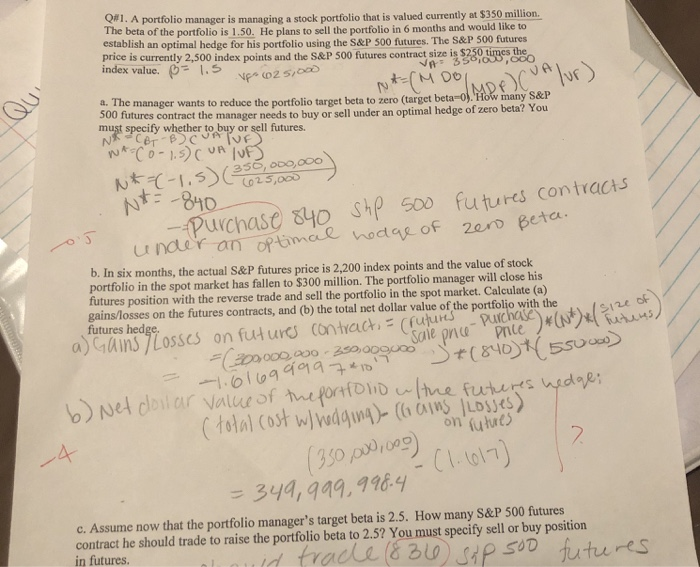

Q#. A portfolio manager is managing a stock portfolio that is valued currently at $350 million. The beta of the portfolio is 1.50. He plans to sell the portfolio in 6 months and would like to establish an optimal hedge for his portfolio using the S&P 500 futures. The S&P 500 futures price is currently 2,500 index points and the S&P 500 futures contract size is $250 times the index value. 1.S VA 3501OD,Oo0 vpe (02 5/000 Qu a. The manager wants to reduce the portfolio target beta to zero (target beta-0).'How many S&P 500 futures contract the manager needs to buy or sell under an optimal hedge of zero beta? You must specify whether to buy or sell futures. Co-1CUF VA Lo25,000 840 Purchase s40 Shp s00 fu tures contracts u nder an oPtimae noctae of 2ero Beta b. In six months, the actual S&P futures price is 2,200 index points and the value of stock portfolio in the spot market has fallen to $300 million. The portfolio manager will close his futures position with the reverse trade and sell the portfolio in the spot market. Calculate (a) gains/Mosses on the futures contracts, and (b) the total net dollar value of the portfolio with the futures hedge. a) Gains Losscs on fut urs (ontract(futuns Sale prce Purchase pre)(N)e{ Riuns/ $12e oF 0l099019710 Net dolar Nalurof teportoliD tne futeres nedae (todal (ost wlwedgm4 ( LDSES) on'futues 4 (350 pd ine) 349,999,9964 c. Assume now that the portfolio manager's target beta is 2.5. How many S&P 500 futures contract he should trade to raise the portfolio beta to 2.5? You must specify sell or buy position in futures. id trace (&30P SOD futeures Q#. A portfolio manager is managing a stock portfolio that is valued currently at $350 million. The beta of the portfolio is 1.50. He plans to sell the portfolio in 6 months and would like to establish an optimal hedge for his portfolio using the S&P 500 futures. The S&P 500 futures price is currently 2,500 index points and the S&P 500 futures contract size is $250 times the index value. 1.S VA 3501OD,Oo0 vpe (02 5/000 Qu a. The manager wants to reduce the portfolio target beta to zero (target beta-0).'How many S&P 500 futures contract the manager needs to buy or sell under an optimal hedge of zero beta? You must specify whether to buy or sell futures. Co-1CUF VA Lo25,000 840 Purchase s40 Shp s00 fu tures contracts u nder an oPtimae noctae of 2ero Beta b. In six months, the actual S&P futures price is 2,200 index points and the value of stock portfolio in the spot market has fallen to $300 million. The portfolio manager will close his futures position with the reverse trade and sell the portfolio in the spot market. Calculate (a) gains/Mosses on the futures contracts, and (b) the total net dollar value of the portfolio with the futures hedge. a) Gains Losscs on fut urs (ontract(futuns Sale prce Purchase pre)(N)e{ Riuns/ $12e oF 0l099019710 Net dolar Nalurof teportoliD tne futeres nedae (todal (ost wlwedgm4 ( LDSES) on'futues 4 (350 pd ine) 349,999,9964 c. Assume now that the portfolio manager's target beta is 2.5. How many S&P 500 futures contract he should trade to raise the portfolio beta to 2.5? You must specify sell or buy position in futures. id trace (&30P SOD futeures