Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Q 2 ) Use the information in part B of the table to fill lines 3 to 5 . Here, capital replacement should be adjusted

Q Use the information in part B of the table to fill lines to Here, capital replacement should be

adjusted for inflation.

Q Use the information in part of the table to fill lines to of column Then, complete the rest of

the column, keeping in mind that operating receipts and expenses need to be adjusted for inflation, but

depreciations do not.

Q Complete lines and Remember that taxable income does not include capital purchases, sales,

or replacements.

Q Calculate the net cash flow and the discounted net cash flow line

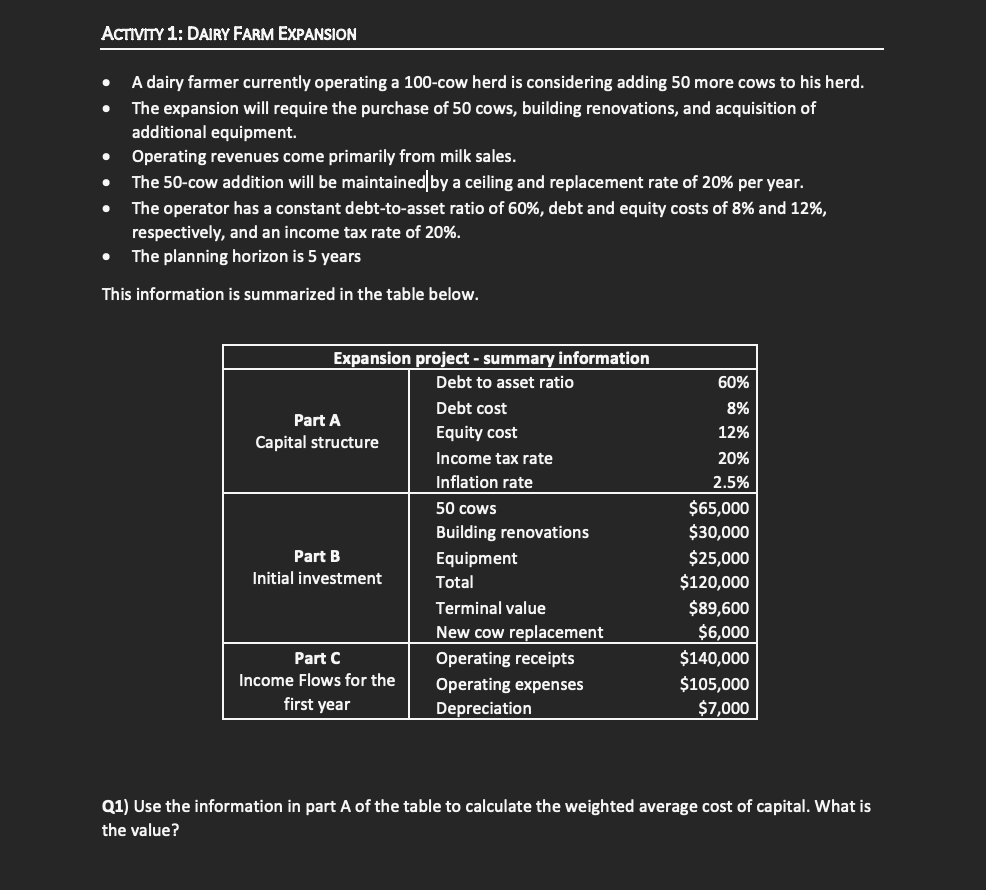

Q What is the NPV of the expansion project?ACTIVITY : DAIRY FARM EXPANSION

A dairy farmer currently operating a cow herd is considering adding more cows to his herd.

The expansion will require the purchase of cows, building renovations, and acquisition of additional equipment.

Operating revenues come primarily from milk sales.

The cow addition will be maintainedby a ceiling and replacement rate of per year.

The operator has a constant debttoasset ratio of debt and equity costs of and respectively, and an income tax rate of

The planning horizon is years

This information is summarized in the table below..

Operating revenues come primarily from milk sales. respectively, and an income tax rate of

The planning horizon is years

This information is summarized in the table below.

Q Use the information in part A of the table to calculate the weighted average cost of capital. What isthe value?

debt to asset ratio debt cost equity cost income tax rate inflation rate cows $ building renovations equipment total$ terminal value new cow replacement operating receipts operating expenses depreciation

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started