q 3 and 4

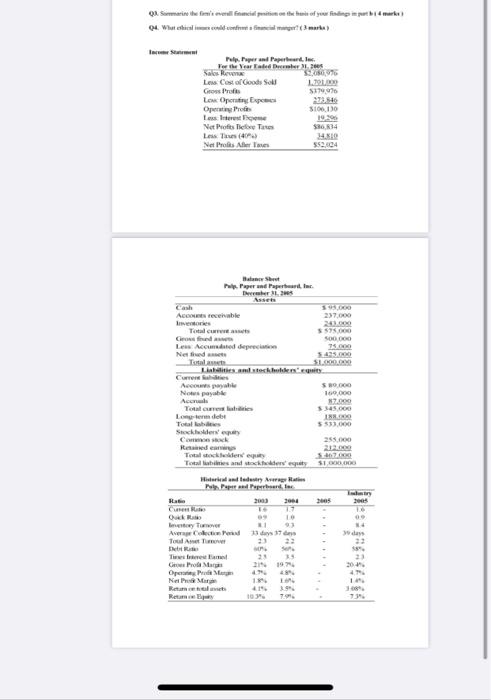

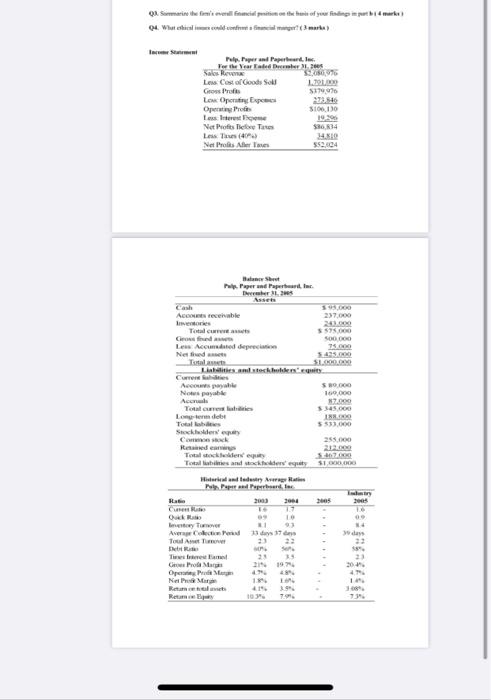

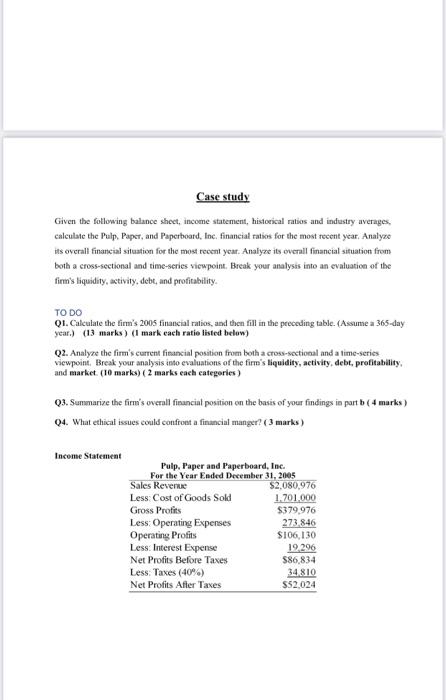

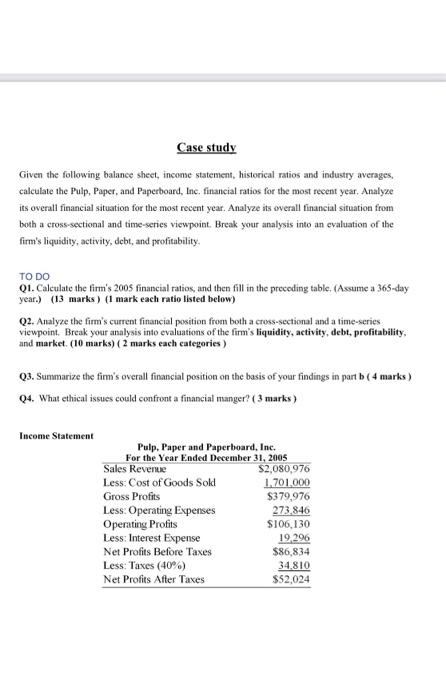

Q3. Summarize the firms overall financial position on the basis of your findings in part b ( 4 marks )

Q4. What ethical issues could confront a financial manger? ( 3 marks )

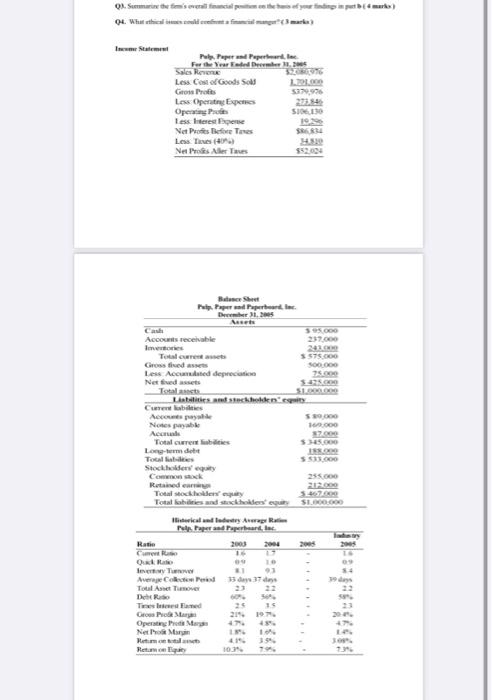

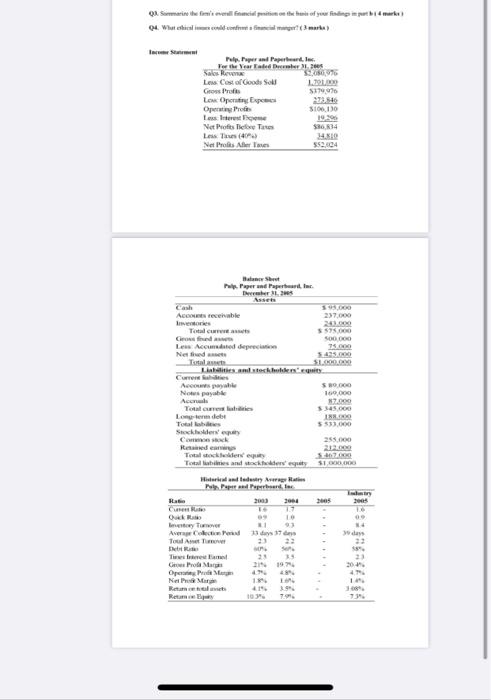

Sumarine the final cilities of your listing is part mark The Varade003 Sales Reven Le Cost of Goods Sol 1.791 Gross Proto 517907 Low Opority Expo Opera Pro SI 130 Les interest Net Profts Tee Tees $36.14 Los Tus (4 14.30 Net Prolis Alberto 552.004 that Shout Paper und Paperbalar There is Asset A recebe 27.000 200 Total Crossfired 500.000 Lew Accudited depreciation 75.000 5.435.000 Cateches SL.000.000 Accounts payable SR9.000 19.00 Nos payable 72.000 $345.000 Londolt 5*33.00 Stocker Cock Red 22.000 Total and Total liabilities and teckere equity 31,00.000 Wedstry Art yam 303 304 O ty 1 Avere Com 37m Tool Twees met 23 N19 Operatiu Mare Nela M Reum 41 23 23 Case study Given the following balance sheet, income statement, historical ratios and industry averages calculate the Pulp, Paper, and Paperboard, Inc, financial ratios for the most recent year. Analyze its overall financial situation for the most recent year. Analyze its overall financial situation from both a cross-sectional and time-series viewpoint, Break your analyses into an evaluation of the finn's liquidity, activity, debe, and profitability TO DO Q1. Calculate the firm's 2005 financial ratios, and then fill in the preceding table. (Assume a 365-day year.) (13 marks) (1 mark each ratie listed below) Q2. Analyze the firm's current financial position from both a cross-sectional and a time-series viewpoint. Break your analysis into evaluations of the firm's liquidity, activity, debt profitability, and market (10 marks) (2 marks each categories ) Q3. Summarize the firm's overall financial position on the basis of your findings in part b(4 marks) Q4. What ethical issues could confront a financial manger? (3 marks) Income Statement Pulp. Paper and Paperboard, Inc. For the Year Ended December 31, 2005 Sales Revenue $2,080,976 Less Cost of Goods Sold 1.700.000 Gross Profits $379.976 Less: Operating Expenses 273,846 Operating Profits SI06, 130 Less: Interest Expense 19.296 Net Profits Before Taxes 586,834 Less Taxes (40%) 34.810 Net Profits After Taxes $52.024 Case study Given the following balance sheet, income statement, historical ratios and industry averages, calculate the Pulp, Paper, and Paperboard, Inc. financial ratios for the most recent year, Analyze its overall financial situation for the most recent year. Analyze its overall financial situation from both a cross-sectional and time-series viewpoint. Break your analysis into an evaluation of the firm's liquidity, activity, debt, and profitability TO DO Q1. Calculate the firm's 2005 financial ratios, and then fill in the preceding table. (Assume a 365-day year.) (13 marks) (1 mark each ratio listed below) Q2. Analyze the firm's current financial position from both a cross-sectional and a time-series viewpoint. Break your analysis into evaluations of the firm's liquidity, activity, debt, profitability, and market. (10 marks) (2 marks each categories) Q3. Summarize the firm's overall financial position on the basis of your findings in part b ( 4 marks) 04. What ethical issues could confront a financial manger? ( 3 marks) Income Statement Pulp. Paper and Paperboard, Inc. For the Year Ended December 31, 2005 Sales Revenue $2,080,976 Less: Cost of Goods Sold 1.701.000 Gross Profits $379,976 Less: Operating Expenses 273,846 Operating Profits S106,130 Less: Interest Expense 19.296 Net Profits Before Taxes $86,834 Less: Taxes (40%) 34.810 Net Profits After Taxes $52,024 Q. She is Pey, Pepe Perde For the Year Teder 18.30 Sales Reven Less CostGoods Sold Gros Prots SI Less Open Experts Opening S06.130 less treene Net Pris Before Teres SRL Less Themes (0 Net Pro Aer Tu $5200 Padahale December 2005 Asset Cash Accomeceivable Totale 575.000 Grossfired as 500.000 Les Accm depreciatia 275.00 Neted assets SCO Listesch Curabilities Accouple Notes able Accra 5200 Total kbities 15. Long-term diete Total de 5533.000 Stockholders Cowok 255.000 Retained 212.000 Total stockholders Total abilities and stockholdes S1.000.000 fikcal und ladesty Awarm Pepaper and Papereant, lac. Ratin 2003 2004 2005 OR IT Averno37 19 Toul Art Temover Debido Times and Groetara 19 Open Marie Netto Marin Reme 10 Sumarine the final cilities of your listing is part mark The Varade003 Sales Reven Le Cost of Goods Sol 1.791 Gross Proto 517907 Low Opority Expo Opera Pro SI 130 Les interest Net Profts Tee Tees $36.14 Los Tus (4 14.30 Net Prolis Alberto 552.004 that Shout Paper und Paperbalar There is Asset A recebe 27.000 200 Total Crossfired 500.000 Lew Accudited depreciation 75.000 5.435.000 Cateches SL.000.000 Accounts payable SR9.000 19.00 Nos payable 72.000 $345.000 Londolt 5*33.00 Stocker Cock Red 22.000 Total and Total liabilities and teckere equity 31,00.000 Wedstry Art yam 303 304 O ty 1 Avere Com 37m Tool Twees met 23 N19 Operatiu Mare Nela M Reum 41 23 23 Case study Given the following balance sheet, income statement, historical ratios and industry averages calculate the Pulp, Paper, and Paperboard, Inc, financial ratios for the most recent year. Analyze its overall financial situation for the most recent year. Analyze its overall financial situation from both a cross-sectional and time-series viewpoint, Break your analyses into an evaluation of the finn's liquidity, activity, debe, and profitability TO DO Q1. Calculate the firm's 2005 financial ratios, and then fill in the preceding table. (Assume a 365-day year.) (13 marks) (1 mark each ratie listed below) Q2. Analyze the firm's current financial position from both a cross-sectional and a time-series viewpoint. Break your analysis into evaluations of the firm's liquidity, activity, debt profitability, and market (10 marks) (2 marks each categories ) Q3. Summarize the firm's overall financial position on the basis of your findings in part b(4 marks) Q4. What ethical issues could confront a financial manger? (3 marks) Income Statement Pulp. Paper and Paperboard, Inc. For the Year Ended December 31, 2005 Sales Revenue $2,080,976 Less Cost of Goods Sold 1.700.000 Gross Profits $379.976 Less: Operating Expenses 273,846 Operating Profits SI06, 130 Less: Interest Expense 19.296 Net Profits Before Taxes 586,834 Less Taxes (40%) 34.810 Net Profits After Taxes $52.024 Case study Given the following balance sheet, income statement, historical ratios and industry averages, calculate the Pulp, Paper, and Paperboard, Inc. financial ratios for the most recent year, Analyze its overall financial situation for the most recent year. Analyze its overall financial situation from both a cross-sectional and time-series viewpoint. Break your analysis into an evaluation of the firm's liquidity, activity, debt, and profitability TO DO Q1. Calculate the firm's 2005 financial ratios, and then fill in the preceding table. (Assume a 365-day year.) (13 marks) (1 mark each ratio listed below) Q2. Analyze the firm's current financial position from both a cross-sectional and a time-series viewpoint. Break your analysis into evaluations of the firm's liquidity, activity, debt, profitability, and market. (10 marks) (2 marks each categories) Q3. Summarize the firm's overall financial position on the basis of your findings in part b ( 4 marks) 04. What ethical issues could confront a financial manger? ( 3 marks) Income Statement Pulp. Paper and Paperboard, Inc. For the Year Ended December 31, 2005 Sales Revenue $2,080,976 Less: Cost of Goods Sold 1.701.000 Gross Profits $379,976 Less: Operating Expenses 273,846 Operating Profits S106,130 Less: Interest Expense 19.296 Net Profits Before Taxes $86,834 Less: Taxes (40%) 34.810 Net Profits After Taxes $52,024 Q. She is Pey, Pepe Perde For the Year Teder 18.30 Sales Reven Less CostGoods Sold Gros Prots SI Less Open Experts Opening S06.130 less treene Net Pris Before Teres SRL Less Themes (0 Net Pro Aer Tu $5200 Padahale December 2005 Asset Cash Accomeceivable Totale 575.000 Grossfired as 500.000 Les Accm depreciatia 275.00 Neted assets SCO Listesch Curabilities Accouple Notes able Accra 5200 Total kbities 15. Long-term diete Total de 5533.000 Stockholders Cowok 255.000 Retained 212.000 Total stockholders Total abilities and stockholdes S1.000.000 fikcal und ladesty Awarm Pepaper and Papereant, lac. Ratin 2003 2004 2005 OR IT Averno37 19 Toul Art Temover Debido Times and Groetara 19 Open Marie Netto Marin Reme 10