Answered step by step

Verified Expert Solution

Question

1 Approved Answer

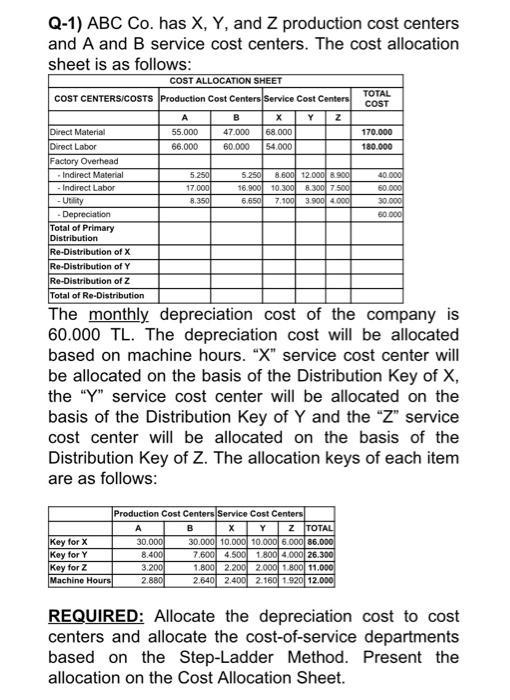

Q-1) ABC Co. has X, Y, and Z production cost centers and A and B service cost centers. The cost allocation sheet is as follows:

Q-1) ABC Co. has X, Y, and Z production cost centers and A and B service cost centers. The cost allocation sheet is as follows: COST ALLOCATION SHEET COST CENTERS/COSTS Production Cost Centers Service Cost Centers Direct Material Direct Labor Factory Overhead Indirect Material Indirect Labor Utility Depreciation Total of Primary Distribution Re-Distribution of X Re-Distribution of Y Re-Distribution of Z Total of Re-Distribution A 55.000 66.000 Key for X Key for Y Key for Z Machine Hours 5.250 17.000 8.350 B X 47.000 68.000 60.000 54.000 Y 5.250 8.600 12.000 8.900 16.900 10.300 8.300 7.500 6.650 7.100 3.900 4.000 Production Cost Centers Service Cost Centers A 30.000 8.400 3.200 2.880 Z B X Y Z TOTAL 30.000 10.000 10.000 6.000 86.000 7.600 4.500 1.800 4.000 26.300 1.800 2.200 2.000 1.800 11.000 2.640 2.400 2.160 1.920 12.000 TOTAL COST The monthly depreciation cost of the company is 60.000 TL. The depreciation cost will be allocated based on machine hours. "X" service cost center will be allocated on the basis of the Distribution Key of X, the "Y" service cost center will be allocated on the basis of the Distribution Key of Y and the "Z" service cost center will be allocated on the basis of the Distribution Key of Z. The allocation keys of each item are as follows: 170.000 180.000 40.000 60.000 30.000 60.000 REQUIRED: Allocate the depreciation cost to cost centers and allocate the cost-of-service departments based on the Step-Ladder Method. Present the allocation on the Cost Allocation Sheet.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started