characteristics. The (economic and physical) life of the machine will be N 10 years and the salvage value at the end of the life will be 10% of the cost. The firm's policy is to consider the salvage value for the straight-line depreciation method and ignore the salvage value for an accelerated depreciation method. The preferred accelerated depreciation method is MACRS with half-year convention. Revenue structure. While the installation of the new machine takes place, the firm will not be able to handle the currently organized production, consequently sales will decline by SS million from the current year's expected sales of x million dollars. If the new machine were installed this year (year 0 or date 0), then the new sales would have been generated at $14.0 million. Once the XC-750 is operational the following year (year 1 or date 1), the growth rate in sales expected to be 6.60% in year 0 (date 0) will decline to the long-run average of 1.60% in year N +1 in the following way 2. Sales growth, 1 Long-run average t 1...,AN Sales growth, Sales growth,- Cost structure. The cost of goods sold (without depreciation) will be 70% ofsales. The sales, general and administrative expense will be 20% of sales. The firm will consider SG&A 3 in year 0 (date 0) as fixed cost, i.e, the firm will not see any change in so&A expense at year 0 (date 0), if sales change. 4 Accounting. The firm's policy is to consider the salvage value for the straight-line depreciation method and ignore the salvage The preferred accelerated depreciation method is MACRS with half-year convention for a ten-year property the life of the project and beyond even though the tax management can be improved with a decline of 1% points every year such that the rate will be a manageable 10% at the horizon date. The year has 365 days. Working capital ratio at year 0 (date 0) and recovered at one year after the end of the life of the machines. a. Receivables Turnover . -6% value for an accelerated depreciation method. class. The current marginal tax rate is 21% and is expected to continue for 5. s The ratios are given below. The incremental cost will be incurred Sales Receivables CGS10 b. Payables Tumover - Payables Payables 10 e. Inventory TumoSales 10 Inventory d. Cash Turnover= Sales =6% Cash Marketing. The advertising and marketing campaign is expected to cost $40,000 p.a. in fixed fees for the first five years and 1% of sales pa. in the first three years of production This campaign is expected to result in additional revenues as follows: 6. Growth Rate in Revenue Year 1.00% 1.50% 1.50% 1.000% 0.50% Cost of capital. The firm is family-owned and has zero debt. The curent capital structure is considered optimal. You, the analyst, do not have information about the availability and quantity of retained earnings that could be used towards the new investment. You, however, are assuming that See information on component costs in Item 10 below Ideally the weights of the components should be based on market values. You, however, wish to use the book-value proportions The WACC is used as the discount rate (a ka. cost of capital) and is calculated from: 7. the book-value proportion of retained earnings would be available. where wweight of notasined cumings ight of preftrrod stock weight of common stock wweight af long-tem debt t -cost of capital for retained eamings cost of oepital for prafterred stock cost of capital for common stodk cost of capital for long-term deb (marginl tax rate for yeart 8. Financial statements. The current (i.e., date 0) income statements (without and with the expected loss of sales) and balance sheet (without the expected loss of sales) are given below Income Statement at t-0 (in '000) Sales Cost of goods sold SG&A expenses EBITDA 265,000.00 185.500.00 53,000.00 26,500.00 4,000.00 22,500.00 0.00 22.500.00 4.725.00 17.775.00 260,000.00 182,000.00 53,000.00 25,000.00 4,000.00 21,000.00 0.00 21,000.00 4.410.00 16.590.00 ation Interest expense EBT Tax Notes: Notes: . Pro forma numbers, without the expected loss of With the expected ales, if new machine is installed loss of sales Balance Sheet at t 0 (in 000) Assets Liabilities Cash Accounts receivable Inventories Total current assets Fixed assets 39,750.00 Short-term debt 39,750.00Accounts payable 26,500.00 Total current liabilities 106,000.00 Long-term debt 40,000.00 Stockholders' equity 87,450 00 18,550.00 106,000.00 0.00 Preferred stoek 12000:00 Retained carnings 8,000.00 Balance Sheet at t-0 (in 000) Assets Liabilities 20,000.00 40,000.00 146,000.00 Common stock Total SE 146,000.00 Total liabilities and SE Total assets Notes: 1. Pro forma numbers, without the expected loss of sales, if new machine is installed. 2. Short-term debt is carried at 0% interest rate. 3. Preferred stock carries a dividend of 8% pa. The par value of preferred shares is 4. The number of shares outstanding of common stock is 8 million Part 2B. Use the following information for questions 2-1-2-3. 9. Analysis of growth rate. Upon further analysis it is determined that the growth rate in sales is related multiplicatively to the growth rates in population and its tastes (market size), price inflation and effort of marketing campaign (market share) as follows: 1) The remainder is attributed to ine Shae 10. Market-based information. Equity beta 1.375, the market price per share of common stock $5, the market price per share of preferred stock-S125, the risk-free interest rates 4%, the market risk premium-5% and the current yield on bonds ofcom parable companies is 7%. Financing. The firm considers the project (XC-750) to be able to ..stand-alone", i.e., it can issue its own debt or common stock and preferred stock. Thus, the firm has three options to raise $5 million without incurring any transaction cost: (1) Raise $5 million proportionately in common stock and preferred stock, thereby maintaining the all-equity nature of the firm. (2) Raise $5 million in debt, thereby financing the majority, if not all, of the project with debt. The debt schedule will be S5 million at0: $4 million at S3 million at t- 2 $2 million at t 3: S1 million at t- 4; and S0 million at t -5. (3) Raise S5 million through a constant debt of S2 million for the life of the project and common stock of S3 million. This means that the debt will be repaid when the working 11. capital is recaptured Part 2C. Use the following information for questions 3-1-3-2. The firm can borrow short-term funds at the prime rate plus a margin of two percent. The firm can lend short-term funds at the three-month LIBOR. The current prime rate is 3.25% p.a. The current three-month LIBOR is 0.25% pa. 12. 1-1. Incremental eash flows. Calculate the incremental carnings (aka. unlevered net income) from the purchase of the machine 1-2. Free cash flows. Calculate the free cash flow from the purchase of the machine. (Hint: You do not need to be concerned about the continuing value either by a multiple or by the constant growth model until you are asked to value the firm or common stock.) NPV and IRR. Calculate the NPV and IRR, using the free cash flows from Question 2. Wht decision would you make? (Hint: Information on 1-3. 1-4. NPV and IRR with market value at horizon +1 date. Assume that at date N+1, the machine fetches $228.4582 6346 1318 (in '000). Calculate the NPV and IRR, using the remaining free cash flows from Question 2. What decision would you make? (This assumption is good only for this question.) NPV and IRR at different sales growth rate. Assume that the estimates of the growth rate in sales for the current year are 14% 6%, 8%, l0%, 12%, 14%, 16%. Using the same procedure as in Question 3, calculate the NPV and IRR. 1-5. 1-6. Break-even level of constant sales. Assume that sales during the life of the machine will be constant. Calculate the break-even level of sales. Using the same procedure as in Question 3, calculate the NPV and IRR. 1-7. Break-even level of sales growth rate for the current year. Revert to the original assumption that sales depend on a decreasing growth rate. Calculate the break-even level of sales growth rate for the current year (year 0). Using the same procedure as in Question 3, caleulate the NPV and IRR 1-8. Purchase of superior machine. The firm could instead purchase XC-900 which offers greater capacity and superior manufacturing technology. The cost of the machine is S2 million more. The additional installation costs will remain as before. The cost of goods sold is expected to start at the level of the current machine and diminish by 1 percentage point pa to the level of 65%. Additional sales of 1 percentage point p.a. are expected from year 3 through N. Calculate the NPV and IRR. 1-9. Valuation by PE ratio, including cash flow from existing assets. The existing assets of the firm are expected to yield an EBITDA of y million dollars in the current year. After the disruption is over, this EBITDA will grow at the growth rate of sales revenue. The annual depreciation on the existing assets is S4 million. The annual capital expenditure is $4 million. The current PE ratio of 15 is considered a fair reflection of the market as well as industry and will continue for the life of the machine. Use the original project of xc-750. Calculate the (market) price expected at the end of each year during the life of the machine. 1-10. Valuation by DCF method, including free cash flow from existing assets. Use the information given in 9 and the original project of xc-750. Use a multi-stage DCF valuation method. Calculate the price expected at date 0, using the cost of capital for common aquity (i.c, two components of retained carmings and common stock). For year 11 (date 11), let the preferred dividend be S1.157,552 96 ( 000) and let it grow by the long-term growth rate. (Hint. The continuing value (a.k.a, terminal value) will have three components, viz. (a) recapture of the working capital due to the project. (b) the unlevered net income (which will grow at the long-term growth rate) and (c) the net amount of depreciation and capital expenditure. Because the last item will net out to zero, we will be left with only two items. Do not use WACC.) Effect of net working capital policy management of the project. Scrutinize the effect of management of working capital policy, consisting of (a) accounts receivable, (b) accounts payable, (c) inventories and (d) cash, applying the same cost of capital to it, on the price per share for the year. Create scenarios with the accounts receivable from 54% days to 20 and 30; accounts payable from 36% days to 50 and 80; and inventory from 36% days to 15 and 20. (Hin The interest cost of the net working capital of the project is explicitly considered in deriving the EPS from which the (market) price expected at the end of each year during the life of the machine is calculated. The interest cost of the net working capital of the existing sales is not included because one presumes the optimality of the earlier decision! One may become creative and imaginative while creating these scenarios in terms of parametric permutations and combinations.) 1-11. Part 2B Incremental cash flows, free cash flows, cost of capital under all-equity financing scenario, APV and IRR. Calculate the incremental cash flows, free cash flows, appropriate costs of capital using the market information (thereby ignoring the information on cost of capital in Point Then calculate the APV and IRR. What decision would you make? Verify the calculation with the flow-to-equity (FTE) method. 2-1. Incremental cash flows, free cash flows, cost of capital under all-debt financing scenario, APV and IRR. Calculate the incremental cash flows, free cash flows, appropriate costs of capital using the market information (thereby ignoring the information on cost of capital in Point 7) Then calculate the APV and IRR. What decision would you make? Verify the calculation with the flow-to-equity (FTE) method. 2-2. Incremental cash flows, free cash flows, cost of capital under debt and common-stock financing scenario, APV and IRR. Calculate the incremental cash flows, free cash flows, appropriate costs of capital using the market information (thereby ignoring the information on cost of capital in Point 7). Then calculate the APV and IRR. What decision would you make? Verify the calculation with the flow-to-equity (FTE) method. 2-3. Part 2C. Use the following information for questions 3-1-3-2. The firm can borrow short-term funds at the prime rate plus a margin of two percent. The firm can lend short-term funds at the three-month LIBOR. The current prime rate is 3.25% p.a. The current three-month LIBOR is 0.25% pa. 12. Answers (E. & O. E.) All numbers, except per share numbers and percentages, are in thousands (i.e, x 10). 0. g.-6.6096, gi-6.1455%, g.-5.6909%, , gu" 2.0545%, gil 1.60%. 1. UNL) =-1,580.00, UNI-21427, UNI,-434.85, , UNI,-1,826.08. 2. FCFo4,430.00, FCF,-5,532.05, FCF2-745.60,.., FCF1 7,507.82. 3. NPV=-66.29, IRR= 9.423%. 4. NPV 0.00, IRR-90. @ 4%; NPV--506.76, IRR = 8.646%; @ 12%; NPv= + 969.55, RR-IO.971%; @ 1496: NPys 1,398.68, IRRE I 1.524%. 6. Si S2S1o-19,580.3. 7. Sales growth rate,-6.9738%. 8. UNI,1,738.00, UNI, -70.13, UNI, 336.73, ., UNI 2,728.73. FCFo6,388.00, FCF,4,981.58, FCF, NPv # 1.623.87, IRR-: 1 1 .689%. 766.09, ., FCF11 8,226.90. 9. P, 34.34, P 37.13., .., Pio 54.02. 10. Dise rate 10.857%, PVo (Terminal value+ Working capital)-106,798.25, NPV-208,21.64, Po 26.03 Benchmark calculations:P, 11. 34.00, P,-36.72, , Po-53.32. Billingham Bags and Packaging (BBP) makes the best camera bags in the world. It is considering expanding its production capacity by purchasing a new machine, the xc-750. The cost of the xC 750 is $4.75 million. The costs of loading, unloading, transportation, installation, engineering etc., will total $250,000. The installation and preparation for operations will take several months and will partially disrupt production. The firm has just completed a S50,000 feasibility study to analyze the decision to expand the production capacity either by additional machines or by replacing the existing machines with new ones. The salient points of the feasibility study are as follows: 1. Machine characteristics. The (economic and physical) life of the machine will be N 10 years and the salvage value at the end of the life will be 10% of the cost. The firm's policy is to consider the salvage value for the straight-line depreciation method and ignore the salvage value for an accelerated depreciation method. The preferred accelerated depreciation method is MACRS with half-year convention. Revenue structure. While the installation of the new machine takes place, the firm will not be able to handle the currently organized production, consequently sales will decline by SS million from the current year's expected sales of x million dollars. If the new machine were installed this year (year 0 or date 0), then the new sales would have been generated at $14.0 million. Once the XC-750 is operational the following year (year 1 or date 1), the growth rate in sales expected to be 6.60% in year 0 (date 0) will decline to the long-run average of 1.60% in year N +1 in the following way 2. Sales growth, 1 Long-run average t 1...,AN Sales growth, Sales growth,- Cost structure. The cost of goods sold (without depreciation) will be 70% ofsales. The sales, general and administrative expense will be 20% of sales. The firm will consider SG&A 3 in year 0 (date 0) as fixed cost, i.e, the firm will not see any change in so&A expense at year 0 (date 0), if sales change. 4 Accounting. The firm's policy is to consider the salvage value for the straight-line depreciation method and ignore the salvage The preferred accelerated depreciation method is MACRS with half-year convention for a ten-year property the life of the project and beyond even though the tax management can be improved with a decline of 1% points every year such that the rate will be a manageable 10% at the horizon date. The year has 365 days. Working capital ratio at year 0 (date 0) and recovered at one year after the end of the life of the machines. a. Receivables Turnover . -6% value for an accelerated depreciation method. class. The current marginal tax rate is 21% and is expected to continue for 5. s The ratios are given below. The incremental cost will be incurred Sales Receivables CGS10 b. Payables Tumover - Payables Payables 10 e. Inventory TumoSales 10 Inventory d. Cash Turnover= Sales =6% Cash Marketing. The advertising and marketing campaign is expected to cost $40,000 p.a. in fixed fees for the first five years and 1% of sales pa. in the first three years of production This campaign is expected to result in additional revenues as follows: 6. Growth Rate in Revenue Year 1.00% 1.50% 1.50% 1.000% 0.50% Cost of capital. The firm is family-owned and has zero debt. The curent capital structure is considered optimal. You, the analyst, do not have information about the availability and quantity of retained earnings that could be used towards the new investment. You, however, are assuming that See information on component costs in Item 10 below Ideally the weights of the components should be based on market values. You, however, wish to use the book-value proportions The WACC is used as the discount rate (a ka. cost of capital) and is calculated from: 7. the book-value proportion of retained earnings would be available. where wweight of notasined cumings ight of preftrrod stock weight of common stock wweight af long-tem debt t -cost of capital for retained eamings cost of oepital for prafterred stock cost of capital for common stodk cost of capital for long-term deb (marginl tax rate for yeart 8. Financial statements. The current (i.e., date 0) income statements (without and with the expected loss of sales) and balance sheet (without the expected loss of sales) are given below Income Statement at t-0 (in '000) Sales Cost of goods sold SG&A expenses EBITDA 265,000.00 185.500.00 53,000.00 26,500.00 4,000.00 22,500.00 0.00 22.500.00 4.725.00 17.775.00 260,000.00 182,000.00 53,000.00 25,000.00 4,000.00 21,000.00 0.00 21,000.00 4.410.00 16.590.00 ation Interest expense EBT Tax Notes: Notes: . Pro forma numbers, without the expected loss of With the expected ales, if new machine is installed loss of sales Balance Sheet at t 0 (in 000) Assets Liabilities Cash Accounts receivable Inventories Total current assets Fixed assets 39,750.00 Short-term debt 39,750.00Accounts payable 26,500.00 Total current liabilities 106,000.00 Long-term debt 40,000.00 Stockholders' equity 87,450 00 18,550.00 106,000.00 0.00 Preferred stoek 12000:00 Retained carnings 8,000.00 Balance Sheet at t-0 (in 000) Assets Liabilities 20,000.00 40,000.00 146,000.00 Common stock Total SE 146,000.00 Total liabilities and SE Total assets Notes: 1. Pro forma numbers, without the expected loss of sales, if new machine is installed. 2. Short-term debt is carried at 0% interest rate. 3. Preferred stock carries a dividend of 8% pa. The par value of preferred shares is 4. The number of shares outstanding of common stock is 8 million Part 2B. Use the following information for questions 2-1-2-3. 9. Analysis of growth rate. Upon further analysis it is determined that the growth rate in sales is related multiplicatively to the growth rates in population and its tastes (market size), price inflation and effort of marketing campaign (market share) as follows: 1) The remainder is attributed to ine Shae 10. Market-based information. Equity beta 1.375, the market price per share of common stock $5, the market price per share of preferred stock-S125, the risk-free interest rates 4%, the market risk premium-5% and the current yield on bonds ofcom parable companies is 7%. Financing. The firm considers the project (XC-750) to be able to ..stand-alone", i.e., it can issue its own debt or common stock and preferred stock. Thus, the firm has three options to raise $5 million without incurring any transaction cost: (1) Raise $5 million proportionately in common stock and preferred stock, thereby maintaining the all-equity nature of the firm. (2) Raise $5 million in debt, thereby financing the majority, if not all, of the project with debt. The debt schedule will be S5 million at0: $4 million at S3 million at t- 2 $2 million at t 3: S1 million at t- 4; and S0 million at t -5. (3) Raise S5 million through a constant debt of S2 million for the life of the project and common stock of S3 million. This means that the debt will be repaid when the working 11. capital is recaptured Part 2C. Use the following information for questions 3-1-3-2. The firm can borrow short-term funds at the prime rate plus a margin of two percent. The firm can lend short-term funds at the three-month LIBOR. The current prime rate is 3.25% p.a. The current three-month LIBOR is 0.25% pa. 12. 1-1. Incremental eash flows. Calculate the incremental carnings (aka. unlevered net income) from the purchase of the machine 1-2. Free cash flows. Calculate the free cash flow from the purchase of the machine. (Hint: You do not need to be concerned about the continuing value either by a multiple or by the constant growth model until you are asked to value the firm or common stock.) NPV and IRR. Calculate the NPV and IRR, using the free cash flows from Question 2. Wht decision would you make? (Hint: Information on 1-3. 1-4. NPV and IRR with market value at horizon +1 date. Assume that at date N+1, the machine fetches $228.4582 6346 1318 (in '000). Calculate the NPV and IRR, using the remaining free cash flows from Question 2. What decision would you make? (This assumption is good only for this question.) NPV and IRR at different sales growth rate. Assume that the estimates of the growth rate in sales for the current year are 14% 6%, 8%, l0%, 12%, 14%, 16%. Using the same procedure as in Question 3, calculate the NPV and IRR. 1-5. 1-6. Break-even level of constant sales. Assume that sales during the life of the machine will be constant. Calculate the break-even level of sales. Using the same procedure as in Question 3, calculate the NPV and IRR. 1-7. Break-even level of sales growth rate for the current year. Revert to the original assumption that sales depend on a decreasing growth rate. Calculate the break-even level of sales growth rate for the current year (year 0). Using the same procedure as in Question 3, caleulate the NPV and IRR 1-8. Purchase of superior machine. The firm could instead purchase XC-900 which offers greater capacity and superior manufacturing technology. The cost of the machine is S2 million more. The additional installation costs will remain as before. The cost of goods sold is expected to start at the level of the current machine and diminish by 1 percentage point pa to the level of 65%. Additional sales of 1 percentage point p.a. are expected from year 3 through N. Calculate the NPV and IRR. 1-9. Valuation by PE ratio, including cash flow from existing assets. The existing assets of the firm are expected to yield an EBITDA of y million dollars in the current year. After the disruption is over, this EBITDA will grow at the growth rate of sales revenue. The annual depreciation on the existing assets is S4 million. The annual capital expenditure is $4 million. The current PE ratio of 15 is considered a fair reflection of the market as well as industry and will continue for the life of the machine. Use the original project of xc-750. Calculate the (market) price expected at the end of each year during the life of the machine. 1-10. Valuation by DCF method, including free cash flow from existing assets. Use the information given in 9 and the original project of xc-750. Use a multi-stage DCF valuation method. Calculate the price expected at date 0, using the cost of capital for common aquity (i.c, two components of retained carmings and common stock). For year 11 (date 11), let the preferred dividend be S1.157,552 96 ( 000) and let it grow by the long-term growth rate. (Hint. The continuing value (a.k.a, terminal value) will have three components, viz. (a) recapture of the working capital due to the project. (b) the unlevered net income (which will grow at the long-term growth rate) and (c) the net amount of depreciation and capital expenditure. Because the last item will net out to zero, we will be left with only two items. Do not use WACC.) Effect of net working capital policy management of the project. Scrutinize the effect of management of working capital policy, consisting of (a) accounts receivable, (b) accounts payable, (c) inventories and (d) cash, applying the same cost of capital to it, on the price per share for the year. Create scenarios with the accounts receivable from 54% days to 20 and 30; accounts payable from 36% days to 50 and 80; and inventory from 36% days to 15 and 20. (Hin The interest cost of the net working capital of the project is explicitly considered in deriving the EPS from which the (market) price expected at the end of each year during the life of the machine is calculated. The interest cost of the net working capital of the existing sales is not included because one presumes the optimality of the earlier decision! One may become creative and imaginative while creating these scenarios in terms of parametric permutations and combinations.) 1-11. Part 2B Incremental cash flows, free cash flows, cost of capital under all-equity financing scenario, APV and IRR. Calculate the incremental cash flows, free cash flows, appropriate costs of capital using the market information (thereby ignoring the information on cost of capital in Point Then calculate the APV and IRR. What decision would you make? Verify the calculation with the flow-to-equity (FTE) method. 2-1. Incremental cash flows, free cash flows, cost of capital under all-debt financing scenario, APV and IRR. Calculate the incremental cash flows, free cash flows, appropriate costs of capital using the market information (thereby ignoring the information on cost of capital in Point 7) Then calculate the APV and IRR. What decision would you make? Verify the calculation with the flow-to-equity (FTE) method. 2-2. Incremental cash flows, free cash flows, cost of capital under debt and common-stock financing scenario, APV and IRR. Calculate the incremental cash flows, free cash flows, appropriate costs of capital using the market information (thereby ignoring the information on cost of capital in Point 7). Then calculate the APV and IRR. What decision would you make? Verify the calculation with the flow-to-equity (FTE) method. 2-3. Part 2C. Use the following information for questions 3-1-3-2. The firm can borrow short-term funds at the prime rate plus a margin of two percent. The firm can lend short-term funds at the three-month LIBOR. The current prime rate is 3.25% p.a. The current three-month LIBOR is 0.25% pa. 12. Answers (E. & O. E.) All numbers, except per share numbers and percentages, are in thousands (i.e, x 10). 0. g.-6.6096, gi-6.1455%, g.-5.6909%, , gu" 2.0545%, gil 1.60%. 1. UNL) =-1,580.00, UNI-21427, UNI,-434.85, , UNI,-1,826.08. 2. FCFo4,430.00, FCF,-5,532.05, FCF2-745.60,.., FCF1 7,507.82. 3. NPV=-66.29, IRR= 9.423%. 4. NPV 0.00, IRR-90. @ 4%; NPV--506.76, IRR = 8.646%; @ 12%; NPv= + 969.55, RR-IO.971%; @ 1496: NPys 1,398.68, IRRE I 1.524%. 6. Si S2S1o-19,580.3. 7. Sales growth rate,-6.9738%. 8. UNI,1,738.00, UNI, -70.13, UNI, 336.73, ., UNI 2,728.73. FCFo6,388.00, FCF,4,981.58, FCF, NPv # 1.623.87, IRR-: 1 1 .689%. 766.09, ., FCF11 8,226.90. 9. P, 34.34, P 37.13., .., Pio 54.02. 10. Dise rate 10.857%, PVo (Terminal value+ Working capital)-106,798.25, NPV-208,21.64, Po 26.03 Benchmark calculations:P, 11. 34.00, P,-36.72, , Po-53.32

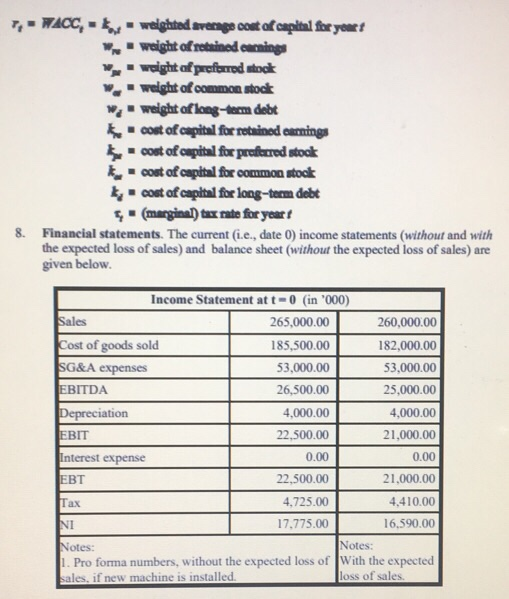

Step by Step Solution

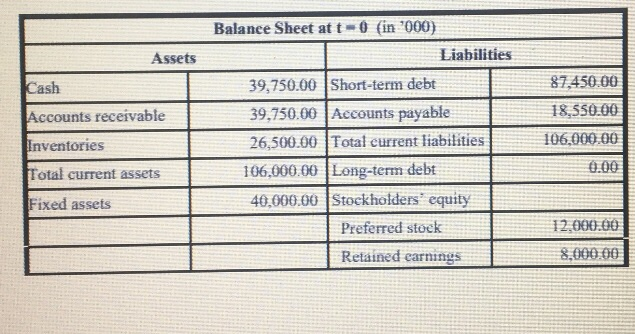

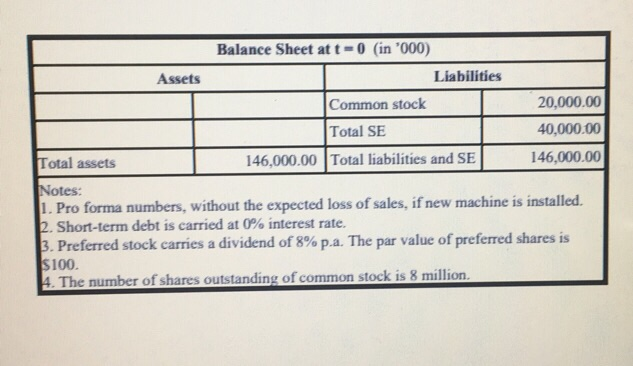

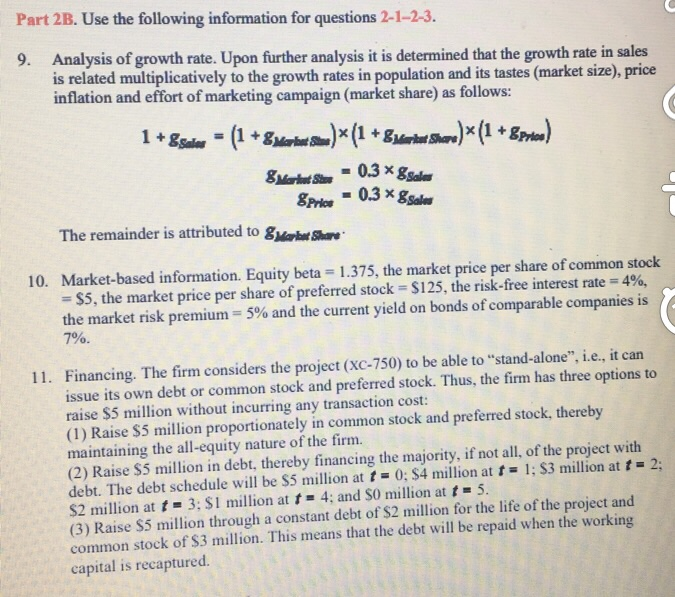

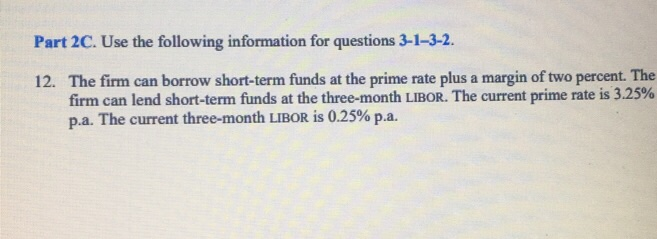

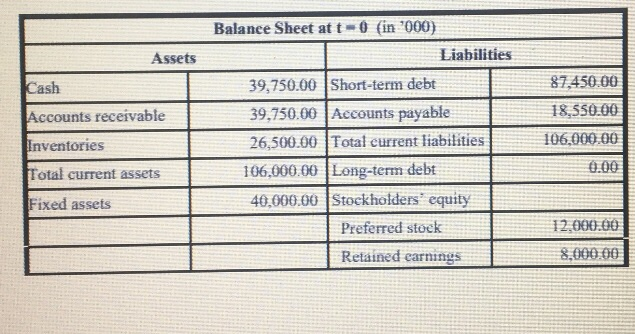

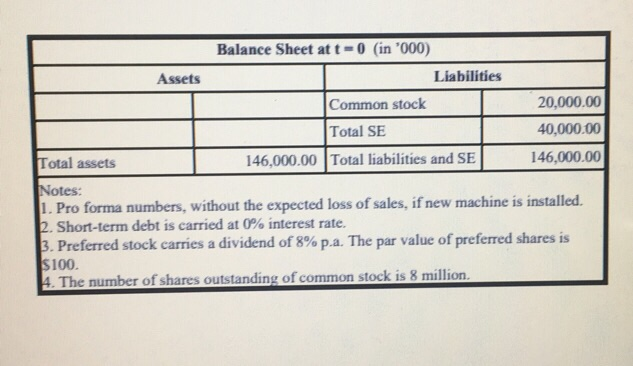

There are 3 Steps involved in it

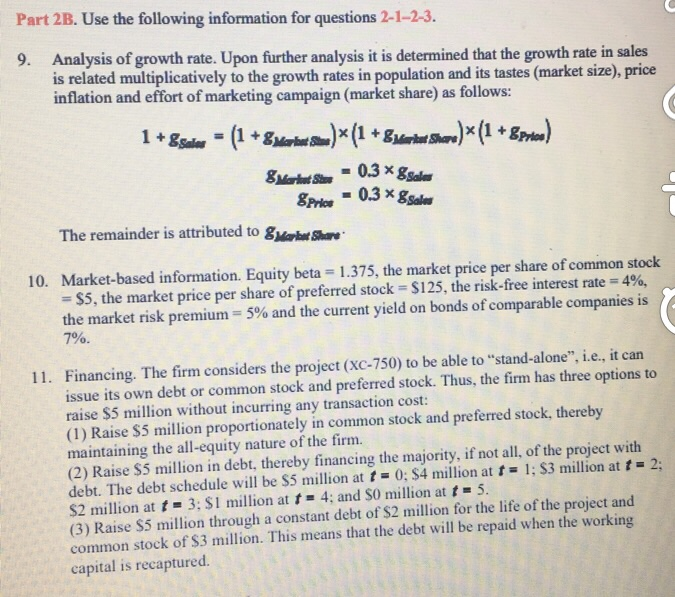

Step: 1

Get Instant Access to Expert-Tailored Solutions

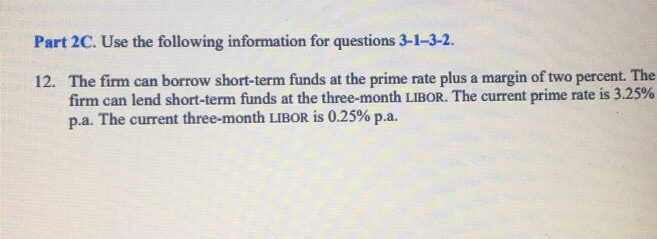

See step-by-step solutions with expert insights and AI powered tools for academic success

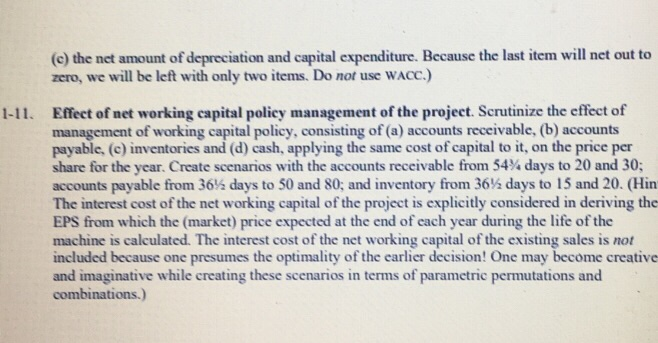

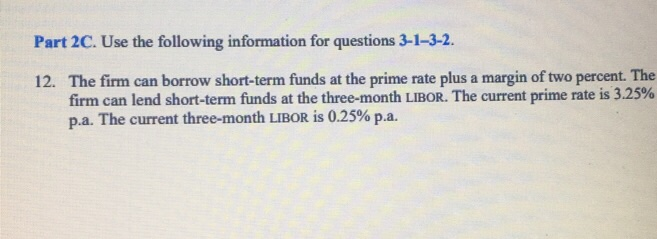

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started