Question

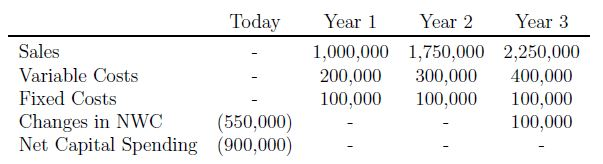

Q: Your new CEO has been very supportive of new projects and asked you to assess the merits of a particular 3-year project. The information

Q: Your new CEO has been very supportive of new projects and asked you to assess the merits of a particular 3-year project. The information you were able to collect is the following:

You were also informed that historically the projects of this particular division have been discounted with a required return of 20%.

Specifically, the CEO asked you for the following measures for this project. Assume a straight-line depreciation over the 3 years for the $900,000 assets you need to acquire for the project.

(a) The Payback Period and the Discounted Payback Period. Do those give rise to different decisions? If so, why?

(b) Internal Rate of Return

(c) NPV

(d) What is the meaning of the values you got in (b) and (c)?

After you computed the measures above, you learned that the Marketing and Sales departments put out a memo saying that there is a possibility of new entrants in the market competing directly with the product to be produced as part of this project. The memo also points out that, in the event that new companies are able to enter the market, the expected sales will be 10%, 15%, and 20% lower in years 1, 2, and 3, respectively.

(e) Update the measures computed above in (a) - (c).

(f) Given your answers to (a) - (c) and (e), how would you recommend your CEO to proceed? What other information and analysis would you like to be able to collect and run before you need to make a definitive decision?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started