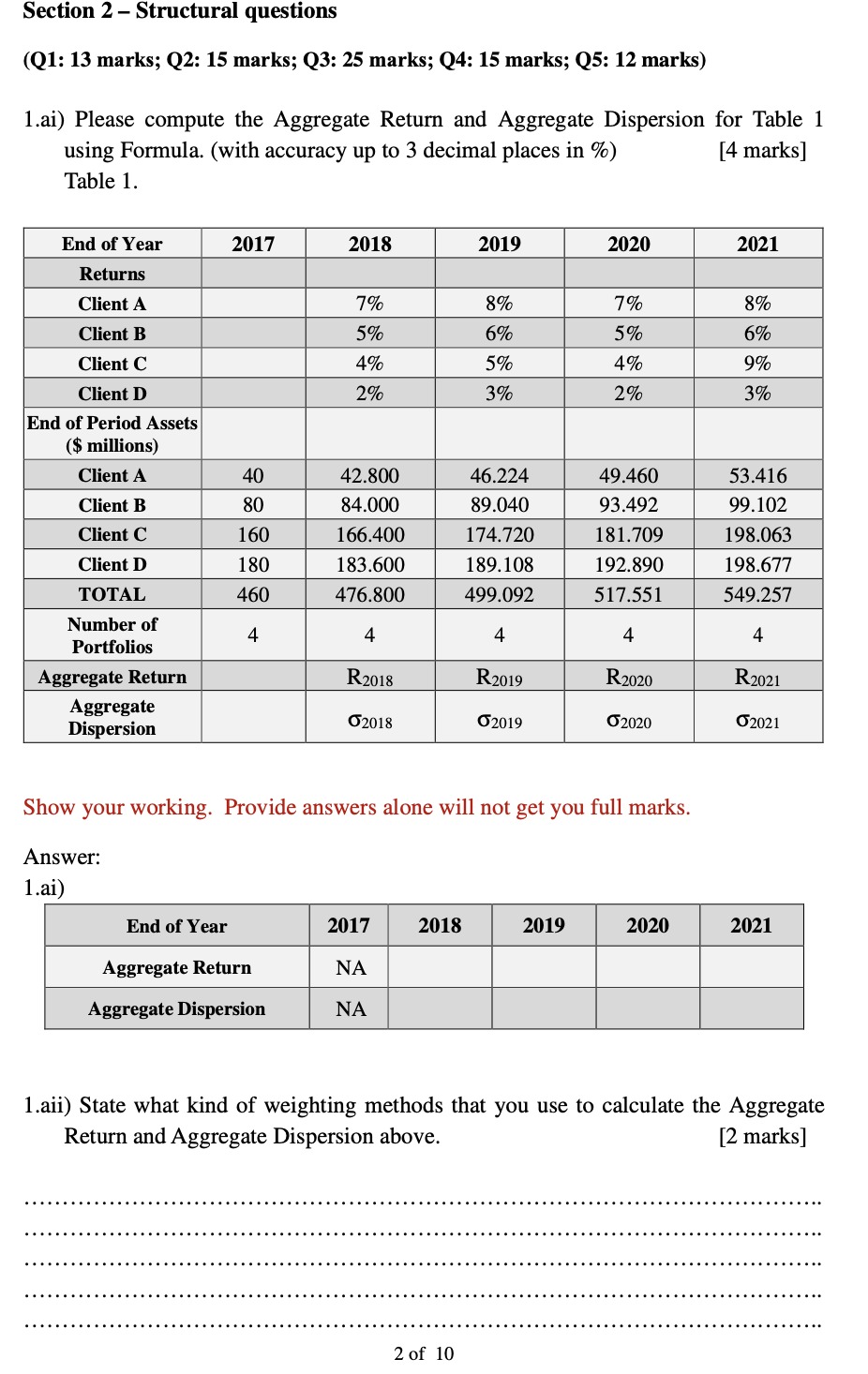

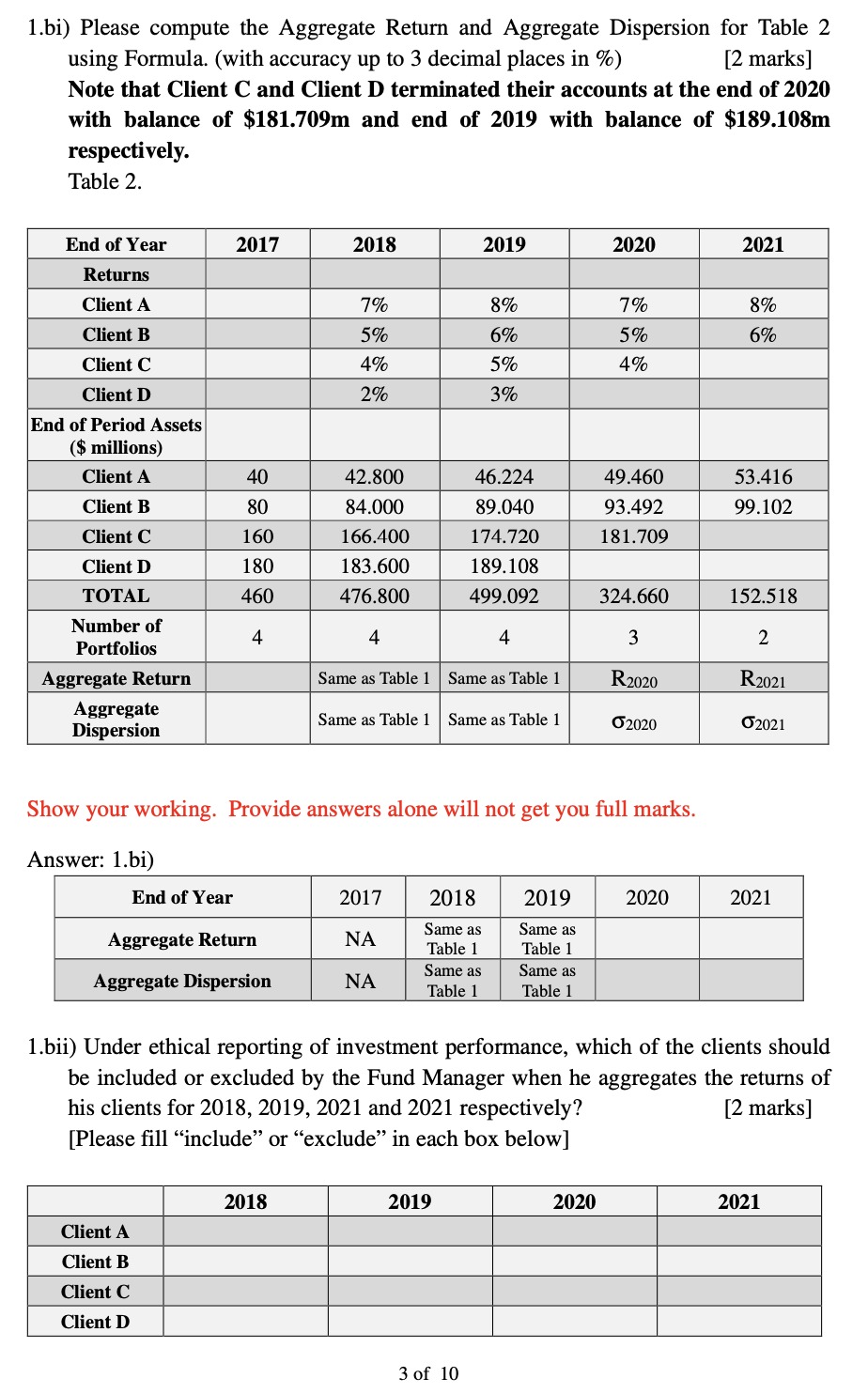

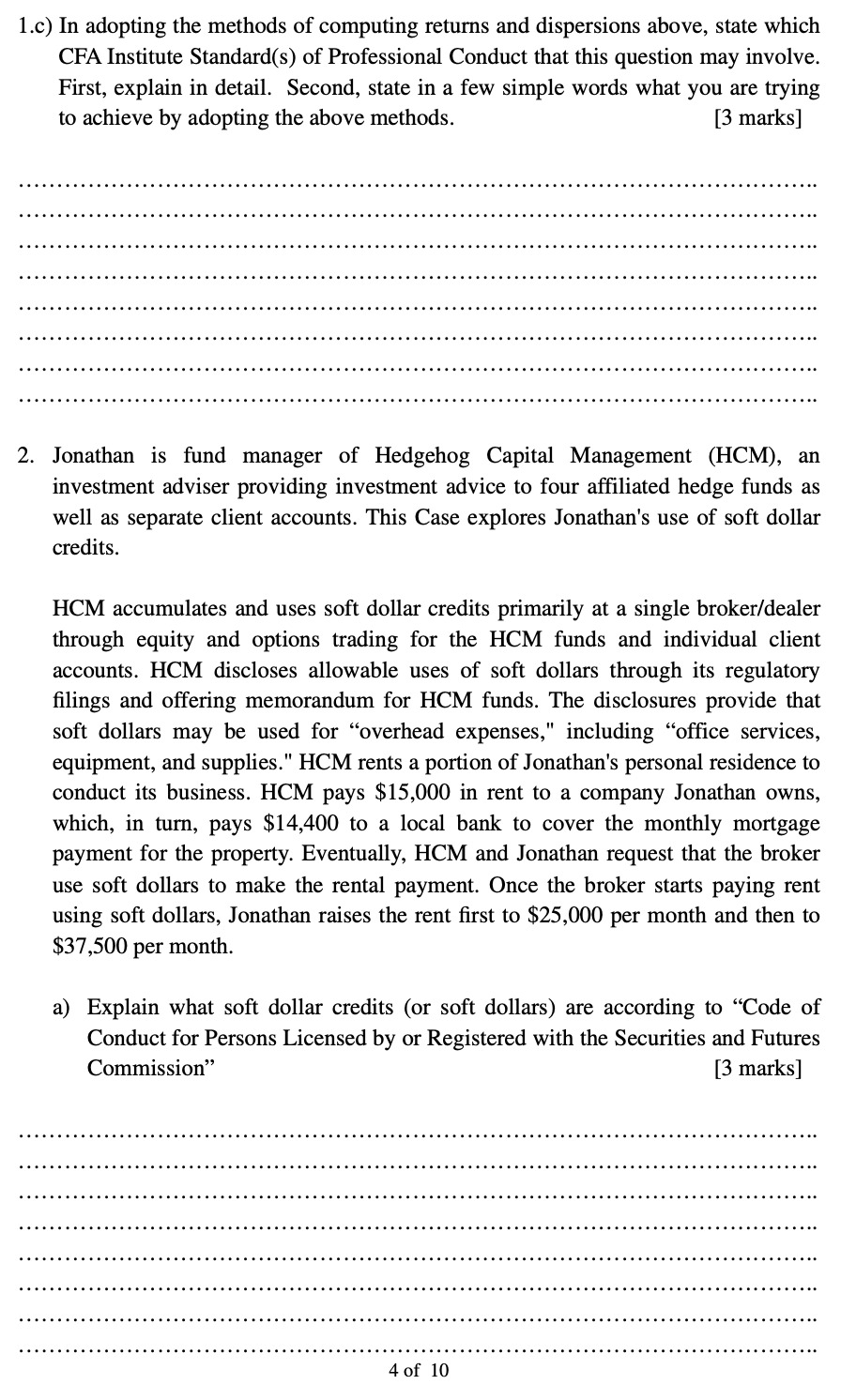

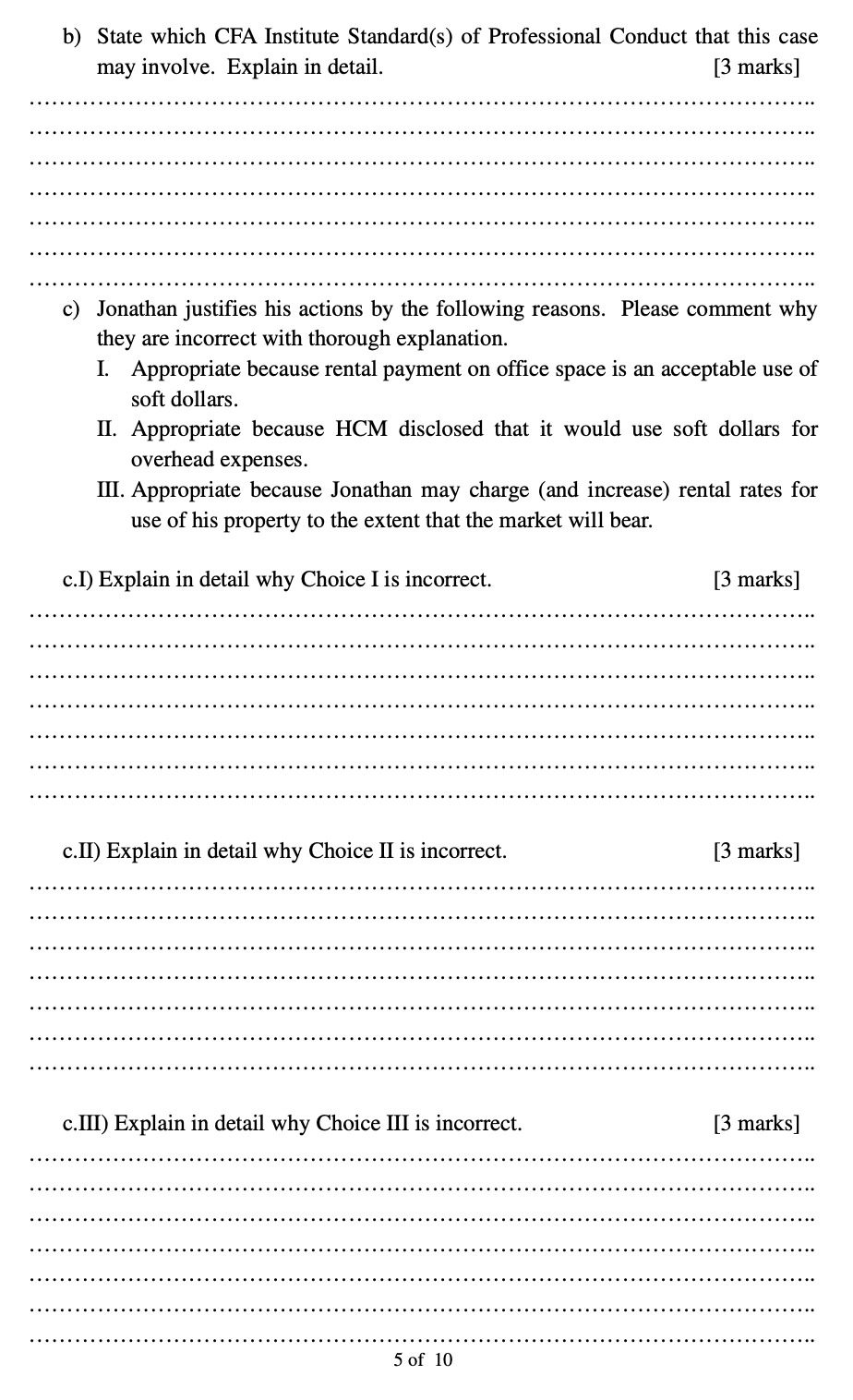

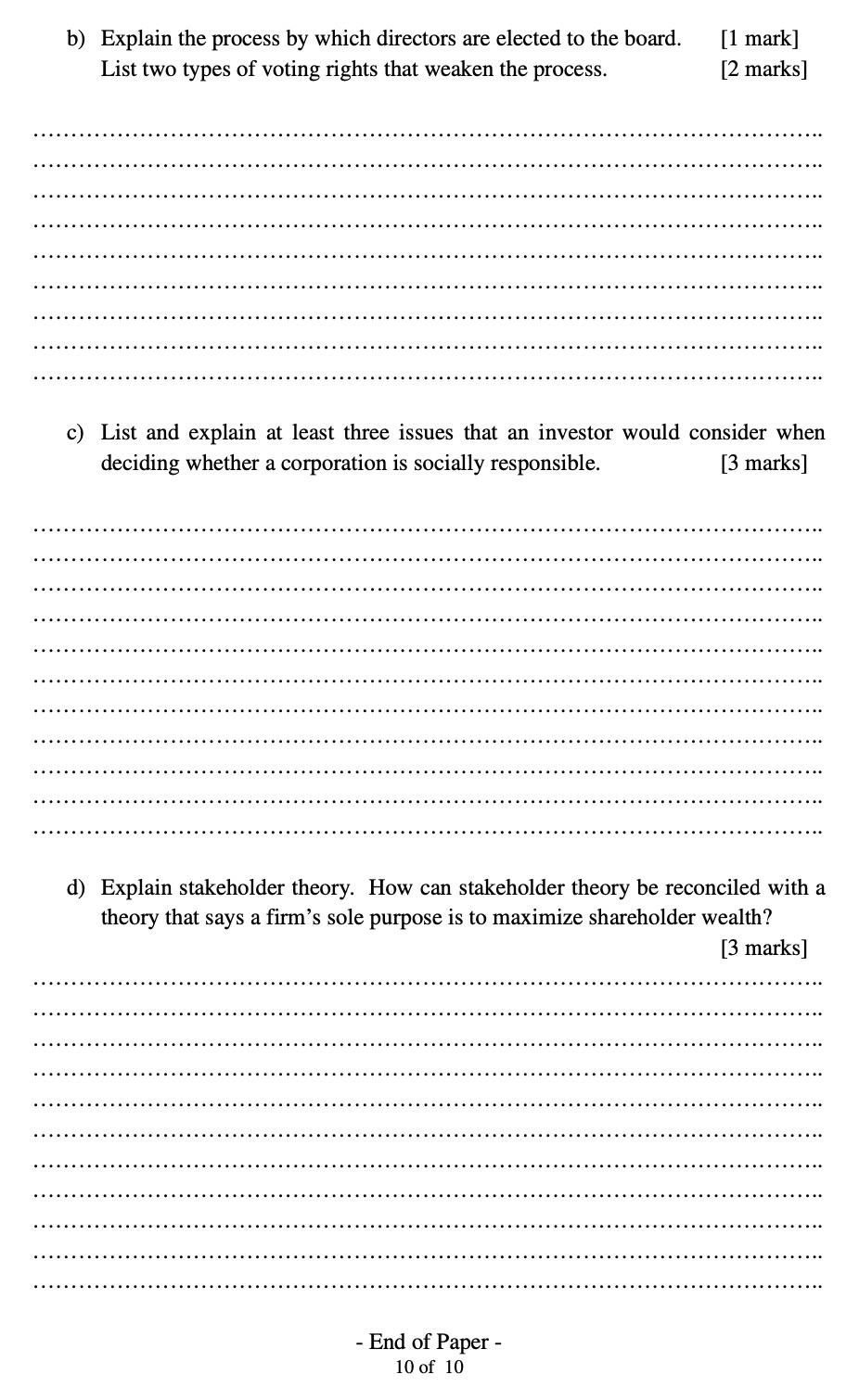

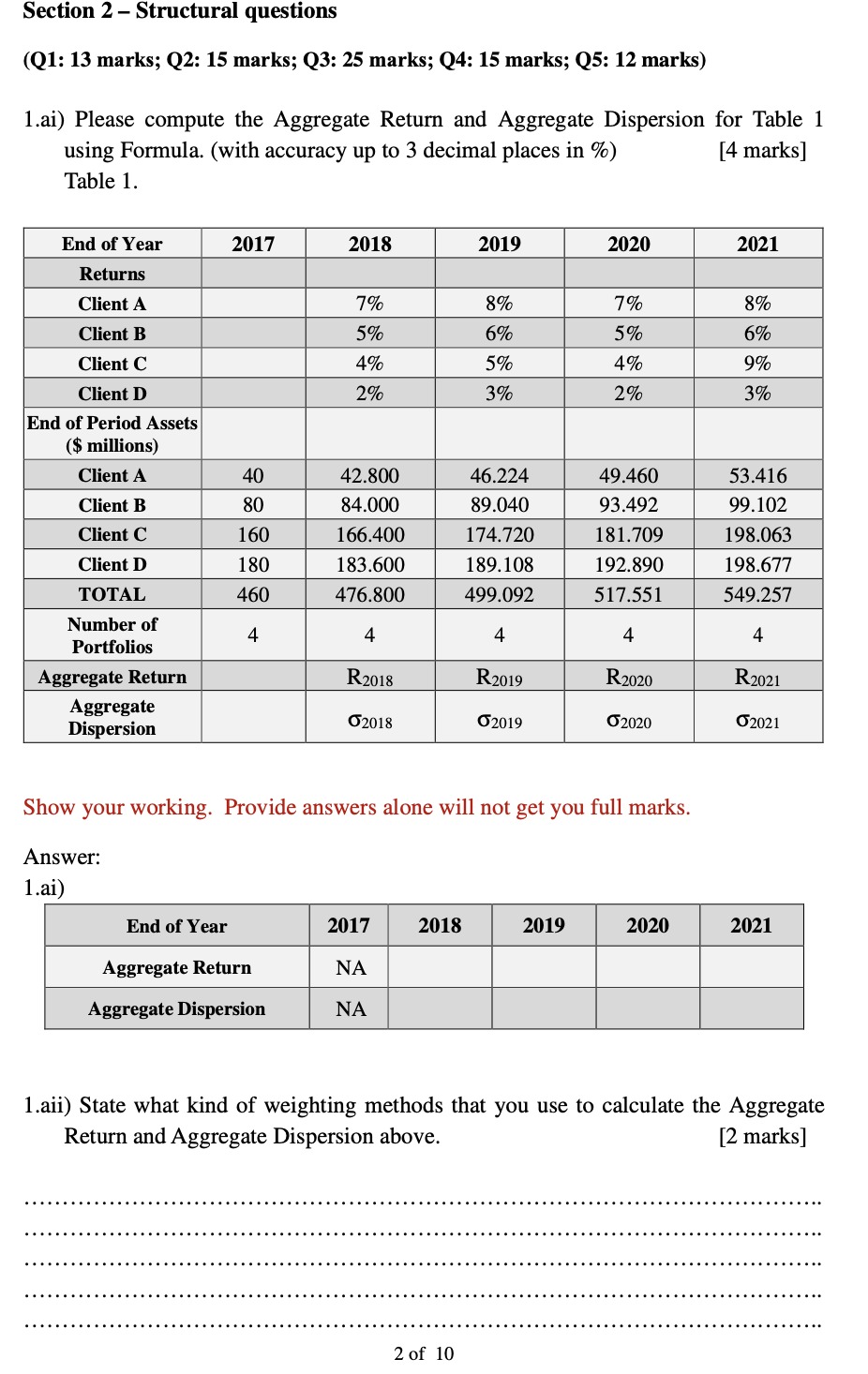

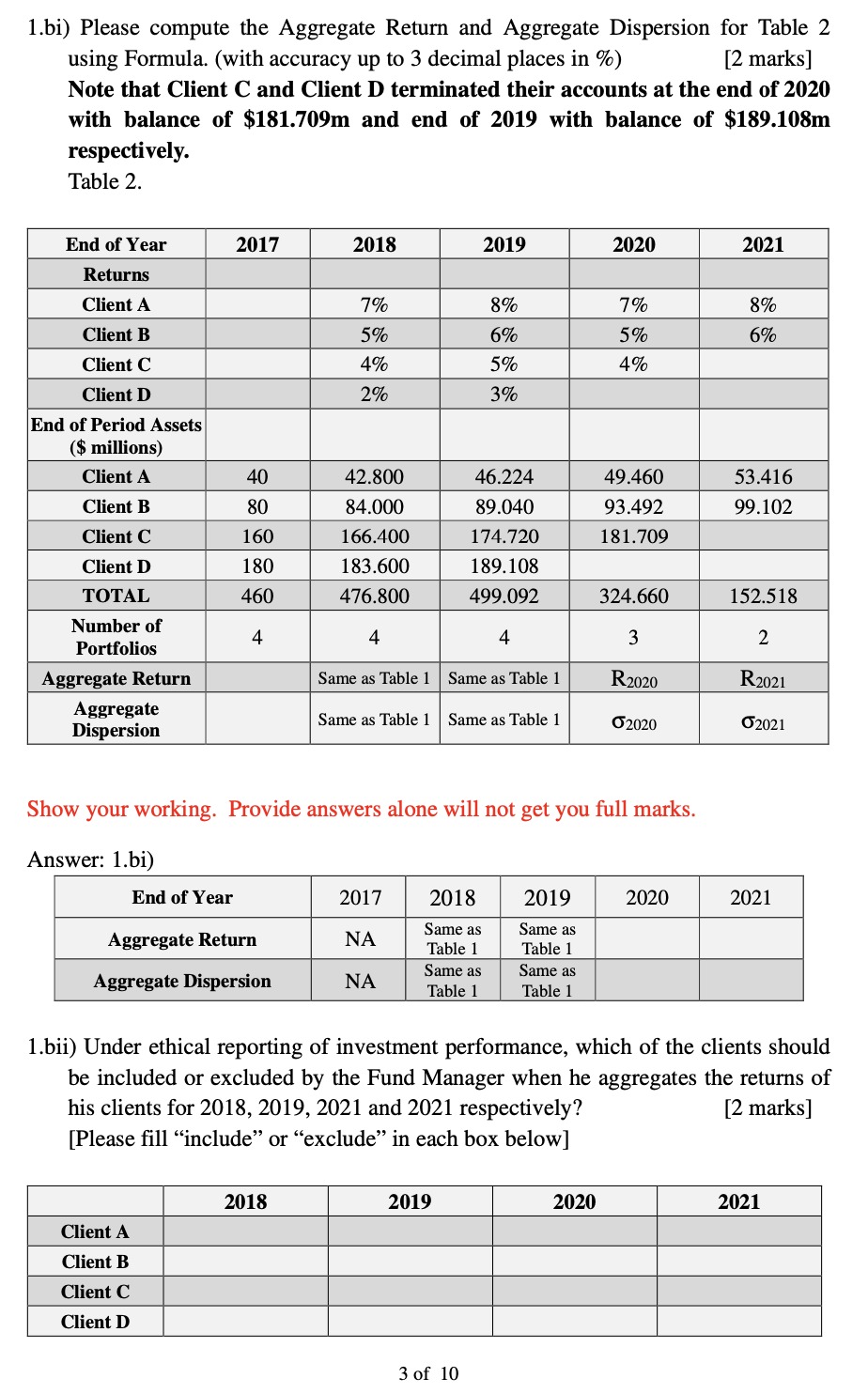

(Q1: 13 marks; Q2: 15 marks; Q3: 25 marks; Q4: 15 marks; Q5: 12 marks) 1.ai) Please compute the Aggregate Return and Aggregate Dispersion for Table 1 using Formula. (with accuracy up to 3 decimal places in \%) [4 marks] Table 1. Show your working. Provide answers alone will not get you full marks. Answer: 1.ai) 1.aii) State what kind of weighting methods that you use to calculate the Aggregate Return and Aggregate Dispersion above. [2 marks] 1.bi) Please compute the Aggregate Return and Aggregate Dispersion for Table 2 using Formula. (with accuracy up to 3 decimal places in \%) [2 marks] Note that Client C and Client D terminated their accounts at the end of 2020 with balance of $181.709m and end of 2019 with balance of $189.108m respectively. Table 2. Show your working. Provide answers alone will not get you full marks. Answer: 1.hi) 1.bii) Under ethical reporting of investment performance, which of the clients should be included or excluded by the Fund Manager when he aggregates the returns of his clients for 2018, 2019, 2021 and 2021 respectively? [2 marks] [Please fill "include" or "exclude" in each box below] 3 of 10 1.c) In adopting the methods of computing returns and dispersions above, state which CFA Institute Standard(s) of Professional Conduct that this question may involve. First, explain in detail. Second, state in a few simple words what you are trying to achieve by adopting the above methods. [3 marks] 2. Jonathan is fund manager of Hedgehog Capital Management (HCM), an investment adviser providing investment advice to four affiliated hedge funds as well as separate client accounts. This Case explores Jonathan's use of soft dollar credits. HCM accumulates and uses soft dollar credits primarily at a single broker/dealer through equity and options trading for the HCM funds and individual client accounts. HCM discloses allowable uses of soft dollars through its regulatory filings and offering memorandum for HCM funds. The disclosures provide that soft dollars may be used for "overhead expenses," including "office services, equipment, and supplies." HCM rents a portion of Jonathan's personal residence to conduct its business. HCM pays $15,000 in rent to a company Jonathan owns, which, in turn, pays $14,400 to a local bank to cover the monthly mortgage payment for the property. Eventually, HCM and Jonathan request that the broker use soft dollars to make the rental payment. Once the broker starts paying rent using soft dollars, Jonathan raises the rent first to $25,000 per month and then to $37,500 per month. b) State which CFA Institute Standard(s) of Professional Conduct that this case may involve. Explain in detail. [3 marks] c) Jonathan justifies his actions by the following reasons. Please comment why they are incorrect with thorough explanation. I. Appropriate because rental payment on office space is an acceptable use of soft dollars. II. Appropriate because HCM disclosed that it would use soft dollars for overhead expenses. III. Appropriate because Jonathan may charge (and increase) rental rates for use of his property to the extent that the market will bear. c.I) Explain in detail why Choice I is incorrect. [3 marks] 3. Answer the following short questions. (Total: 25 marks) a) Name two pitfalls that analysts may make and explain briefly what they are. Answers without explanations carry no mark. [4 marks] b) Explain two reasons management would have incentives to manipulate earnings upward. [3 marks] c) Explain two reasons management would have incentives to manipulate earnings downward. [3 marks] d) List two methods that management may use to manipulate earnings. [3 marks] 6 of 10 e) There are 11 categories of ethical dilemmas in business covered in the module. Category 1 - Saying things that you know are not true. For example, when a car salesperson insists to a customer that a used car has not been in a previous accident, when it, indeed, has, an ethical breach has occurred. Please name 2 other categories with examples. [6 marks] f) Name 2 types of inside information that are material. Please also explain why they are material. [6 marks ] 4. Silverman Sachs is an investment firm providing both advisory and investment banking services. One of Silverman Sachs investment banking clients, TenPenny (a high-tech firm which specializes in online games), wants to raise its stock price to facilitate a private offering, for which it will be using Silverman Sachs as its placement agent. Joe works for Silverman Sachs as an investment adviser. To assist TenPenny with its plans, Joe solicits several of his advisory clients to buy TenPenny stock, and at the same time solicits other clients to sell TenPenny stock, 7 of 10 frequently effecting matched orders among his customers. For a 10 -day period, these trades represented 45% of the total market volume of TenPenny, and the price of the stock increased from $15 to $24 and then stabilized at $22 for the next several days. b) There are at least two ethical issues relevant to this case. Name two and explain why they are the issues of this case. [3 marks] c) Joe justifies his actions by the following reasons. Please comment why they are incorrect with thorough explanation. I. acceptable if the purchase and sale of TenPenny stock fit within each of his advisory clients' Investment Policy Statements (IPS). II. acceptable because he was acting to promote the interests of his client, TenPenny. III. acceptable as long as he discloses to his advisory clients Silverman Sachs investment banking relationship with TenPenny. c.II) Explain in detail why Choice II is incorrect. [3 marks] c.III) Explain in detail why Choice III is incorrect. [3 marks] 5. Answer the following short questions. (Total: 12 marks) a) Describe the major functions of the board of directors in publicly held corporations. [3 marks] b) Explain the process by which directors are elected to the board. [1 mark] List two types of voting rights that weaken the process. [2 marks] c) List and explain at least three issues that an investor would consider when deciding whether a corporation is socially responsible. [3 marks] d) Explain stakeholder theory. How can stakeholder theory be reconciled with a theory that says a firm's sole purpose is to maximize shareholder wealth