Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Q.1 (10 points) Consider a three date environment, t=0,1,2,t=0 is now, t=1 is one year from now and t=2 is two years from now. There

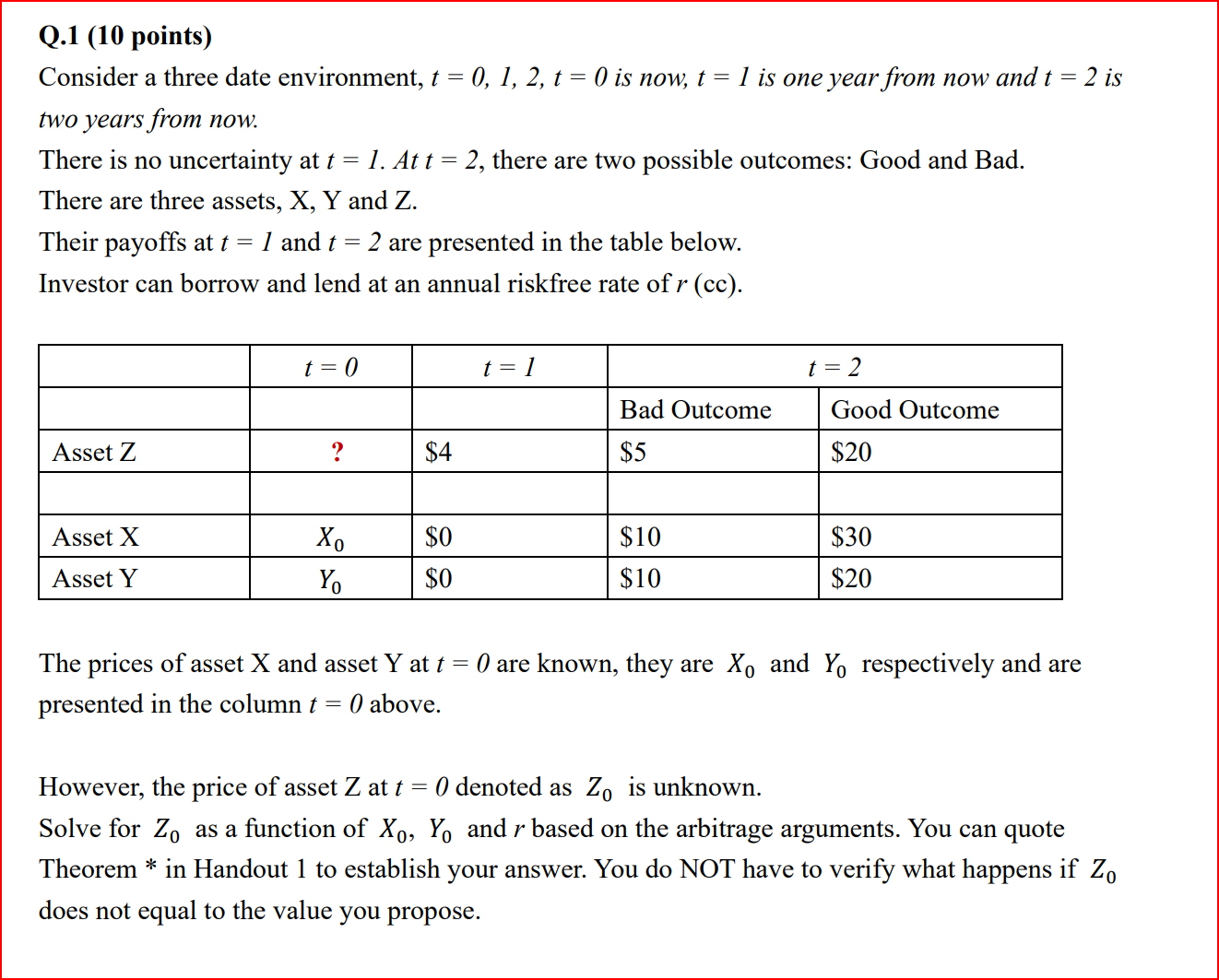

Q.1 (10 points) Consider a three date environment, t=0,1,2,t=0 is now, t=1 is one year from now and t=2 is two years from now. There is no uncertainty at t=1. At t=2, there are two possible outcomes: Good and Bad. There are three assets, X,Y and Z. Their payoffs at t=1 and t=2 are presented in the table below. Investor can borrow and lend at an annual riskfree rate of r(cc). The prices of asset X and asset Y at t=0 are known, they are X0 and Y0 respectively and are presented in the column t=0 above. However, the price of asset Z at t=0 denoted as Z0 is unknown. Solve for Z0 as a function of X0,Y0 and r based on the arbitrage arguments. You can quote Theorem * in Handout 1 to establish your answer. You do NOT have to verify what happens if Z0 does not equal to the value you propose

Q.1 (10 points) Consider a three date environment, t=0,1,2,t=0 is now, t=1 is one year from now and t=2 is two years from now. There is no uncertainty at t=1. At t=2, there are two possible outcomes: Good and Bad. There are three assets, X,Y and Z. Their payoffs at t=1 and t=2 are presented in the table below. Investor can borrow and lend at an annual riskfree rate of r(cc). The prices of asset X and asset Y at t=0 are known, they are X0 and Y0 respectively and are presented in the column t=0 above. However, the price of asset Z at t=0 denoted as Z0 is unknown. Solve for Z0 as a function of X0,Y0 and r based on the arbitrage arguments. You can quote Theorem * in Handout 1 to establish your answer. You do NOT have to verify what happens if Z0 does not equal to the value you propose Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started