Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Q 23 Real and Brigitte are retired and looking for ways to save on income tax. Given the difference in their respective incomes, their financial

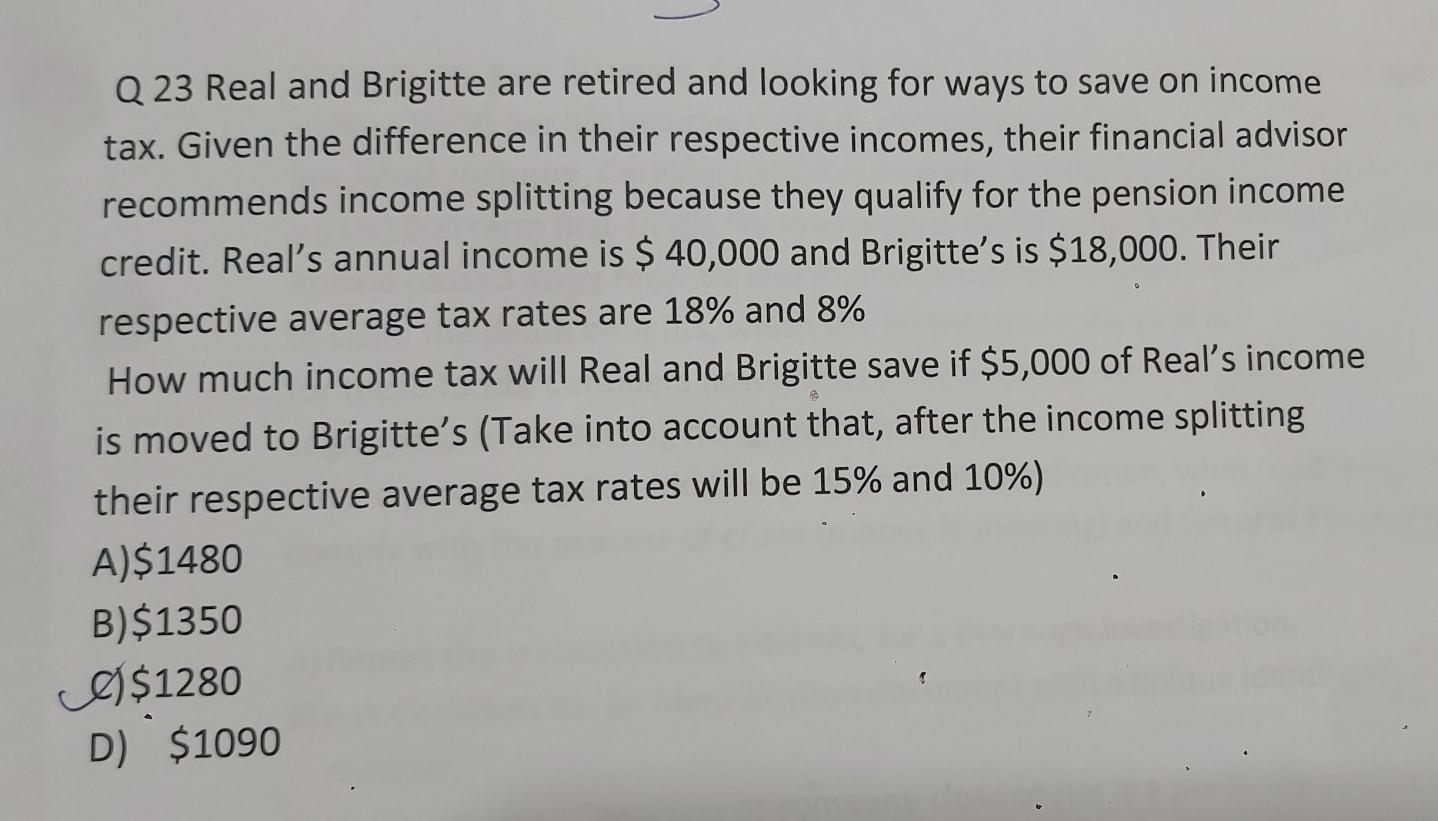

Q 23 Real and Brigitte are retired and looking for ways to save on income tax. Given the difference in their respective incomes, their financial advisor recommends income splitting because they qualify for the pension income credit. Real's annual income is $ 40,000 and Brigitte's is $18,000. Their respective average tax rates are 18% and 8% How much income tax will Real and Brigitte save if $5,000 of Real's income is moved to Brigitte's (Take into account that, after the income splitting their respective average tax rates will be 15% and 10%) A)$1480 B)$1350 0 $1280 D) $1090

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started