Answered step by step

Verified Expert Solution

Question

1 Approved Answer

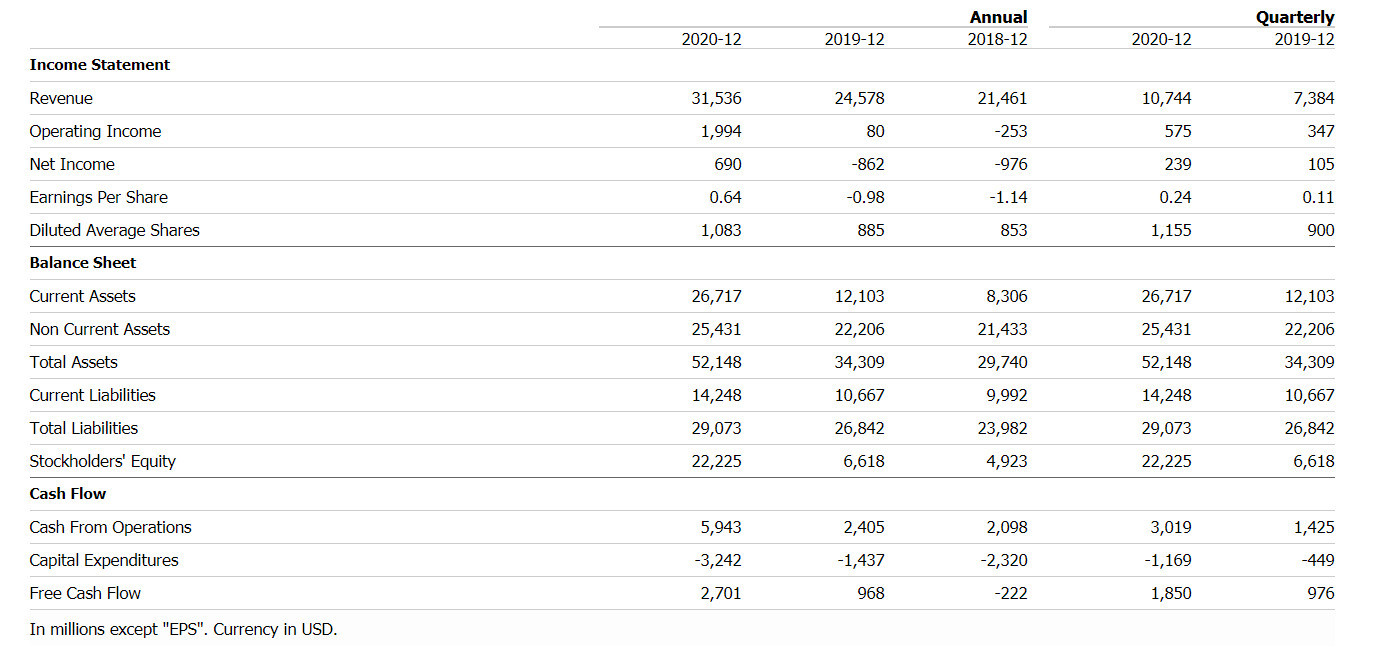

Q1. Calculate the three Dupont components and verify the Dupont identity for the years 2018 and 2019. (Profit margin, asset turnover, equity multiplier, and ROE).

Q1. Calculate the three Dupont components and verify the Dupont identity for the years 2018 and 2019. (Profit margin, asset turnover, equity multiplier, and ROE).

Q2. Discuss the change in each component and its impact on the overall profitability for the TSLA equity holders.

Annual 2018-12 Quarterly 2019-12 2020-12 2019-12 2020-12 Income Statement Revenue 31,536 24,578 21,461 10,744 7,384 Operating Income 1,994 80 -253 575 347 Net Income 690 -862 -976 239 105 Earnings Per Share 0.64 -0.98 -1.14 0.24 0.11 Diluted Average Shares 1,083 885 853 1,155 900 Balance Sheet Current Assets 12,103 8,306 26,717 25,431 Non Current Assets 22,206 21,433 26,717 25,431 52,148 12,103 22,206 34,309 Total Assets 52,148 34,309 29,740 Current Liabilities 14,248 10,667 9,992 14,248 10,667 Total Liabilities 29,073 26,842 23,982 29,073 26,842 Stockholders' Equity 22,225 6,618 4,923 22,225 6,618 Cash Flow Cash From Operations 5,943 2,405 2,098 3,019 1,425 Capital Expenditures -3,242 -1,437 -2,320 -1,169 -449 Free Cash Flow 2,701 968 -222 1,850 976 In millions except "EPS". Currency in USDStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started