Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Q. Artisan Plastic and Processing (APP) wants to expand its operations. It is considering the purchase of pressing machine for its new line of

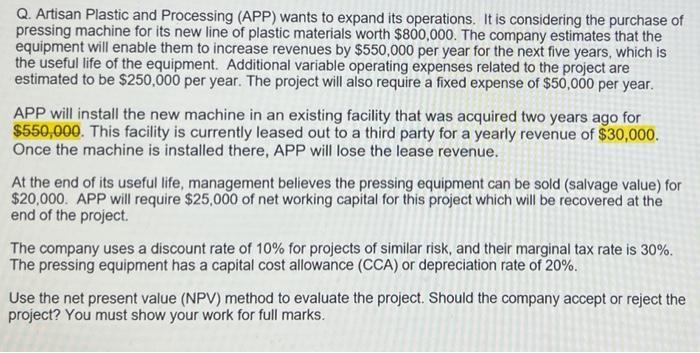

Q. Artisan Plastic and Processing (APP) wants to expand its operations. It is considering the purchase of pressing machine for its new line of plastic materials worth $800,000. The company estimates that the equipment will enable them to increase revenues by $550,000 per year for the next five years, which is the useful life of the equipment. Additional variable operating expenses related to the project are estimated to be $250,000 per year. The project will also require a fixed expense of $50,000 per year. APP will install the new machine in an existing facility that was acquired two years ago for $550,000. This facility is currently leased out to a third party for a yearly revenue of $30,000. Once the machine is installed there, APP will lose the lease revenue. At the end of its useful life, management believes the pressing equipment can be sold (salvage value) for $20,000. APP will require $25,000 of net working capital for this project which will be recovered at the end of the project. The company uses a discount rate of 10% for projects of similar risk, and their marginal tax rate is 30%. The pressing equipment has a capital cost allowance (CCA) or depreciation rate of 20%. Use the net present value (NPV) method to evaluate the project. Should the company accept or reject the project? You must show your work for full marks.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To evaluate the project using the net present value NPV method we need to calculate the cash flows f...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started