Answered step by step

Verified Expert Solution

Question

1 Approved Answer

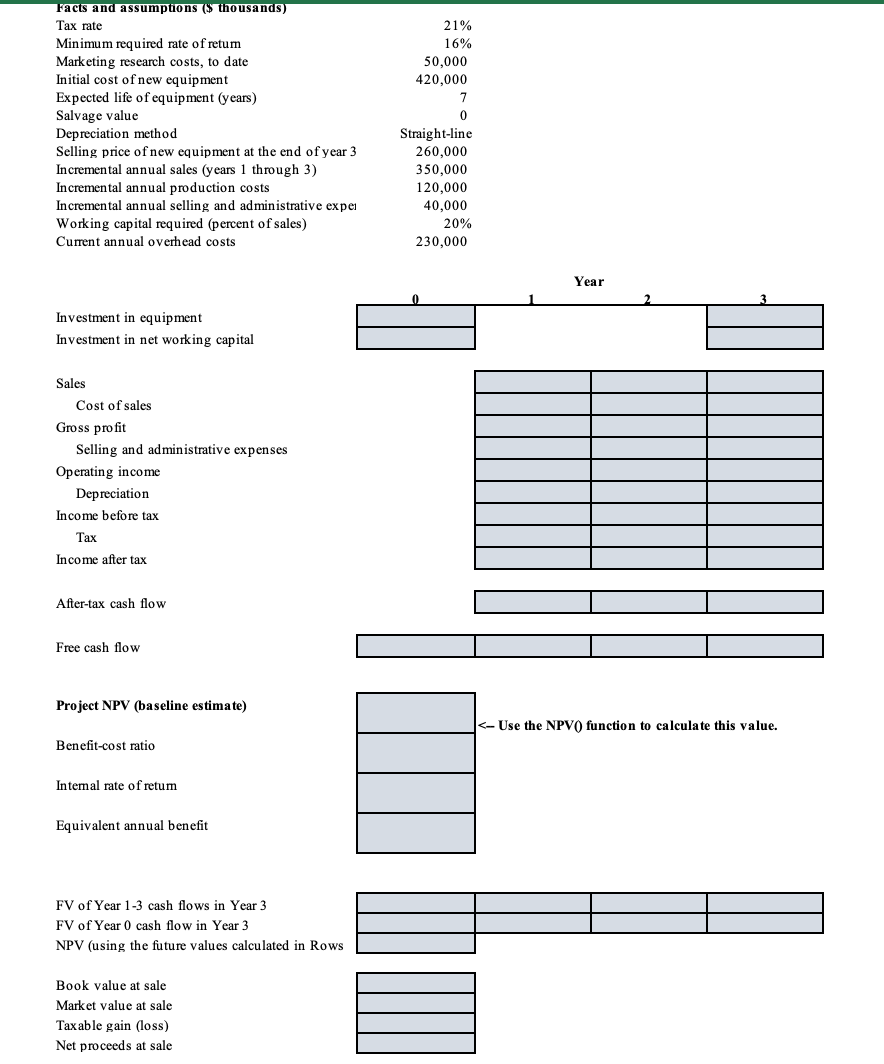

Q 1 a . Waldo Entertainment Products, Inc. is negotiating with Disney for the rights to manufacture and sell superhero - themed toys for a

Qa Waldo Entertainment Products, Inc. is negotiating with Disney for the rights to manufacture and sell superherothemed toys for a threeyear period. At the end of year Waldo plans to liquidate the assets from the project. In addition to the facts and assumptions below, assume that working capital must be invested immediately in year and will be fully recovered at the end of year and that no incremental overhead expense will be incurred from the project. Note that the difference between the selling price of the equipment at the end of year and the equipment's book value at the time of the sale is a taxable gain. Identify the relevant cash flows, then calculate figures of merit listed below.

Facts and assumptions $ thousands

Sales

Cost of sales

Gross profit

Selling and administrative expenses

Operating income

Depreciation

Income before tax

Tax

Income after tax

Aftertax cash flow

Free cash flow

Project NPV baseline estimate

Use the NPV function to calculate this value.

Benefitcost ratio

Internal rate of retum

Equivalent annual benefit

FV of Year cash flows in Year

FV of Year cash flow in Year

NPV using the future values calculated in Rows

Book value at sale

Market value at sale

Taxable gain loss

Net proceeds at sale

For the link to the excel file comment and I will send it over

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started