Answered step by step

Verified Expert Solution

Question

1 Approved Answer

q1 a8 pt2 During 2023, Flounder Corporation started a construction job with a contract price of $5,74 million. Flounder ran into severe technical diffculties during

q1 a8 pt2

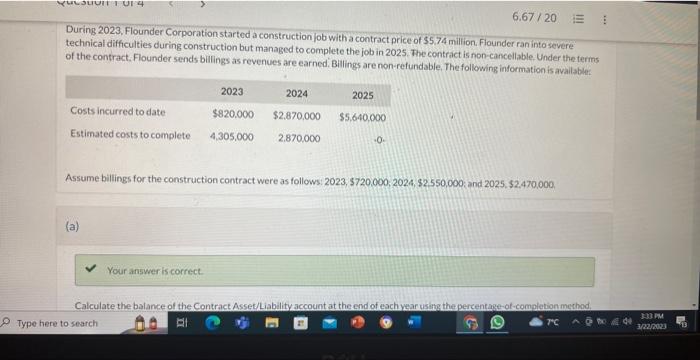

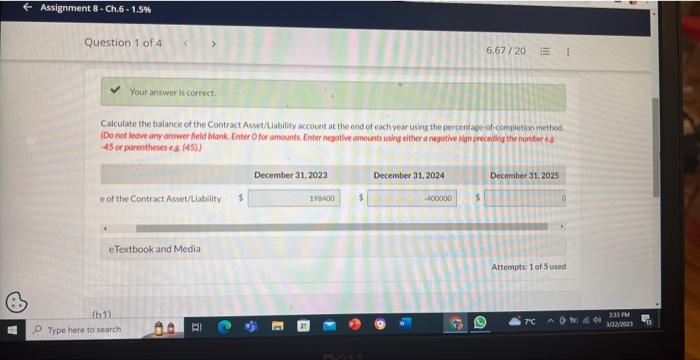

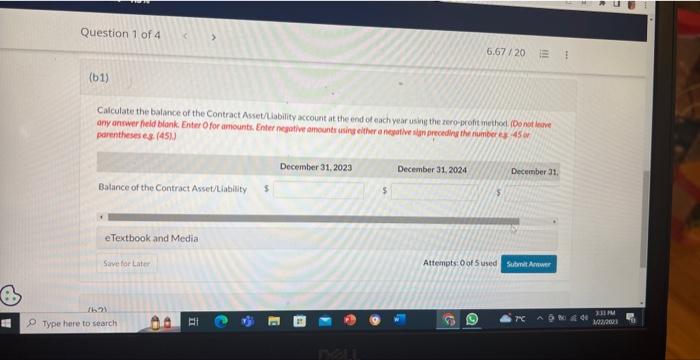

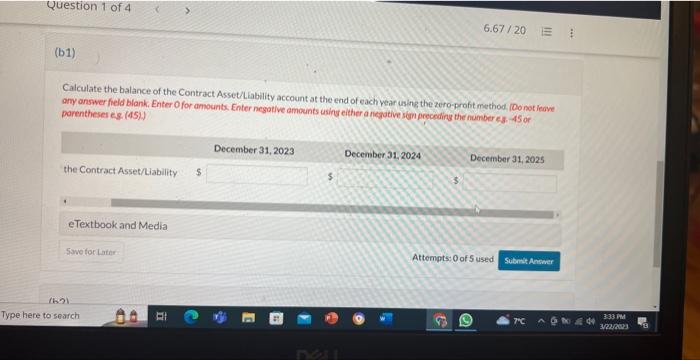

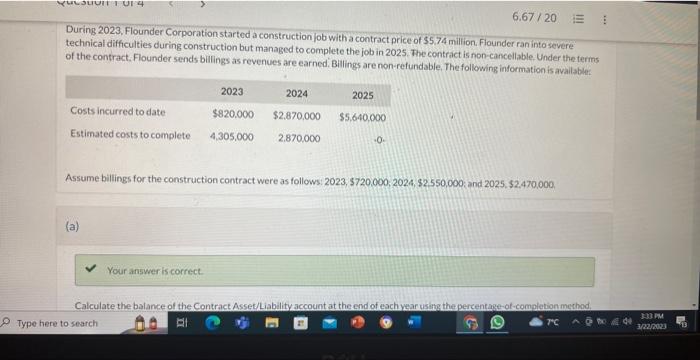

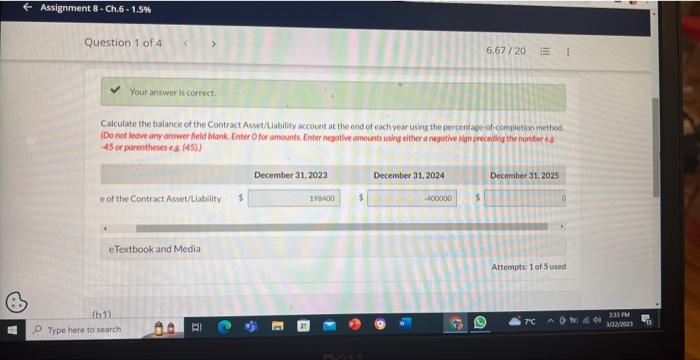

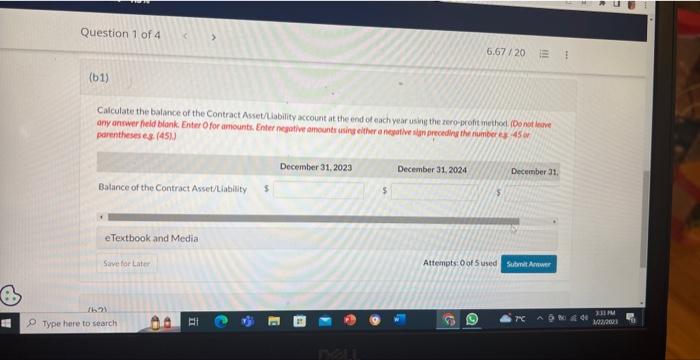

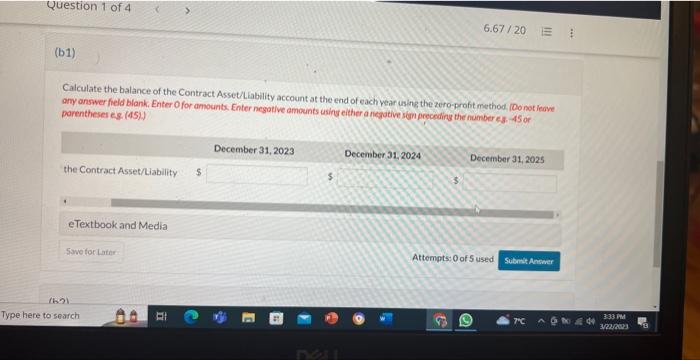

During 2023, Flounder Corporation started a construction job with a contract price of $5,74 million. Flounder ran into severe technical diffculties during construction but managed to complete the job in 2025 . The contract is non-cancellable. Under the terms of the contract. Flounder sends billings as revenues are earned. Billings are non-refundable. The following information is avallabler Assume billings for the construction contract were as follows: 2023, $720,000,2024,$2,550,000; and 2025,$2,470,000. Calculate the balance of the Contract Asset/Liability account at the end of each year using the gercentage-of-completion methed (Do not inove ary answer field blank. Enter O for amounti, Enter nesative amounts osthg either a neputive iden preceding the number ess 45 or parentheses es. (45)) Calculate the balance of the Contract Assetdiability account at the end of each year using the zero-profit mecthod ioo not leane parentheses es (45).) Calculate the balance of the Contract AssetLiability account at the end of each vear using the zero-probt method, (Do not leove amy answer field blank, Enter O for amounts. Enter negotive amounts using either a niegative sign preceding the number es. 45 or. parentheses eg. (45)) During 2023, Flounder Corporation started a construction job with a contract price of $5,74 million. Flounder ran into severe technical diffculties during construction but managed to complete the job in 2025 . The contract is non-cancellable. Under the terms of the contract. Flounder sends billings as revenues are earned. Billings are non-refundable. The following information is avallabler Assume billings for the construction contract were as follows: 2023, $720,000,2024,$2,550,000; and 2025,$2,470,000. Calculate the balance of the Contract Asset/Liability account at the end of each year using the gercentage-of-completion methed (Do not inove ary answer field blank. Enter O for amounti, Enter nesative amounts osthg either a neputive iden preceding the number ess 45 or parentheses es. (45)) Calculate the balance of the Contract Assetdiability account at the end of each year using the zero-profit mecthod ioo not leane parentheses es (45).) Calculate the balance of the Contract AssetLiability account at the end of each vear using the zero-probt method, (Do not leove amy answer field blank, Enter O for amounts. Enter negotive amounts using either a niegative sign preceding the number es. 45 or. parentheses eg. (45))

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started