Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Q . No . 5 ( i ) Marks 2 The Vermas ( Mr . Sujat and Mrs . Sheetal Verma ) plan to create

QNoi

Marks

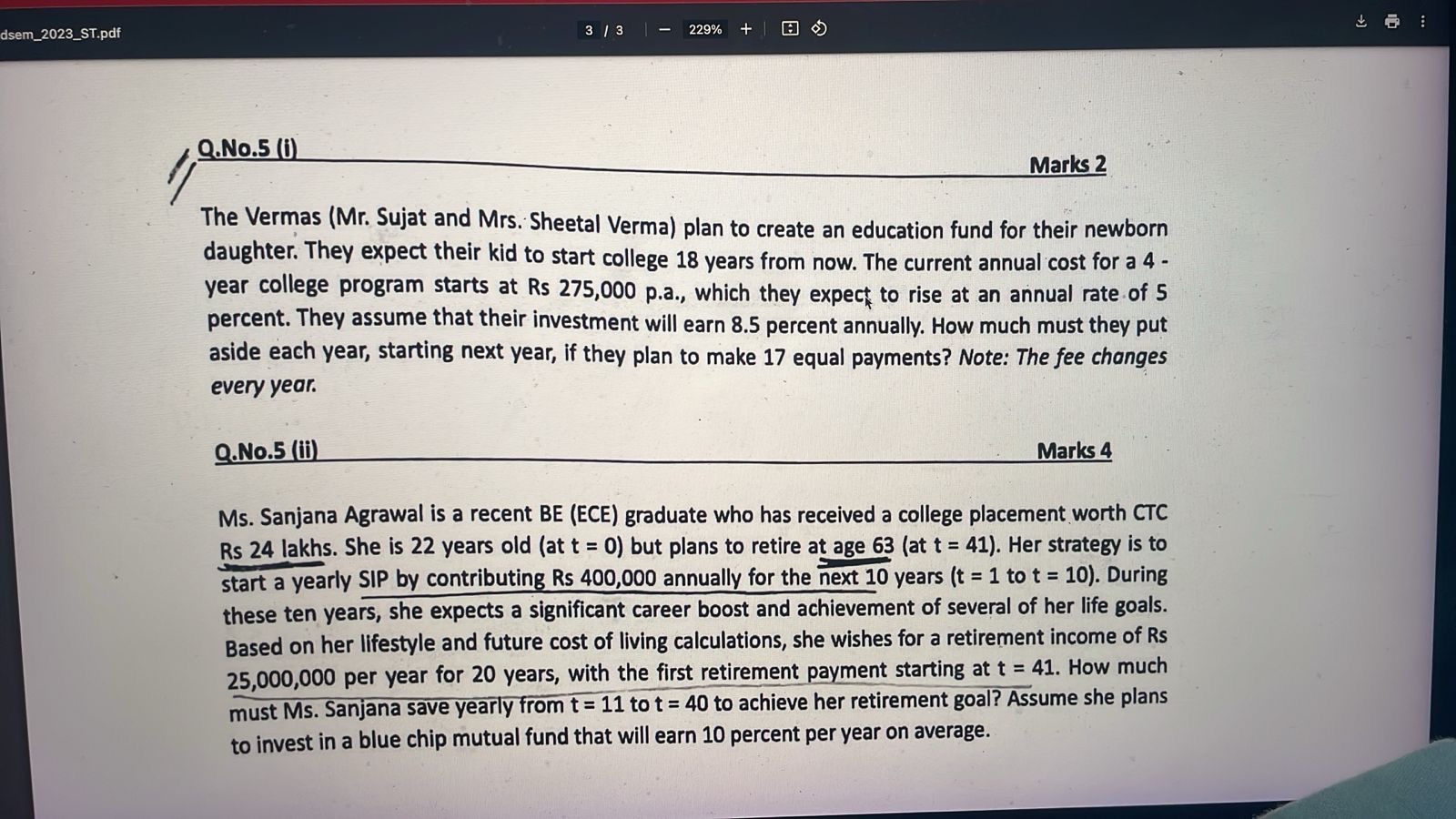

The Vermas Mr Sujat and Mrs Sheetal Verma plan to create an education fund for their newborn

daughter. They expect their kid to start college years from now. The current annual cost for a

year college program starts at Rs pa which they expect to rise at an annual rate of

percent. They assume that their investment will earn percent annually. How much must they put

aside each year, starting next year, if they plan to make equal payments? Note: The fee changes

every year.

QNoii

Marks

Ms Sanjana Agrawal is a recent BE ECE graduate who has received a college placement worth CTC

Rs lakhs. She is years old at but plans to retire at age at Her strategy is to

start a yearly SIP by contributing Rs annually for the next years to During

these ten years, she expects a significant career boost and achievement of several of her life goals.

Based on her lifestyle and future cost of living calculations, she wishes for a retirement income of Rs

per year for years, with the first retirement payment starting at How much

must Ms Sanjana save yearly from to to achieve her retirement goal? Assume she plans

to invest in a blue chip mutual fund that will earn percent per year on average.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started