Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Python Program 1. Calculating Taxes (10 points): In this problem, we will accept the taxable income from the user (who files single) and determine his/her

Python Program

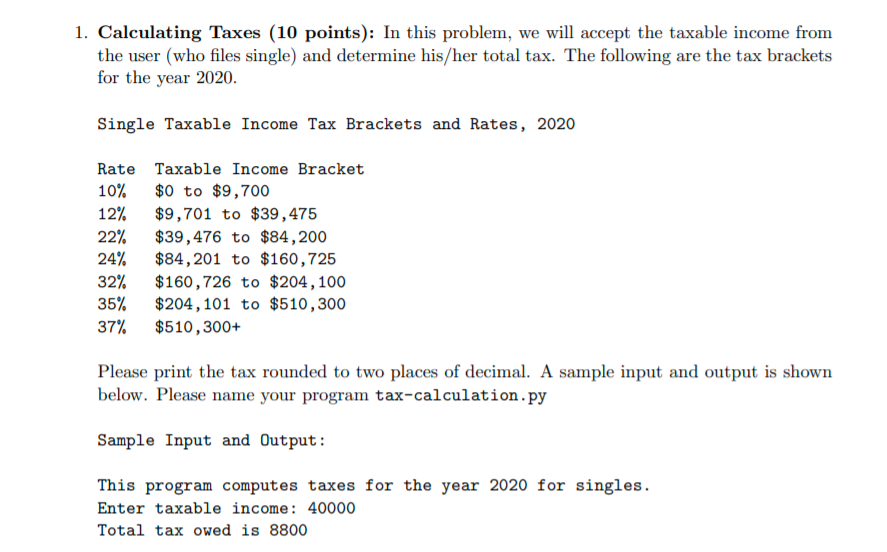

1. Calculating Taxes (10 points): In this problem, we will accept the taxable income from the user (who files single) and determine his/her total tax. The following are the tax brackets for the year 2020. Single Taxable Income Tax Brackets and Rates, 2020 Rate Taxable Income Bracket 10% $0 to $9,700 12% $9,701 to $39,475 22% $39,476 to $84,200 24% $84,201 to $160,725 32% $160,726 to $204,100 35% $204,101 to $510,300 37% $510,300+ Please print the tax rounded to two places of decimal. A sample input and output is shown below. Please name your program tax-calculation.py Sample Input and Output: This program computes taxes for the year 2020 for singles. Enter taxable income: 40000 Total tax owed is 8800

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started