Answered step by step

Verified Expert Solution

Question

1 Approved Answer

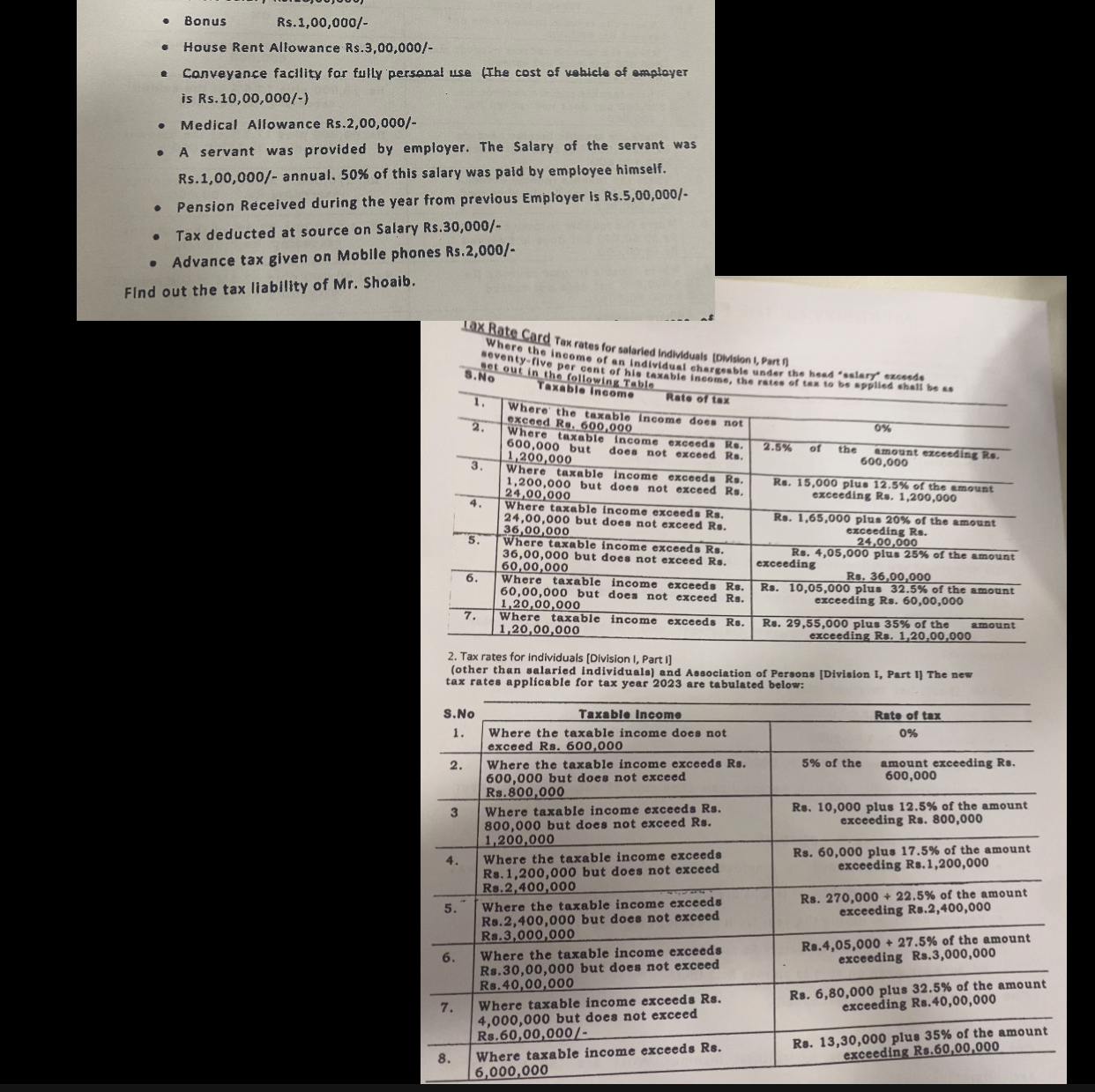

Q 5 ) Mr . Shoaib has received salary as under: Basic Salary Rs . 1 8 , 0 0 , 0 0 0 ?

Q Mr Shoaib has received salary as under:

Basic Salary Rs

Bonus Rs

House Rent Allowance Rs

Conveyance facility for fully personal use the cost of vebicle of employer is Rs

Medical Allowance Rs

A servant was provided by employer. The Salary of the servant was Rsannual. of this salary was paid by employee himself.

Pension Received during the year from previous Employer is Rs

Tax deducted at source on Salary Rs

Advance tax given on Mobile phones Rs

Find out the tax liability of Mr Shoaib.

Bonus Rs

House Rent Allowance Rs

Conveyance facility for fully personal use The cost of vebicle of employer is Rs

Medical Allowance Rs

A servant was provided by employer. The Salary of the servant was Rsannual. of this salary was paid by employee himself.

Pension Received during the year from previous Employer is Rs

Tax deducted at source on Salary Rs

Advance tax given on Moblle phones Rs

Find out the tax liability of Mr Shoaib.

Where the ineome of an Individual chargesble under the hese "salary" exeseds soventyfive per cent of hig taxable ineome, the rates of tax to be spplled shall be as No

Tax rates for individuals Division I, Part

other than salaried individuala and Association of Persons Division Part i The new tax rates applicable for tax year are tabulated below:

Bonus Rs

House Rent Allowance Rs

Conveyance facility for fully personal use The cost of vebicle of employer is Rs

Medical Allowance Rs

A servant was provided by employer. The Salary of the servant was Rsannual. of this salary was paid by employee himself.

Pension Received during the year from previous Employer is Rs

Tax deducted at source on Salary Rs

Advance tax given on Moblle phones Rs

Find out the tax liability of Mr Shoaib.

Where the ineome of an Individual chargesble under the hese "salary" exeseds soventyfive per cent of hig taxable ineome, the rates of tax to be spplled shall be as No

Tax rates for individuals Division I, Part

other than salaried individuala and Association of Persons Division Part i The new tax rates applicable for tax year are tabulated below:

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started